Both new home sales and home starts showed some improvement in August, ending months of disappointing activity. Existing home sales failed to expand for the fifth straight month however, and housing in general remains a weak area for freight demand.

Home building jumps but remains below previous levels

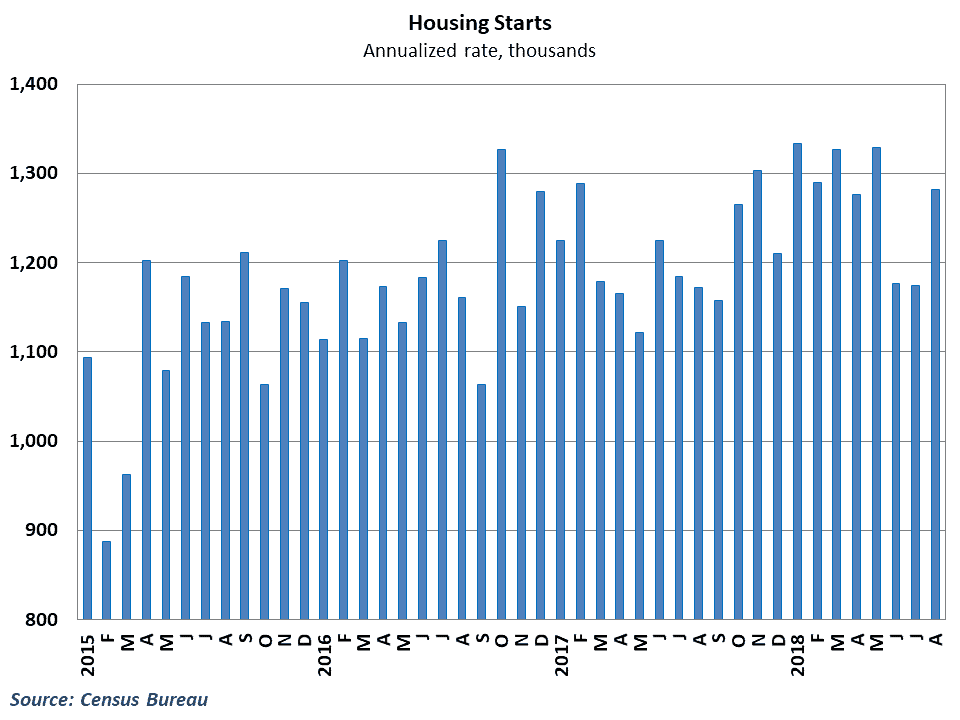

Earlier this month, the Census Bureau reported that housing starts rebounded nicely in August, advancing to a 1,282,000 annualized pace after declines in both June and July. This beat consensus expectations of a 1,240,000 pace, and gives some hope for the beleaguered construction sector. Housing starts had fallen short of consensus estimates in each of the previous four months, and the big drop off after May raised some concerns that home building may be contracting for an extended period.

To that extent, the August result provide some relief. However, even with the sizeable gain during the month, the pace of home building remains below what was seen earlier this year, and certainly below any acceleration that many expected headed into the middle part of the year. In addition, August’s results brought a surprise drop in building permits, which does not bode well for future construction.

Trends in the West region of the country have fared particularly poorly, and starts are approximately 25% lower than they were at the end of 2017. Other regions in the country have fared better, with the South and Midwest not showing much deviation from previous trends.

Softening prices for materials costs likely played a role in the better results in August. Lumber and other building materials prices have come down after peaking a couple months ago, making it more cost effective for builders to build homes. In addition, hiring has been fairly strong in construction in 2018, which is likely starting to translate into additional construction activity.

Home builders continue to wrestle with a lack of developed lots for building, however. This shortage of available lots for construction means that prospective home builders have to pay more for the limited supply available. In addition, construction companies continue to face a shortage of skilled labor despite recent hiring trends. Opening within the construction industry far exceed the level of hires, indicating a severe lack of available labor.

New sales improved, but purchases of existing homes continue to struggle

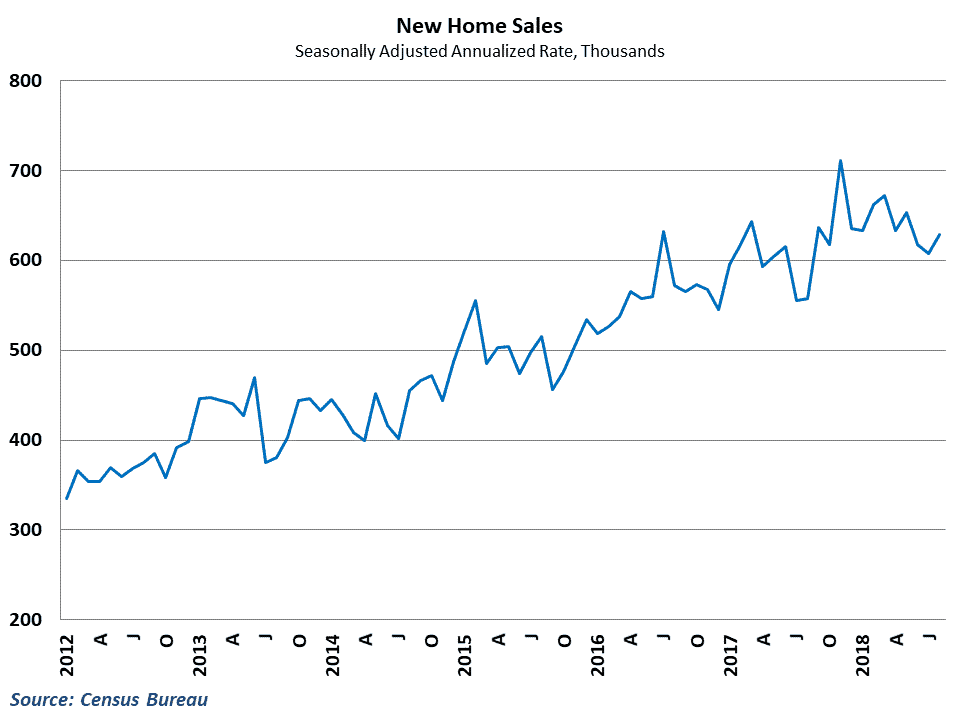

On the demand side, new home sales also exceeded expectations, rising to a 629,000 annualized pace in August. This is up 3.4% from July’s pace and 12.7% higher than last year’s results. Like housing starts, the growth in new home sales comes on the heels of consecutive declines in June and July. Also, like housing starts, the current pace is still well below the pace of home buying seen earlier this year.

Going forward, the pace of new home sales is likely to continue to depend on the pace of home building in the economy. Strong job growth and high confidence would suggest that demand for housing is out there, and the real question is whether or not there will be houses available for purchase. As new homes are made, households appear willing to shrug off higher mortgage rates and buy despite generally rising prices.

Existing home sales, which make up the majority of home purchases, again fell short of expectations in August. The National Association of realtors reported last week that sales of previously owned homes remained unchanged at a 5,340,000 annualized pace. This ends a streak of four consecutive months of declining sales of previously-owned homes, but continues to point towards weakness in this aspect of housing activity.

Again, part of the problem with existing sales revolves around the number of available units being offered up for sale. Rising prices has led owners of existing houses, who may have considered offering their homes for sale, to hold on to their properties longer. Homeowners are moving less frequently, and when they do move, they are often offering their homes for rent rather than selling them. This behavior further restricts the housing supply and affects the overall affordability of housing in the economy.

Housing market and freight demand

Activity in the housing market plays a key role in overall freight demand in the economy. From a building perspective, the transportation of construction materials accounts is a key component of freight demand, and the disappointing results from home building will reduce the demand for flatbed carriers and other modes of transporting construction materials.

Home sales, on the other hand, typically affect demand for associated goods. Rising home sales and homes offered for sale often provide a benefit for building materials and gardening equipment, as owners spend on remodeling and landscaping efforts. In addition, heavy consumer durable goods like furniture, air conditioning units, refrigerators, and stoves (known as “white goods” for their traditional finish) typically see a lift from rising home sales This provides a boost to freight movements to ship these items to and from warehouses and distribution centers. In addition, these white goods sales have increasingly opened up to e-commerce channels in recent years, helping to drive some of the growth in last-mile delivery services for truckers and LTL carriers.

Retail results over the past couple months have reflected this weakness in home purchases, as furniture and building material sales have stumbled despite a generally healthy retail environment.

Behind the numbers

Any sign of good news coming out of housing is a positive at this point, as the weak data from June and July had many thinking that housing was headed for a prolonged contraction. This is a particularly frustrating period for housing because so many of the fundamentals for demand like demographic, household finances, and household formation would point to an acceleration in activity. Instead, bottlenecks on the supply side are keeping things softer than they otherwise might be.

The does not appear to be any quick solution on the horizon either. The unavailability of developed lots is unlikely to resolve itself any time soon, and the lack of inventory on the existing home side could take quite a while to improve.

Housing data for the next couple of months is likely to have some Hurricane Florence-related noise affecting the results, particularly in the South region’s home start data. For now, however, the outlook remains fairly subdued for housing and construction activity going forward.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.