Housing growth, Canadian tariffs, insect infestations, and Chinese imports all pushing lumber to record prices

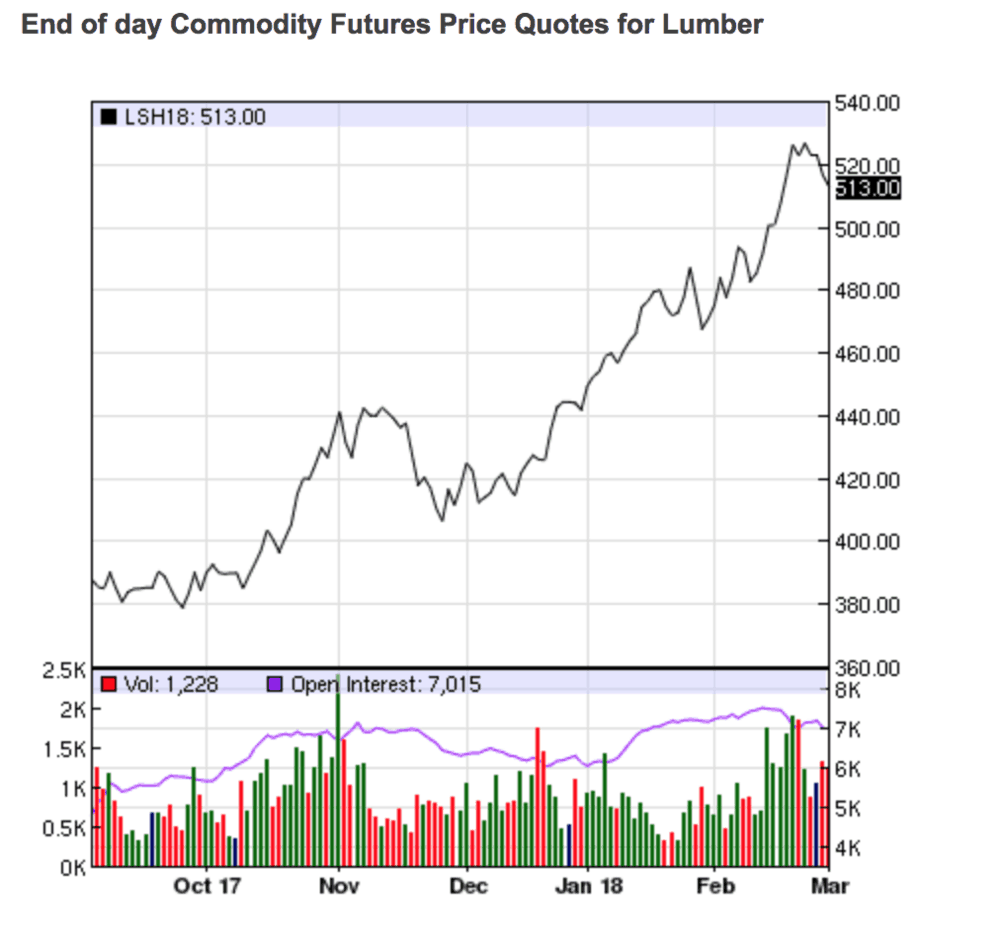

Lumber prices are the highest they’ve ever been in the United States—let that sink in for a moment. Futures contracts for 1,000 board feet of lumber are trading at $513. For perspective, according to Wood Markets, in the 1980s it was rare for average monthly prices to exceed $200 (it only happened in 14 months that decade); in the 1990s, U.S. prices managed to crack $400 for 14 months that decade; in the 2000s, the housing crisis put downward pressure on lumber prices, which only broke $400 8 months that decade, and dropped under $200 for 11 months.

Ted Ostranger, a market manager for 84 Lumber, said, “Usually prices drop in January. This year is a different scenario, and most people are shocked by the fact the lumber market is not coming off any this year.”

We’ve passed the $500 threshold, and the main question is whether these high prices are evidence of a sustainable new market environment or simply a cyclical peak. Similar to sky-high transportation rates, lumber prices are being boosted by strong demand coinciding with tight supply. We’re experiencing a rare alignment of strong GDP growth across all of the world’s major regions, generating a major tailwind for the construction industry. American single-family housing starts grew 7%+ year-over-year in January, and that pace is expected to continue throughout 2018, with the majority of activity concentrated in the Southeast and Western regions. Chinese lumber imports are also steadily growing due to the effects of the Natural Forest Protection Program, which went in place in 2000, but has taken years to fully implement. By 2015, China had cut its deforestation rate from 2.7% annually to less than 1%, and was importing a corresponding volume of wood.

“We’re in a lumber supply crisis,” said Stinson Dean, a Kansas City lumber broker, in an analyst note to investors. “None of us have experienced a market like this.” The other side of the equation is supply, which has been cramped by the 20.83% average tariff imposed on Canadian lumber imports by the Trump administration starting in November 2017, but retroactive to January.

According to Wood Markets’ February 2018 report, lumber mills in British Columbia are cutting shifts and even shutting down due to the impacts of mountain pine beetle and spruce beetle infestations: the mountain pine beetle has destroyed 16M hectares of lodgepole pine forest in British Columbia out of a total of 55M hectares. Meanwhile the spruce beetle epidemic, which destroys trees about twice as quickly as the pine beetle, is growing at an estimated 50% per year, a pace accelerated by warming weather patterns. And last summer more than 375 wildfires in British Columbia burnt down even more lumber supply.

Tight labor markets in everything from logging to milling and home construction, as well as higher prices for trucks, railcars, and containers are also limiting market access to lumber and raising costs for homebuilders. In January, flatbed truck rates were up 24% YOY.

The bottom line is that the cost of major homebuilding materials—everything from 2x4s to OSB and plywood—are soaring. Small builders are spending more resources sourcing their materials and cost-engineering their estimates because they aren’t able to pass everything along to the developers. National builders typically have a more flexible supply chain with access to more sources, and won’t feel the impact of sky-high lumber prices as quickly, but regional and local builders are being forced to get creative. Home prices are already forecast to experience strong growth over the next decade, because the millennial generation has finally started buying single-family homes in large numbers. If homebuilding materials costs keep rising, that will accelerate price increases, potentially to the point where demand is stifled.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.