Dry bulk shipping is the world’s largest ocean shipping market by volume and boasts the world’s largest freight futures market. After spending most of this year on the sidelines, dry bulk shipping is suddenly back in the spotlight again.

Spot rates for larger bulkers have skyrocketed over the past four weeks. Freight futures trading has been frenetic. Dry bulk stocks are up double digits.

The caveat is that this market spike is expected to be short-lived. Rates may have already peaked.

A week that shipowners ‘dream of’

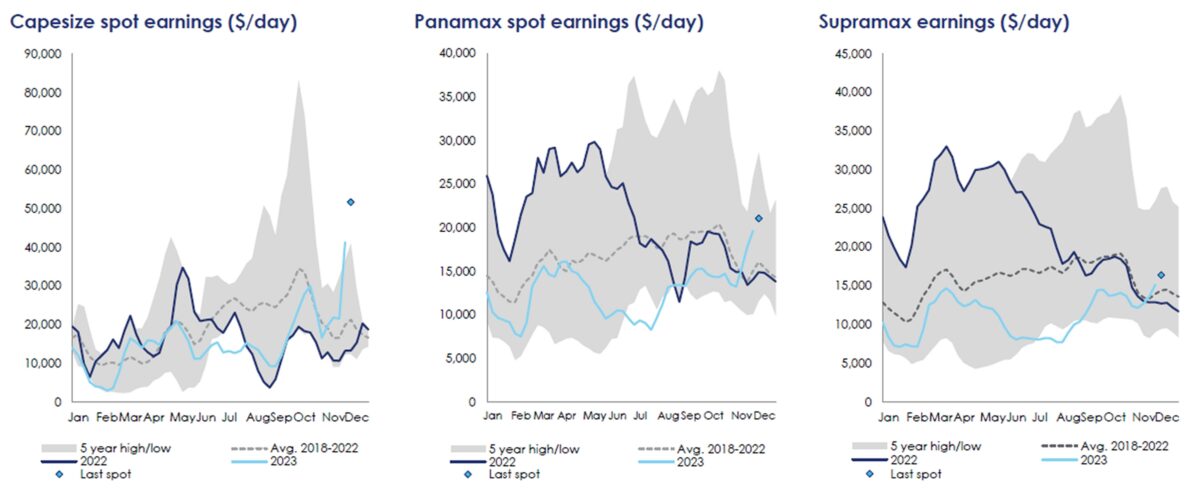

Rates for Capesizes — larger dry bulk vessels with capacity of around 180,000 deadweight tons (DWT) that carry iron ore, coal and bauxite — averaged $54,600 per day on Monday, according to Clarksons Securities, more than triple rates on Nov. 1 of $15,800 per day.

“This is a week that [shipowners] dream of,” said ship brokerage Braemar on Thursday. “There were astronomical gains made in all markets related to Capes.”

Deutsche Bank analyst Chris Robertson noted that last week’s 71% surge in Capesize rates was “one of the biggest jumps in the spot market in the last decade.”

John Kartsonas, managing partner of the Breakwave Dry Bulk Shipping ETF (NYSE: BDRY), said in an interview with FreightWaves on Monday: “It is not only Capes. It’s across the board. This has been a synchronized rally across every asset class over the last three or four weeks.”

Panamaxes (65,000-90,000 DWT) and Supramaxes (45,000-60,000 DWT) transport grains, coal and so-called “minor bulks” (minerals, steel, etc.). Panamax spot rates reached $21,100 per day on Monday, according to Clarksons Securities, up 53% since Nov. 1. Supramax rates hit $16,400 per day, up 31% over the same period.

“Clearly the Atlantic market is lacking ships, not only Capes but also Panamaxes and Supramaxes,” said Kartsonas.

Why dry bulk rates spiked in November

One driver of the dry bulk rally — particularly for Panamaxes and Supramaxes carrying U.S. grain exports to Asia — is restrictions at the Panama Canal.

“Everyone has been talking about this since the summer. Now it is finally having an effect,” said Kartsonas. Ships carrying U.S. grain are taking the longer route via the Suez Canal, and bulkers face long delays returning to the Atlantic from Asia via the Panama Canal.

Panama Canal restrictions are compounding fleet inefficiencies caused by months of heavy congestion at Brazilian grain ports. Braemar reported that there are still 113 Panamaxes and geared bulkers waiting to load off Brazilian ports, down from a peak of 168 but more than double levels a year ago.

Another rate driver is winter weather, said Kartsonas. “The weather has finally gotten worse in both Europe and China, so there are a lot of delays in unloading there.”

In the all-important iron ore trade, 400,000-DWT Valemax-class bulkers controlled by Brazilian iron ore miner Vale (NYSE: VALE) are being bogged down by weather issues at unloading ports, prompting Vale to secure more Capesize tonnage in the spot market, said Kartsonas.

Yet another driver of Capesize rates: West African exports of iron ore and bauxite. Braemar said Monday that last week was “the most active week on record for bauxite and iron ore Capesize shipments from West Africa.”

According to Kartsonas, “We always think about Brazil for the Capesize trade, but it’s increasingly about West Africa. There are times when West Africa accounts for more spot charter demand than Brazil. This is a very important change to the whole equation and it’s something the market is just starting to figure out.”

Is the end of rate spike nigh?

The BDRY exchange-traded fund, which buys near-dated forward freight agreements (FFAs), was down 7% on Monday in almost quintuple average volume.

“The consensus, when you look at the futures market, is that rates are going to collapse,” Kartsonas told FreightWaves.

Dry bulk rates typically hit annual lows in the first quarter. Compared to current rates of over $50,000 per day, the January Capesize FFA contract was trading at just $17,250 per day on Monday, down 17% versus Friday. The February contract was at $10,125 per day, down 8% versus Friday.

Brokerage Thurlestone Shipping said on Monday: “There were some signs of nervousness on the FFA market towards the close of play, with the market taking a bit of a battering. Time will tell whether this is a fundamental shift in sentiment or just profit-taking, but undeniably, things feel a little more nervous here, although the physical fundamentals are still relatively unchanged with tonnage tight everywhere.”

According to Kartsonas, “The belief is clearly that this [rally] is very temporary. And I think that makes a lot of sense. If this was positional tightness that happened because all of these circumstances came together at the same time, it is very easy to see how this is going to unwind. The question is how deep the correction will be.”

Ship brokerage BRS issued a bearish outlook on dry bulk’s 2024 prospects on Thursday. “There has been a general improvement in dry cargo volumes this year, [but] it lacks the robustness that industry participants have grown accustomed to.” Fleet supply growth is outpacing demand growth and there are concerns over China, it said.

“Without tailwinds afforded by one-off disruptive events, we are now confronting ‘darker storms ahead,’” warned BRS.

Capturing rate upside while it lasts

Dry bulk stocks are moved by expectations on future cash flows, company-specific issues unrelated to rates and broader stock market issues unrelated to dry bulk. The BDRY exchange-trade fund, due to its purchase of FFAs, is more correlated with spot rates.

FFA trading volumes exploded as dry bulk rates spiked in November. “On one day last week, hundreds of millions of dollars of freight were traded, multiples of what the average has been over time,” said Kartsonas. “The liquidity is incredible. You can get in and out of major positions on a daily basis without affecting the price. What this tells you is that there is a lot of institutional money in the [FFA] space.”

Buying FFAs is not a practical option for the typical retail trader seeking to profit off dry bulk rates, so they either buy dry bulk stocks or the BDRY ETF.

BDRY more than doubled — up 109% — between Nov. 1 and Friday, according to data from Koyfin. In contrast, Himalaya Shipping (NYSE: HSHP) rose only 34% over the same period, Eurodry (NASDAQ: EDRY) 33%, Golden Ocean (NASDAQ: GOGL) 28%, Safe Bulkers (NYSE: SB) 27%, Genco Shipping & Trading (NYSE: GNK) 24%, Star Bulk (NASDAQ: SBLK) 19% and Eagle Bulk (NYSE: EGLE) 17%.

“For traders looking to capture these kinds of short-term spikes, BDRY is clearly the better product,” argued Kartsonas. “BDRY follows the futures market and the futures market will follow spot rates, whereas stocks are priced over longer-term cash flows — and I think that’s a different animal.”

Click for more articles by Greg Miller

Related articles:

- No reservation at Panama Canal? Prepare for a long wait

- Panama Canal crisis forces US farm exports to detour through Suez

- There’s more coal being shipped by sea than ever before

- Shipping braces for impact as Panama Canal slashes capacity

- Yet another shipping ‘chokepoint’ risk as Yemen rebels attack

- China and global trade: Why stimulus is MIA and risks are rising

ST

Thank you, Mr. Miller. Your articles always show your awareness of a particular market’s unusual pulse, a clear thesis backed up by evidence, and a pedagogical explanation of factors.