UPS Airlines is expanding in the midst of a coronavirus pandemic that is forcing passenger airlines to shrink fleets and permanently downsize in line with expectations for weak travel demand in the coming years.

The UPS (NYSE: UPS) fleet has been busy flying charter flights for the Federal Emergency Management Agency and other customers ordering desperately needed medical supplies for the COVID-19 response in the U.S. and other countries. But the real driver of extra business and aircraft investment is e-commerce and customers seeking express shipping – factors that were rising in importance well before the pandemic.

In the first quarter, Next Day Air shipments in the U.S. grew by 20.5%, the fourth consecutive quarter of double-digit growth, the company said in its earnings report. In 2019, Next Day Air grew more than 22%.

The popularity of online shopping continues to grow and consumers don’t want to wait for their orders. Two-day shipping is now standard for many merchants. It remains an open question whether coronavirus stock-outs will force a rethink among companies trying to implement one-day or same-day deliveries.

Global e-commerce sales are projected to more than double to $6.5 trillion by 2023, according to Statista. The Boston Consulting Group estimates U.S. e-commerce sales will double too, to $1 trillion, growing at six times the rate of all retail transactions. More than half of that growth is through giant marketplaces such as Rakuten, JD.com, Alibaba and Amazon that enable merchants to reach much larger audiences than they could on their own.

Amazon (NASDAQ: AMZN), is UPS’ largest customer, accounting for 11.6% of UPS’ $74 billion in revenue last year. UPS is picking up more business as rival FedEx Corp. (NYSE:FDX) dissolved its U.S. air and ground delivery partnerships with Amazon.

And e-commerce continued to boom as the coronavirus pandemic forced large numbers of people to quarantine at home and avoid brick-and-mortar stores.

On May 12, UPS Airlines took delivery of a new 767 freighter from Boeing, one of 22 new, converted or leased 767s the company is adding over five years ending in 2022. Seven days later the all-cargo plane took its first revenue flight, UPS spokesman Jim Mayer said in an email. Boeing’s website shows seven unfilled UPS orders for production of 767 freighters.

Overall, UPS is expanding its in-house airline by 55 aircraft over that period, equivalent to more than 12 million pounds of payload capacity, including 28 Boeing 747-8 production freighters. Thirteen of the 747-8s are still on back order.

The fourth-largest cargo airline in the world currently operates 261 aircraft of its own and utilizes about 200 more through short-term leases and charters, according to a company fact sheet.

UPS said in a tweet several days ago that it is adding five MD-11 aircraft — two this year and three in 2021. Mayer confirmed that the planes are used aircraft being resold by Boeing.

Although the triple-engine planes are less fuel-efficient than many others in service today, they have large cargo payloads and are inexpensive, Mayer explained to The Points Guy blog.

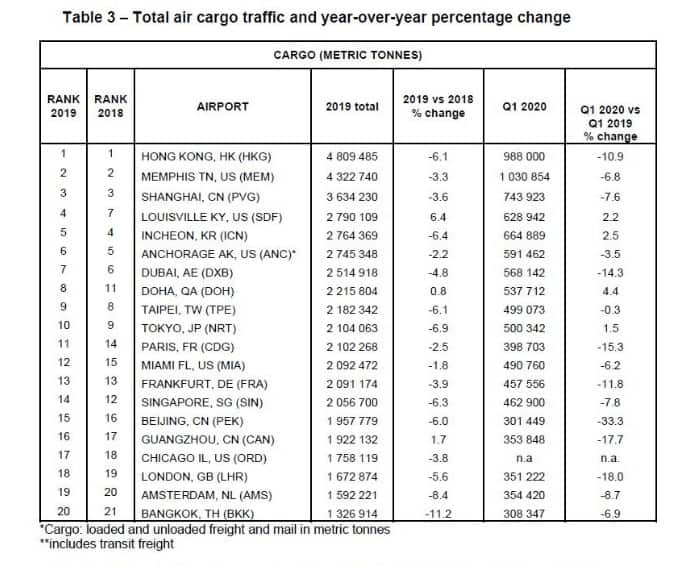

E-commerce also propelled Louisville International Airport in Kentucky to fourth place in preliminary rankings of the world’s busiest cargo airports, released this month by Airports Council International. UPS’s Worldport global package hub is located at the airport, which also serves as home base to UPS Airlines.

The Louisville airport moved up three spots as freight and mail volume increased 6.4% to a record 6.2 billion pounds (2.8 million metric tons). It also moved up to second place, from third, among the largest cargo airports in the U.S. Louisville was one of the few airports to gain cargo business during a year when overall cargo demand fell 3.9%. And cargo volume grew 2.2% in the first quarter, despite economic slowdowns around the world due to the coronavirus.

Hong Kong remained the top global airport for cargo, despite a 6.1% decline in volume attributed to trade tensions between the U.S. and China and pro-democracy protests that dampened air travel and flights to the city. Memphis, Tennessee, home to FedEx Express, continued to hold the second spot for cargo, followed by Shanghai.

New Chicagoland Airport

Online deliveries are also behind the recent decision to expand the UPS express air network to Gary/Chicago International Airport in Indiana. UPS said it will begin operating there Nov. 2, in time for the peak holiday shipping season, with an Airbus A300 cargo plane that can carry more than 14,000 packages.

Each weeknight the aircraft will depart Gary for the UPS Worldport in Louisville and return in the morning with packages sorted from around the world for the northern Indiana and Chicago area.

UPS said it expects to employ about 60 people at the airport, including ground handlers, administrative personnel, aircraft maintenance technicians and managers. UPS signed a lease on May 13 for 14,000 square feet of office space in the airport’s passenger terminal and a 150,000-square-foot ramp area with enough space to park two A300s.

UPS will install a mobile distribution center on the ramp, Mayer tells FreightWaves. The MDC is a poured foundation and a modular metal building with truck doors and a conveyor belt inside for directing packages to the correct vehicle. Mayer said the MDCs give UPS a quick way to add sort capacity and are sometimes used at existing warehouses to expand operating space during the peak holiday season.

(Correction: An earlier version of this story incorrectly indicated that the MD-11s were passenger aircraft that needed to be converted into freighters.)