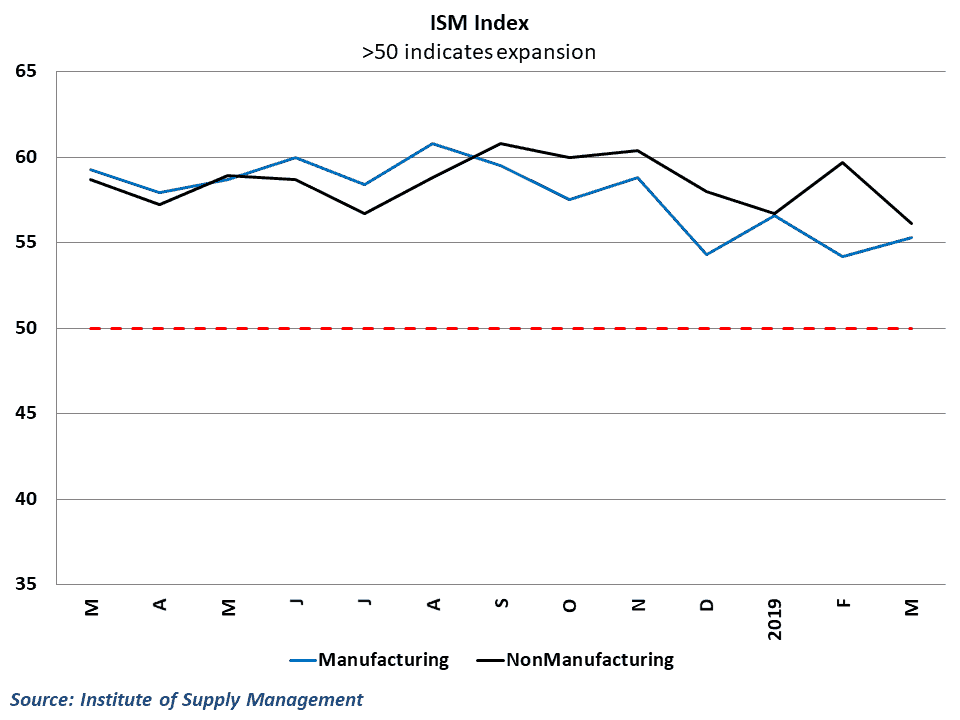

Survey data from the manufacturing and service sectors continue to point towards growth in the overall economy. Manufacturing activity rebounded nicely in March, while readings from the service sector slipped but remain generally strong.

Data from the Institute of Supply Management (ISM) showed that U.S. factory activity expanded at a faster pace in March, as the manufacturing purchasing manager’s index rose 1.1 points to 55.3 on a seasonally adjusted basis. Readings above 55 typically signal solid growth in the sector, and results from the manufacturing sector have been trending downward in recent months before hitting a 14-month low of 54.2 in February. As a result, March’s results are a welcomed sign that activity may be picking up after losing considerable momentum.

Within the manufacturing data, sub-indices on both current production and new orders experienced sizable gains in February, with the latter erasing much of the decline from the previous month. Employment readings also jumped in the manufacturing sector, in a sign that hiring may begin to pick back up. Sixteen of the 18 industries surveyed by the ISM reported growth during the month, with only Paper and Apparel manufacturers reporting contraction.

In the service sector, results moved in the opposite direction, falling 3.6 points to 56.1 in February. Unlike the manufacturing sector, readings on current activity and new orders both retreated during the month, pushing the overall index to the lowest reading since the middle of 2017. The vast majority of service sector industries also registered growth in March, with only Retail Trade and Educational Services reporting a contraction.

Labor availability, poor weather affecting growth

Comments from ISM respondents suggest that the recent snowstorms and flooding in the country kept growth in the economy from being more robust in March. One respondent from the Wood Products industry noted: “Weather in the domestic market is constraining homebuilding across the nation – too wet in the south, severe winter in the north. Expectations are that homebuilding backlog is growing, and a surge of domestic business will come in May and June.” These thoughts were echoed in the Machinery industry, where a commenter noted “Current weather conditions [are] causing significant delivery delays [and] diminishing our production capabilities.”

Tight labor conditions were also among the chief concerns facing producers in both sectors, continuing a trend that emerged in the early part of last year. One respondent in the Public Administration industry highlighted these concerns, stating, “Locally as construction grows, a shortage of available workers for the industry is occurring for future projects.” These issues were also prevalent in the Transportation and Warehousing industry, which includes trucking, where one respondent simply stated: “Labor, weather and regulatory issues have impacted operations.”

About the ISM Index

Each month, the Institute of Supply Management surveys purchasing managers in the manufacturing and service sectors on different aspects of business, asking whether or not their activity is expanding or contracting. Data is collected on things such as employment, production, prices, exports, inventories and orders. Responses are then weighted to create the ISM manufacturing and nonmanufacturing indices.

Readings above 50 signal that more than half of the respondents to the survey believe that overall manufacturing activity is expanding during the month, while readings below 50 are a sign that activity is contracting. Historically, index results over 55 are a sign of above-trend growth in the manufacturing sector.

ISM data also gives some insight into trucking freight conditions. Manufacturing production is one of the key supports for freight demand in the economy, and readings from the ISM index typically are a leading indication on the amount of truck tonnage growth in trucking markets.

Behind the Numbers

The survey data in the U.S. continues to point to an economy that grew at a slower pace in the first quarter of the year. The ISM data seems to be more optimistic than some of the “hard” data on output and sales that have emerged over the past few months, however, creating something of a disconnect when trying to determine the overall health of the economy. Retail sales, trade and manufacturing growth have all been trending below historical averages at the start of the year, but ISM data suggests that business activity is slightly above average. Even the service sector data, which fell by a good amount in March, remained at a level that is consistent with above-average growth.

In this regard, the commentary gives some useful insight. Many of the respondents highlighted that demand remained generally strong for their business, expressing some relief that some of the temporary factors such as the government shutdown and weather are now hopefully in the past. This would suggest that growth in some of the hard data will begin to pick in some of the more troubled areas in the economy such as housing and construction, and should lead to stronger growth overall in the second quarter. FreightWaves has maintained that first quarter GDP growth will likely fall well below 2 percent once the data is released at the end of the month, but growth should improve in the second quarter, regaining some of the lost momentum.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.