Lower shipment weights and the loss of some project freight won in the early days of Yellow Corp.’s wind-down a year ago weighed on metrics at ArcBest’s asset-based unit in August.

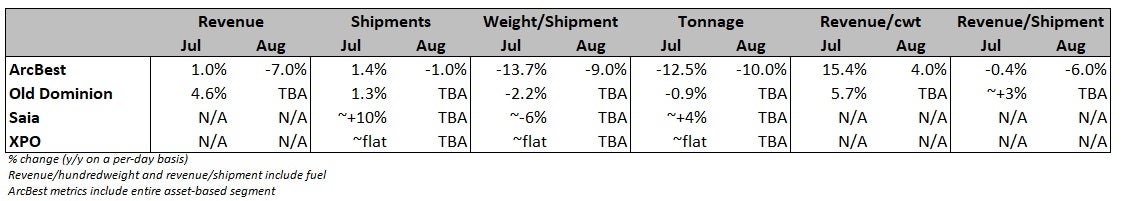

The company’s asset-based segment, which includes results from less-than-truckload carrier ABF Freight, saw tonnage fall 10% year over year in August, following a 12.5% decline in July, according to a Tuesday evening filing with the Securities and Exchange Commission. The August decline was the combination of a 1% dip in shipments and a 9% drop in weight per shipment. The carrier foreshadowed the y/y decline on its second-quarter call in early August, saying some of the initial wins captured last summer had been lost to lower-cost providers.

ArcBest (NASDAQ: ARCB) has continued to swap out transactional freight taken on prior to Yellow’s (OTC: YELLQ) shutdown with more profitable shipments from core accounts. However, an overall malaise across the industrial complex is protracting the freight swap.

“We anticipate that daily tonnage levels for third quarter 2024 will be below the prior year, as some of the core business increase that began in July 2023 was project-related, and some of the increased business has shifted to other providers over the past year,” the filing said.

The y/y tonnage declines have continued to recede from a May high of 22%.

Revenue per hundredweight, or yield, was up just 4% y/y in August after a 15.4% jump in July. (The metric was 23% higher y/y during the second quarter.) On a two-year-stacked comparison, which helps neutralize the impact of prior-year comparisons, yield was up 8% in August compared to a 9% increase in July.

Lower shipment weights boost the yield calculation.

Asset-based revenue per day was down 7% y/y in August, following a 1% increase in July. However, the two-year-stacked comps for the two months are within 130 basis points.

The Tuesday update said “pricing remains rational” and that it will implement a general rate increase of 5.9% on Monday. The percentage increase, which is an expected average across lanes, is in line with the GRI announced last year but roughly three weeks earlier.

The company recorded a 5.1% increase on contractual pricing renewals in the second quarter and previously said it expects similar increases in the back half of the year.

ArcBest modestly lowered its third-quarter margin guidance on Tuesday. It now expects the asset-based operating ratio (inverse of operating margin) to be flat to 50 basis points worse than the 89.8% adjusted OR posted in the second quarter. It said on its second-quarter call in early August that the OR would be flat sequentially in the third quarter (versus a normal change rate of flat to 100 bps of improvement).

A “soft manufacturing environment and truckload markets” along with lower shipment weights and a wage increase were cited as the detractors to margins. ABF just started year two of its collective bargaining agreement with the union, which called for a 2.7% combined increase to wages and benefits.

ArcBest’s asset-light unit, which includes truck brokerage, reported a 5% y/y decline in revenue per day during August, following a 10% decline in July. Shipments per day were flat y/y for the two-month period, but revenue per shipment was down 8%.

“Shipment growth has moderated due to lower demand from existing customers, reflecting current macroeconomic conditions,” the filing read. “Additionally, truckload volumes have slowed as we strategically reduce less profitable freight.”

The unit booked a fourth consecutive operating loss in the second quarter, and the company said on Tuesday an adjusted operating loss of $5 million to $6 million (roughly twice the loss posted in the second quarter) is expected for the third quarter.

Shares of ARCB were off 1.2% in after-hours trading on Tuesday.