‘Swedish furniture,’ along with an IT refresh and 24 percent share premium, may factor in combining two top freight forwarders.

Denmark’s DSV (Nasdaq: OMX) is making its biggest bet on turning around a troubled peer in the freight forwarding industry as it makes public a $4.1 billion offer for its Swiss rival Panalpina (SWX: PWTN).

A tie-up between the two companies would create one of the largest global freight forwarders, and offers them more leverage as ocean carriers show more pricing power in seaborne freight. The offer also comes just two months after Kuehne + Nagel (SWX: KNIN) expressed similar interest in Panalpina, sending its shares up some 20 percent in November.

As reported this morning, DSV made a cash-and-stock offer for Panalpina at the U.S. dollar equivalent of $172 per share, which represents a premium of 24 percent over Panalpina’s last closing price. Stifel transportation analyst J. Bruce Chan noted that Panalpina’s shares had already been at elevated levels due to the previous takeover attempt.

DSV has largely grown through acquisition; its previous big move was for U.S.-based UTi Worldwide, which it bought for $1.5 billion. In Chan’s view, the move for Panalpina is similar in that UTi was also underperforming the market when DSV acquired it .

UTi was in a “messy and ineffectual IT turnaround for a number of years,” Chan says, hurting the company’s margins. Likewise, Panalpina currently has the “worst margins in the industry… and has been engaged in a multi-year implementation of its” SAP transportation management software package.

DHL Express was similarly dogged by its implementation of an SAP software package. Even if Panalpina is successful in installing its company-wide software system, “there’s still going to a process of training up people to get comfortable on the systems.

“There’s a lot of things that have to go right for (Panalpina) to get to where they need to be.”

But Chan expressed confidence that DSV could help turnaround the Panalpina business thanks to its strong information technology platform and management execution.

DSV’s CargoWise TMS and investment in technology infrastructure “really helped them to get the UTi deal done well and done quickly,” Chan said. “I think they are going to employ a similar strategy here if Panalpina accepts.”

As Chan points out, DSV chief executive Jens Bjorn has said the turnaround starts “when DSV comes in, refreshes your office space, installs attractive Scandinavian furniture, and starts to recognize and reward high-performers and invest in growth.”

In terms of ranking, the combination would propel DSV to the number one air freight forwarder at 1.3 million tons and the number four ocean freight forwarder.

DSV saw cumulative ocean freight volume hit one million containers in the third quarter, up four percent versus market growth of three percent. Panalpina handled just over 1.1 million containers in the same amount of time, but that volume was down two percent.

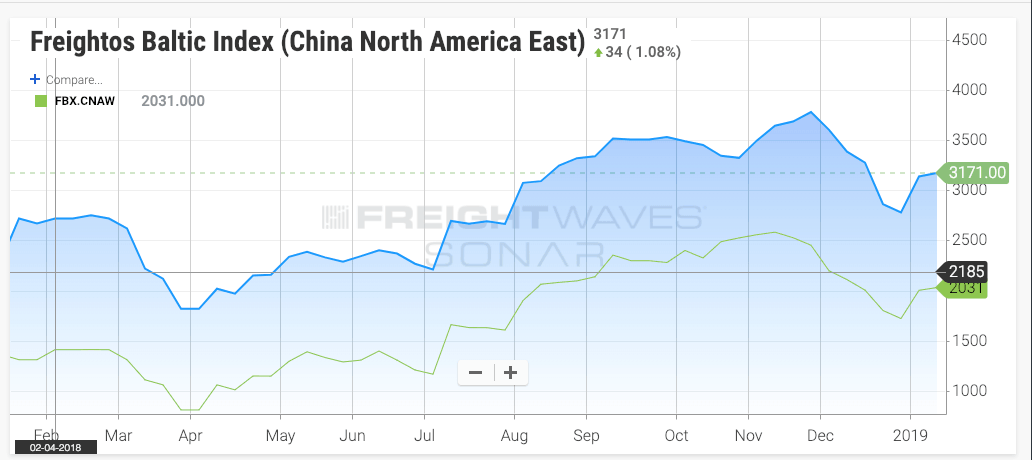

The ocean carrier market has undergone tremendous consolidation over the last two years, with eight major carriers operating in three major alliances carrying most containers. Along with strong global demand, consolidation is one factor that has pushed rates for ocean shipping up 25 to 50 percent higher.

“Scale does help,” Chan said. “It helps both from purchasing standpoint and helps with customers you get entry into.”

“One thing DSV saw after it bought UTi is that they could start talking to these larger multi-national corporations,” he added. “The incremental benefit is not as large on a percentage basis, but I think there is an opportunity to get a larger piece of supply chains sheerly through size.”

Whether Panalpina’s shareholders take the offer is questionable, because about half of the company’s shares are controlled by a foundation, which has rebuffed earlier takeover attempts. That strong insider control, along with the prospect of layoffs, make the choice of accepting DSV’s bid difficult for Panalpina’s investors and management.

But the potential of slowing global trade growth and ocean carriers extracting higher rates “may make Panalpina shareholders, including the foundation, more receptive to DSV’s offer now,” Chan said.

“There’s been a lot of pressure on the foundation and management to do something because frankly a lot of investors have gotten tired of the company’s performance,” Chan said.