The most important diesel fuel price for the trucking industry dropped this week by an amount not seen since the pandemic was in full swing.

The Department of Energy/Energy Information Administration average weekly retail diesel price declined 4.6 cents to $3.674 a gallon. That decline is the largest since a 7.3-cent drop posted on March 30, 2020, when the benchmark diesel number for fuel surcharges was in the midst of a pandemic-created collapse that took the price from $3.079 on Jan. 6 and sent it down for 19 consecutive weeks to $2.386.

This week’s decline is the first time that the price has captured some of the decline in spot and wholesale markets that first began the day after Thanksgiving when oil markets reacted to the first news of the omicron variant. On the CME commodity exchange, ultra low sulfur diesel settled at $2.383 a gallon the day before Thanksgiving; two days later, after U.S. markets took the holiday off, the price of ULSD was down almost 29 cents per gallon to a settlement of $2.0945. That downward move eventually bottomed out with a settlement of $2.0638 last Tuesday.

Wholesale prices captured that decline. Based on data in the ULSDR.USA data stream in SONAR, which is a national average of wholesale diesel prices, the national average price fell to $2.308 a gallon last Wednesday, down from $2.58 on the final business day before Thanksgiving.

Since then, average wholesale diesel prices rose Monday to $2.344 a gallon as commodity prices rebounded. But that move up does not capture what happened in oil and other markets Monday, when a broad rebound lifted equity and commodity levels.

In particular, the price of ULSD on CME Monday climbed 7.28 cents a gallon, to $2.1712, an increase of 3.47%. With that gain, the benchmark commodity price is now up almost 11 cents a gallon from where it settled last Tuesday.

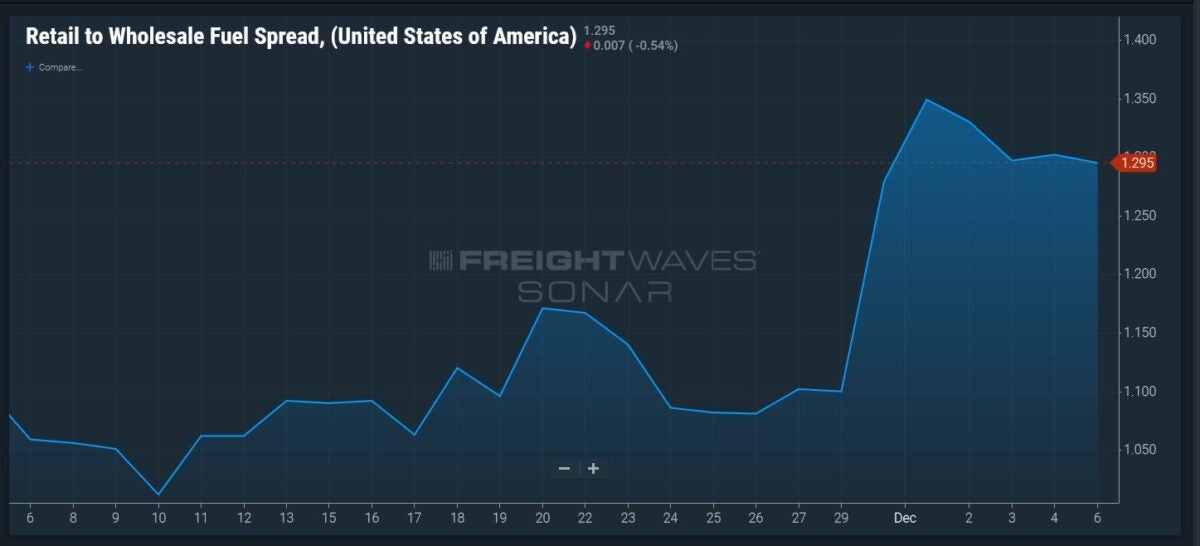

Retail prices lag wholesale moves, particularly on the way down. Retail price decisions are made at the individual station level, and station owners have long tried to keep their retail prices as high as they can even as their acquisition costs decline. The sharp difference between the decline in retail prices reflected in the DTS.USA price in SONAR and the ULSDR.USA number means that the FUELS.USA, which reflects that spread, blew out as wide as almost $1.35 a gallon Thursday. That number exceeded even the levels seen in the beginning of the pandemic, when spot and wholesale prices were plummeting at a dizzying rate.

The FUELS.USA number came back slightly to earth, dropping Sunday to just under $1.30 a gallon.

Oil markets were supported Monday not only by the rise in equities, but also by interpretation of the Saudi monthly pricing formulas for January, released over the weekend. The Saudi prices are a differential to benchmarks such as Brent, and their relative strength persuaded some traders that the order book state-owned Saudi Aramco is seeing is strong enough to have increased those differentials, a sign of solid demand.

More articles by John Kingston

Lender’s transportation sector write-offs flat; size of impaired loans down

CEO predicts Variant will drive USX sequential growth by Q1

Truck jobs rose in November seasonally, but fell without adjustment