Major supply chain solutions provider, Manhattan Associates, Inc. (NASDAQ: MANH), held a call with investors to discuss its first quarter 2019 earnings results which were ahead of analysts’ forecasts on an adjusted basis.

MANH reported adjusted first quarter earnings per share of $0.41 compared to analysts’ expectations of $0.34 and the prior year period of $0.37. The biggest adjustment in the period was an $0.08 per share headwind related to equity-based compensation which the company explained typically does not require cash settlement and is more in-line with financial reporting from its peers.

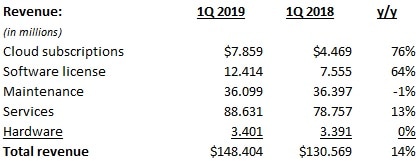

The company saw a 14 percent year-over-year increase in total revenue with management calling out the increases in licensing revenue ($4.9 million), cloud subscriptions ($3.4 million) and services revenue ($9.9 million) which all exceeded first quarter targets. Manhattan Associates President and Chief Executive Officer, Eddie Capel, said that the company experienced “strong demand for products and services, versus a fairly weak 2018 comp.”

Further, management said that total revenue increased 3 percent sequentially with services revenue growth continuing to strengthen and given strong demand for new license and cloud sales. MANH is still in the early stages of its transformation to a cloud service platform. Management said that retail, consumer goods and food and beverage verticals drove more than 50 percent of the company’s license and cloud revenue in the quarter.

MANH’s 24 percent adjusted operating margin declined 70 basis points year-over-year, but the company remains heavily focused on research and development (R&D) investment which was up 24 percent in the period.

Capel continued, “For 2019, we’re accelerating our innovation investments, committing more than $80 million in total R&D spend and we believe market demand will generate positive ROI [return on investment] on these R&D investments.”

“Despite appropriate cautions regarding the global macro volatility, we are bullish on our outlook for 2019 and we’re raising our 2019 full-year total revenue and earnings per share guidance whilst maintaining our operating margin,” said Capel.

The company increased its full-year 2019 guidance, calling for revenue growth of 4 to 6 percent (up from 1 to 3 percent), an adjusted operating margin of 21 to 21.2 percent and adjusted earnings per share guidance of $1.42 to $1.46 (up from $1.38 to $1.42) compared to the current consensus estimate of $1.41.

MANH is seeing strong demand for its services and said that half of its pipeline opportunities represent new customer relationships. On the call, management said that its 2019 full-year guidance for total combined license and cloud-recognized revenue remains at $76 million, an 11 percent increase year-over-year. While MANH expects mid-single digit revenue growth in 2019, investments in R&D, increased headcount in sales and marketing as well as its consulting services division (it added 6 percent capacity to the division in the period compared to the fourth quarter of 2018) will provide a headwind to operating margins moving forward.

MANH said its remaining performance obligation (unearned revenue or future bookings for its cloud services) totaled $101 million, up 196 percent year-over-year and 31 percent higher compared to the fourth quarter 2018.

We remain committed to investing in innovation and are bullish on our growth opportunity in 2019 and beyond,” said Capel.

Manhattan Associates is a technology leader in supply chain and omnichannel commerce. It is known for uniting information across the enterprise, converging front-end sales with back-end supply chain execution.