Freight Transport Q4 preview may be best in the last two years

For the folks at Morgan Stanley, Q4 earnings season has the potential to reveal actual progress and results for freight transportation companies, according to a research report released on Monday. But the management teams themselves may not speak much of it. Ravi Shanker, equity analyst with Morgan Stanley, writes, “While companies are likely to talk down 1Q on seasonality, we see data momentum continuing into 2025.” Shanker cites initial conversations that suggest management teams are likely to talk about a step down in Q1 and warn against extrapolating the strength of Q4. The risk for those management teams now: If they claim they don’t see momentum, others may accuse them of sandbagging.

It boils down to closing the perception gap that has plagued the industry for most of the Great Freight Recession. The previous narrative of the continued sluggish freight cycle is crashing against the reality of sharply improving data points in spot market and outbound tender rejection rates.

Shaker notes that the truckload segment has the best fundamentals and will be the biggest beneficiary of improving conditions. But he urges paying close attention to what management teams say on their earnings calls, adding, “All eyes will be on how aggressively mgmt. teams either endorse the positive trends or tamp down expectations for 1H25 – and whether that will be viewed as real or sandbagging.”

Keep an eye on Knight-Swift’s earnings and commentary. Shanker told Bloomberg’s Lee Klaskow on a recent Talking Transports podcast that Knight-Swift’s size and exposure in the full truckload segment make it an important voice in determining sentiment across the broader full truckload space. Shanker adds that management has sounded reasonably confident on Q4 with its Q1 guidance already issued and pointing to normal seasonality. However, management’s tone on the first half of 2025 could be critical for the entire sector, as many are debating whether 2025 will bring a return to “normal” seasonality or if the cycle will have a sudden and rapid upswing due to various political and economic events like imposition of tariffs.

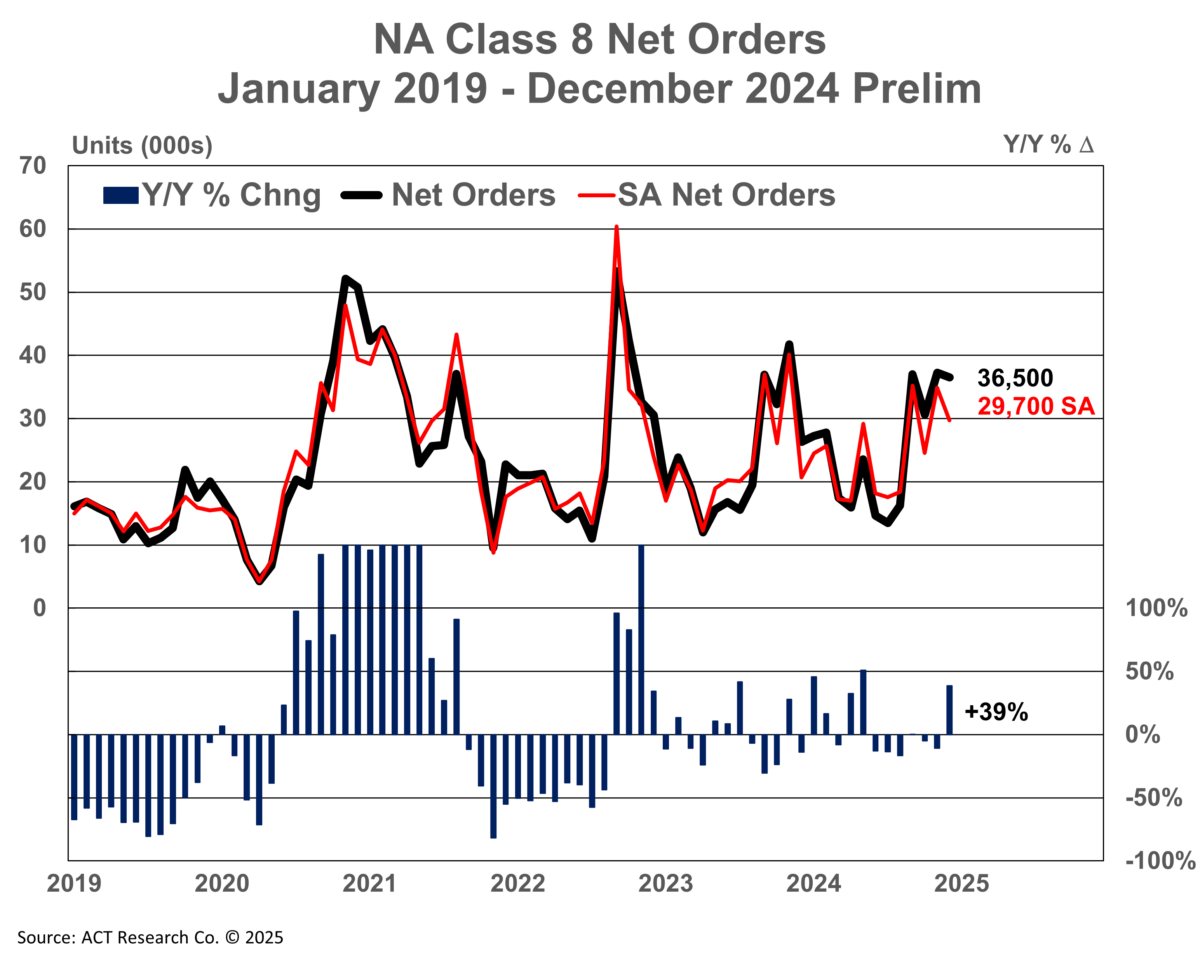

December Class 8 net orders outperform seasonal expectations

December Class 8 orders fell compared to November but posted stronger gains against year-over-year comps. ACT Research reported preliminary December Class 8 Net orders at 36,500 units, a 2.1% m/m decline but 39% higher y/y. Kenny Vieth, president and senior analyst at ACT Research, wrote, “Strength continues to be the applicable descriptor of Class 8 order activity as the industry looks to 2025. While down from November, orders were up nearly 39% compared to last December’s performance. With the largest seasonal factor of the year, seasonal adjustment is always unkind in December. On a seasonally adjusted basis, Class 8 orders fell 15% from November to 29,700 units, and a 356k SAAR [seasonally adjusted annual rate].”

Rival firm FTR Transportation Intelligence reported fewer Class 8 orders in December at 31,900 units, a 7% m/m decline but 23% higher y/y. The order data outperformed the seven-year December average of 29,716 units, with FTR noting positive momentum despite a soft freight environment. Dan Moyer, senior analyst of commercial vehicles at FTR, wrote in the release, “December is traditionally a slower month for Class 8 orders. However, the 2025 order season (September-December 2024) closed with a 6% y/y gain, suggesting that fleets are positioning themselves for opportunities in 2025 despite freight market softness.”

Moyer continued to caution that proposed tariffs on Mexico, Canada and China could cause supply chain disruptions due to higher costs for fleets and OEMs. EPA 2027 nitrogen oxide regulations were mentioned due to the added complexity and potential to pull fleet orders forward in 2025.

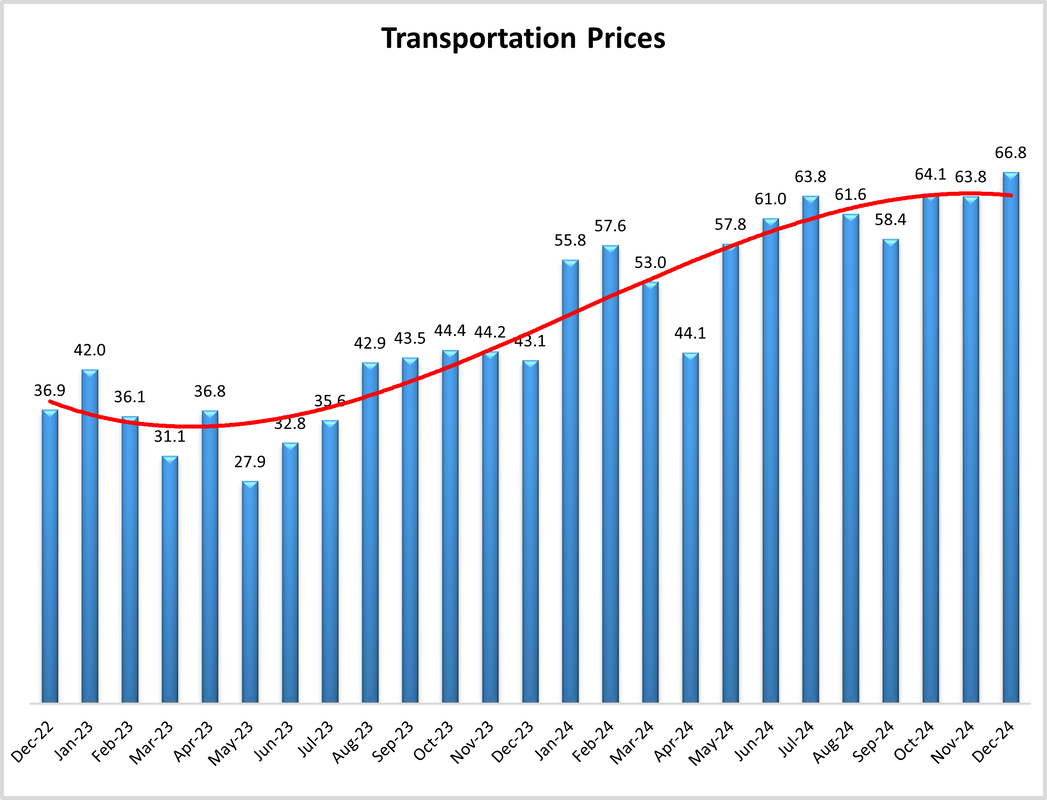

Market update: December LMI Transportation Pricing Index reaches 2-year high

Despite an expected seasonal decline in the overall Logistics Managers’ Index, December brought higher upstream inventory levels and propelled transportation prices to their highest levels since the beginning of the Great Freight Recession two years ago. The LMI is a diffusion index, with a reading above 50 signaling an expansion and below 50 a contraction. The overall LMI composite score fell 1.1 points in December to 57.3 compared to November’s reading of 58.4. Part of the slowdown in logistics activity came from the seasonal wind-down in inventory levels, which fell 6.1 points to 50, or “no change.”

However, there exists a wide gulf in that inventory reading between upstream and downstream. The report notes, “Inventory Levels actually increased, reading in at 57.9, for Upstream firms like manufacturers, wholesalers, and 3PLs that are on the receiving end of the surge of imports that have been coming into the U.S. through December. Conversely, Downstream retailers are reporting significant contractions in Inventory Levels at 33.9; which is what should be happening in December during the holiday shopping season.”

Transportation pricing rose 3 points m/m to 66.8, the fastest rate of expansion for that metric since April 2022. The report added more context, “This also puts Transportation prices above the all-time average of 65.0 for this metric for the first time in over 2.5 years.” When highlighting the extent of the capacity glut, the LMI noted Available Transportation Capacity has not contracted since March of 2022 when the freight recession of 2022-2024 began, “This is a testament to the high levels of capacity that were built from 2020-2021.”

Regarding future capacity trends, FreightWaves’ Todd Maiden wrote, “The 12-month outlook for capacity was neutral at 50. However, supply chain managers are bracing for higher rates. Their collective forward-looking expectation for pricing came in at 77 during the month.”

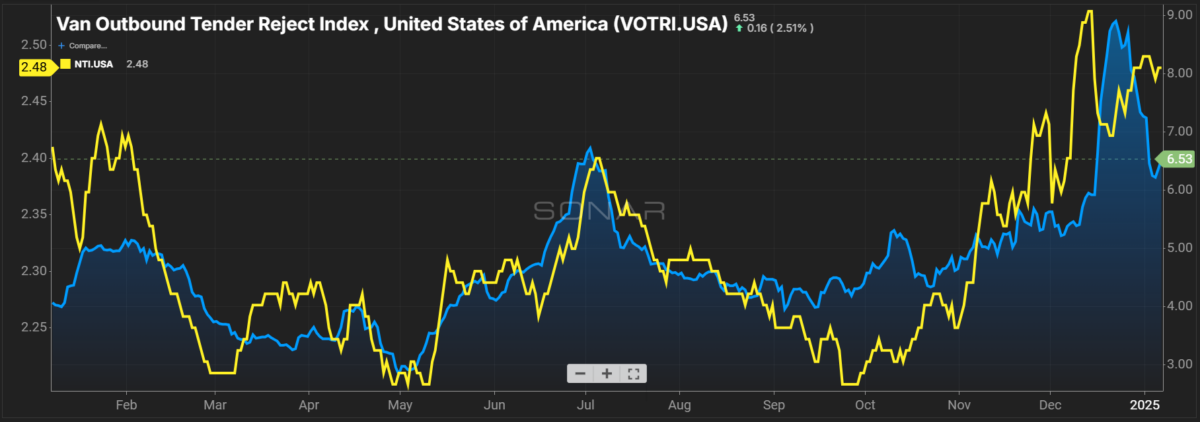

SONAR spotlight: Dry van tender rejection rates get seasonal New Year’s hangover

Summary: The past week saw dry van outbound tender rejection rates follow seasonal trends but remain elevated compared to the past two years. VOTRI fell 81 basis points w/w from 7.34% on Dec. 30 to 6.53%. Despite the decline, the dry van segment’s m/m performance exceeded seasonal expectations compared to 2022 and 2023. VOTRI remains 110 bps higher compared to Jan. 7, 2023, but fell 237 bps from its monthly peak of 8.9% on Dec. 22, 2023. Looking at historical trends, the return of trucking capacity following the holidays is expected, and the decline in outbound tender rejection rates fits seasonal trends.

The takeaway for truckload conditions is that they are improving and remain above 5%, considered parity by some routing guides expecting a 95% tender acceptance rate, leaving only a 5% rejection rate. Anecdotally, some customers expect a 97% to 98% tender acceptance rate in part from the persistent overabundance of truckload capacity observed the past two years.

All-in dry van spot market rates fared better, remaining flat over the past week at $2.48 per mile and 3% higher y/y compared to $2.41 per mile on Jan. 6, 2024. A development to watch for dry van spot rates will be the impacts of winter weather, with the first major winter storm of 2025 dropping record snowfall from the Midwest to the mid-Atlantic and a second system impacting parts of Texas and the mid-South.

The Routing Guide: Links from around the web

Key trucking trends to watch in 2025: tariffs, M&A and rate changes (Trucking Dive)

FMCSA to gauge value of truck roadside warning devices (FreightWaves)

178,000 CDLs downgraded? What really happened in November (Overdrive)

Ford drops auto hauler Jack Cooper after 40 years in business together (FreightWaves)

Rejection rates hit highest level since 2022 – but could have been higher (FreightWaves)

Test drives of 2024: New models, new tech and a couple bucket listers (Commercial Carrier Journal)