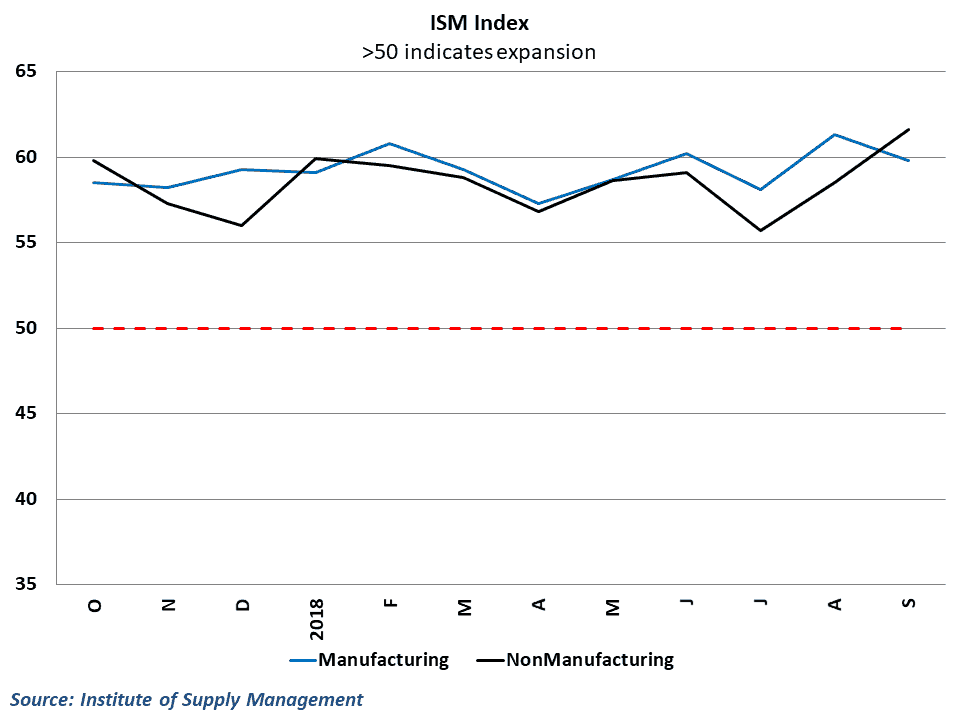

Survey data from the manufacturing and service sectors continue to point towards robust growth in the 3rd quarter. Manufacturing activity slipped slightly from multi year highs during the month, but service activity has pushed to record highs despite concerns over labor shortages and the lack of trucking capacity.

Data from the Institute of Supply Management (ISM) showed that US factory activity expanded at a slightly slower pace in September, as the manufacturing purchasing manager’s index fell 1.5 points to 58.1 on a seasonally adjusted basis. This decline was largely expected however, as August’s results were the highest on the manufacturing side of the economy since 2004. Readings above 55 typically signal solid growth in the sector, and manufacturing reading have been hovering around 60 for most of the year. September’s results fall right in line with this, with subindices on both current production and new orders showing considerable strength at the end of the 3rd quarter. Moreover, the expansion in activity appears to be fairly robust, as only one (Primary Metals) of the 18 industries tracked in the manufacturing sector reported contracting activity during the month.

In the service sector, results were even stronger, as the ISM non-manufacturing purchasing manager’s index jumped for the 2nd consecutive month, rising 31. Points to 61.6 in September. The marks the all-time high since the creation of the composite index in 2008, though the ISM survey began in 1997 in the service sector. Like the manufacturing side of the economy, growth in the service sector was broad-based, with no industry in the survey reporting a decline in activity during the month.

Taken in tandem, reports from the ISM point to an economy that is still chugging along at a strong pace in the 3rd quarter. With both the current and future-looking components of the index posting strong readings, there is little evidence of a slowdown in upcoming months.

Service sector responses highlight the trucking shortage

That is not to say that these sectors aren’t facing challenges. In the service sector, several respondents called out some of the challenges they have been having in finding labor to fill positions, while others specifically highlight the issues that the current driver shortage is causing on business. One respondent from the Accommodation and Food Services industry noted: “[Additional] logistics costs, both inbound and distribution, caused by increased governmental regulation, and a shortage of class-A drivers is leading to a significant increase in [the] cost of goods [sold].”

Elsewhere in the economy, a respondent from the Wholesale Trade industry commented on the challenges of passing higher costs on to the end consumer: “Import tariffs on steel, plywood, and [other] lumber are inflating prices, which are difficult to pass along to the end user due to competitive pressures. Labor and trucking shortages are affecting the industry. Low finished goods inventory is inflating home prices and causing buyers to delay purchases.”

New round of tariffs roils manufacturers

Commentary on the manufacturing side of the economy was dominated by concerns over tariffs. The Trump administration began the next round of tariffs on China’s goods in September, targeting an additional $200 billion in imports from China to be subject to a 10% tariff.

One respondent from the Computer and Electronic Products industry summed up the feelings of many on the manufacturing side, saying: “The market is in a state of chaos with the latest round of tariffs. As an electronics original equipment manufacturer, our component prices have been impacted almost across the board. The tariffs have caused a mass rush to buy up inventories of affected products in order to minimize the long-term financial impact. This, in turn, is causing market constraints, which further drive up the cost and increase lead times.”

Other respondents were quick to note of the wave of tariffs is affecting their bottom-line and disrupting supply chain activity. One respondent noted: “Suppliers are impacted by China tariffs, [which is] delaying or cancelling manufacturing transfer projects.”

About the ISM Index

Each month, the Institute of Supply Management surveys purchasing managers in the manufacturing and service sectors on different aspects of business, asking whether or not their activity is expanding or contracting. Data is collected on things such as employment, production, prices, exports, inventories, and orders. Responses are then weighted to create the ISM manufacturing and nonmanufacturing indices.

Readings above 50 signal that more than half of the respondents to the survey believe that overall manufacturing activity is expanding during the month, while readings below 50 are a sign that activity is contracting. Historically, index results over 55 are a sign of above-trend growth in the manufacturing sector.

ISM data also gives some insight into trucking freight conditions. Manufacturing production is one of the key supports for freight demand in the economy, and readings from the ISM index typically are a leading indication on the amount of truck tonnage growth in trucking markets.

Behind the Numbers

The survey data coming out of the US continues to be historically strong, making impressive numbers like 60 in the ISM data seem relatively routine. Of course, challenges exist on both the manufacturing and non-manufacturing sector, but it is very telling that all of the components that cover actual output have shown little to no sign of weakness.

As always, the commentary from respondents also gives some interesting insight. For one, there was very little commentary suggesting that demand was weakening in any way, save some comments on how tariffs were affecting exports. In addition, there were more mentions of trucking capacity problems on the service side of the economy in September, suggesting that this is a problem that is spreading beyond just manufacturing activity.