There are just over 1.6 million railroad freight cars in the U.S. market. Yet, on any given day more than 900,000 won’t move.

WOW! That’s a big number. Why?

Freight cars stand still in railyards waiting for an empty car placement from shippers. They stand empty on customers’ sidings. Loaded railcars in general cargo (manifest) service often sit idle for 23 hours in a switch yard before being routed to their destination, according to Oliver Wyman’s industry expert Rod Case. This is the opposite of most trucking utilization patterns.

The situation differs by railcar type. Intermodal railway cars might move as many as 400 to 600 miles every day, at better than 80 percent calculated utilization. However, that is atypical of the overall fleet.

Given this market image, is building freight railcars a good or bad market to be in? That depends upon a number of economic factors, including one’s investment risk tolerance.

Simplistically, one can argue that the profitability of railway freight is extremely high. The largest railroad companies can earn revenue margins exceeding 15 percent. Returns on invested capital are now excellent, at about 12 to 14 percent.

Translation? For some traffic commodities, and over some origin-to-destination market routes, freight railcars provide a secure return for both the railroad and the freight wagon investor.

However, investing in railway freight car equipment is best left to the professionals.

Let’s briefly review that environment.

Decades ago, regulatory policy in the United States encouraged speculation by the wealthy in financing freight railcars. Rates for using that mortgaged equipment were supported by Interstate Commerce Commission oversight. Today, the rail freight market is fundamentally unregulated. Lease rates for today’s freight railcars are subject to market demand changes.

Decades ago, the typical freight railcar had a new cost below $50,000. Today, the typical freight railcar is in the $100,000 to $150,000 range.

Overall, there are six basic freight railcar types. But within each railcar type, there are multiple specific design factors. The design options impact each railcar’s capital cost.

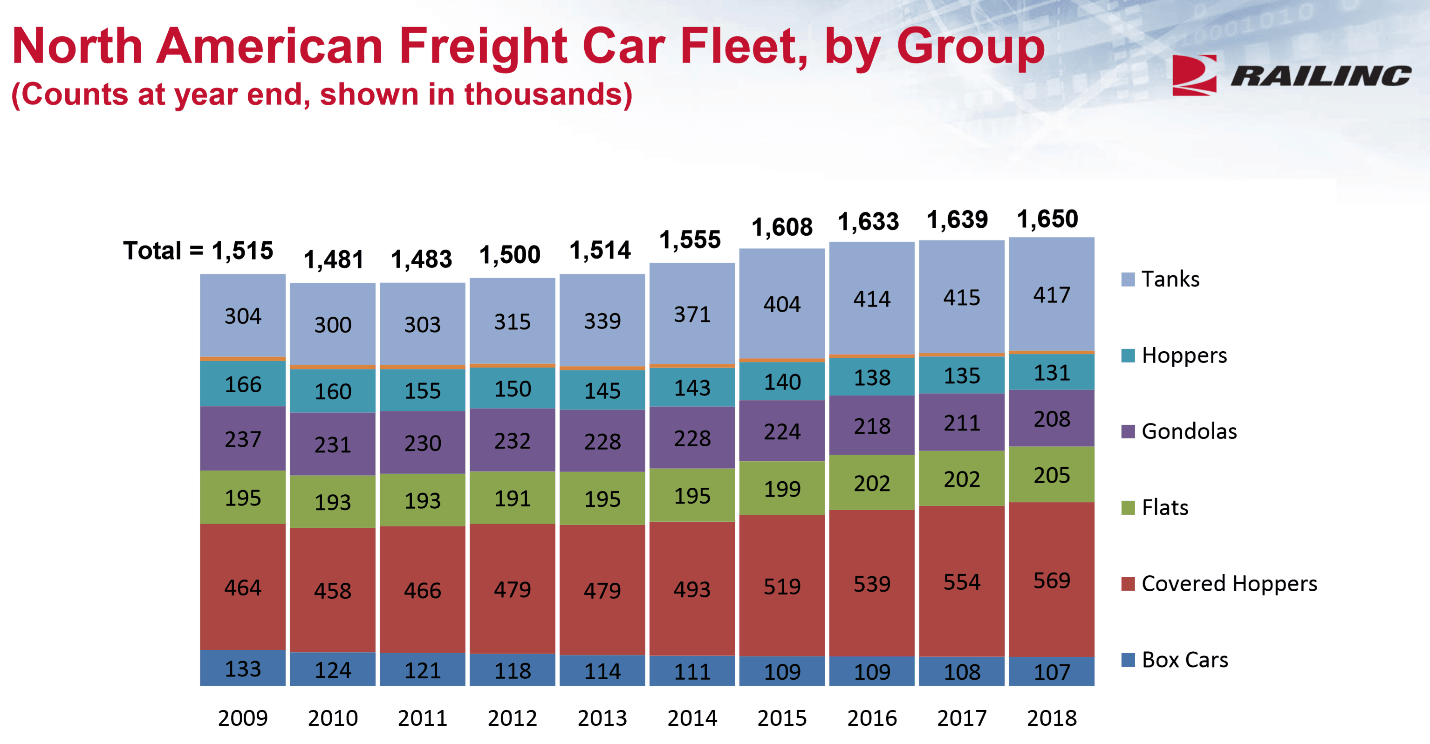

Here are the six railcar types and their approximate percentage of the Association of American Railroad’s registered fleet.

David Humphrey, a Railinc executive identified the year-end 2018 rail car fleet as consisting of six broad car types (below). Humphrey points out that the North American fleet increased slightly (by about 0.7 percent between 2017 and 2018).

Within these six categories there are multiple car sub-types. For example, coal cars come as open hopper car designs or as advanced high-side gondola cars. These coal cars can be either built with steel or aluminum bodies. They can have rotary couplers for twist and dump unloading, or straight couplers with doors for gravity unloading.

Freight railcars are built to different loading weights. Older railcar capacity is a maximum of 263,000 pounds when fully loaded (including the car’s tare weight). Modern railcars built after 1989 are typically built with a heavy axle design and have a capacity of 286,000 pounds.

Changing market demand results in a high variance of cars built per annum. Railway freight traffic witnessed a volume growth spurt between 1980 and 2006. Then, with the Great Recession, railway cars available (market supply) far exceeded the market demand.

Railcar investors were hurt. Badly.

Car utilization rates declined. According to a March 2009 survey by Longbow Research, “as many as a half million cars went to storage.” Lease rates fell an average of 21 percent year-over-year in a Longbow Research report. Progressive Railroading’s March 18, 2009 outlook for new railcar deliveries in 2010 fell to fewer than 17,000 units.

In contrast, 40,000 to 50,000 new railcars are delivered in “normal good years.”

A recovery from the recession combined with an unforeseen but welcomed surge in crude oil rail tank car volume benefited railcar manufacturers between 2009 and 2014. Orders surged by early 2014 to more than 80,000.

Then “pop” – the volume of crude oil transported by rail fell as world and U.S. oil prices fell unexpectedly to less than $50 per barrel. In some heavy crude markets, prices dropped below $35 a barrel.

That signaled a drop in new rail car orders.

What is the market today one third of the way through 2019? It’s like “the fog of war.” At least four economic forces are at play as you read this.

A stagnant economic pattern has developed, at least for railway freight units moved year-to-date.

Geo-political uncertainty over trade and tariffs is depressing what would otherwise be growth in exported grains and energy. That negatively impacts covered hoppers (grains), gondolas and hoppers (coal), and even tank cars (oil, chemicals) and various railcar types that carry plastics.

The Amazon effect that drives lower supply chain pricing in trucking compared with freight railway rates is the next economic uncertainty. Railroads might report slightly higher train speeds and faster yard through-put. But those metrics cannot support Amazon’s promise of delivering goods in one- or two-day “Prime” fashion. To date, the railroads have not figured out how to provide a short-haul delivery service that is fast and reliable. This could be hurting the demand for intermodal flat cars.

The final risks are the promised but not yet seen freight railcar utilization increases from so- called precision scheduled railroading (PSR).

Circling back to those approximate 900,000 freight cars a day that don’t move – this PSR improvement could be a breakthrough if the executive promises of more precision are achieved – at the final railway freight users’ docks. If this PSR model eventually improves railcar cycle times by as much as 20 percent, that could increase railcar fleet capacity by as many as 200,000 railcars.

That’s the equivalent of three to four years of nominal volume freight railcar deliveries.

So far, no one seems to be predicting that PSR will have such an impact on the railcar building industry. Nevertheless, the potential exists.

There are other ways to improve railcar utilization. Better computer software that provides predictive movement control tied to enhanced “train GPS” could also see fewer cars spending a day “at rest.”

In conclusion, the economics of freight railcar investment are complex. The solutions and the lower risk railcar strategies are in flux. Experts like Philip Baggaley and Betsy Snyder from S&P Global Ratings suggested in March that “railroad credit strength remains strong with ample liquidity and capital strength to weather any downturn,” if one occurs.

Kristine Kubacki from Mizuho Securities USA suggests that “rail is still looking for the next great business opportunity (post-crude by rail). Rail equipment investors are being cautious.”

Ron Sucik from RSE Consulting points out that “contrary to expectations, rail was unable to capture intermodal market share from truck in 2018.” He projected that 2019 intermodal growth might be around 3 percent.

Yes, it’s a complex business. This article just scratches the surface of the rewards and risks. If you want to learn more, contact David Nahass, Financial Editor of Railway Age for his professional insight. Go to this URL https://www.railwayage.com/financeleasing/ref-2019-roundup/?RAchannel=home