Regional surveys from Federal Reserve districts were mixed during the month, as softening conditions from the Philadelphia and Kansas City districts were offset by improvements in the Richmond and New York regions. Commentary from the regional surveys suggests tariffs, labor shortages, and the inability to find trucking capacity are curbing economic activity across the board, though growth remains generally positive.

About the regional surveys

Each month, several Federal Reserve banks conduct surveys with local manufacturers on various aspects of business activity, including current production, new orders, shipments, hours worked, and prices paid and received. Indexes are created for each of the components of the survey by subtracting the percentage of businesses that say that activity is contracting from the percentage that say that activity is expanding. As such, any reading above zero indicating that activity in the region is expanding, with readings above 15 typically signaling solid growth.

These regional surveys typically provide the first look at manufacturing conditions among government data. Results from the regional Fed surveys often provide insight into other economic indicators such as the ISM index and industrial production which are released in subsequent weeks.

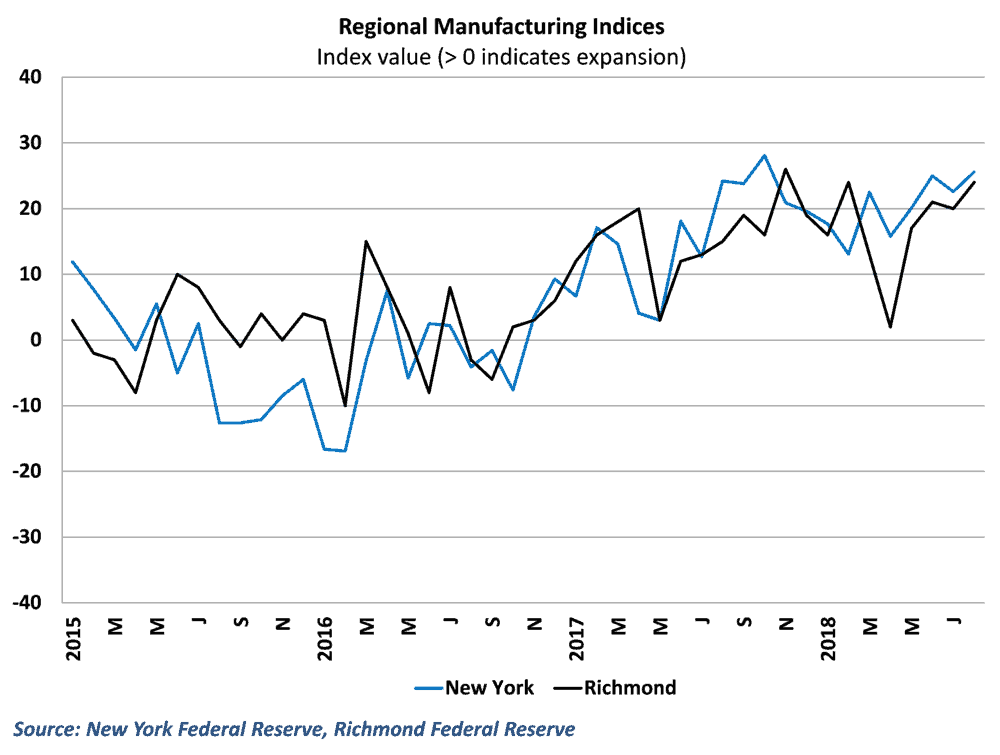

Strength in New York, Southeast, Texas

The New York Federal Reserve’s Empire State manufacturing index rose to 25.6 in August, up from 22.6 in the previous month. This marks the highest reading for New York’s manufacturing sector of the year, and serves as a sign that demand conditions remain healthy well into the 3rd quarter. Both current shipments and new order showed some improvement during the month, and the various components on future expectations show that business in the area remain optimistic about growth going forward.

A similar story emerged from the Richmond district, which covers the Southeastern part of the US above Georgia. The Richmond manufacturing index jumped four points in August to 24. Like the Empire State index, components for both current shipments and new orders remained strong, indicating solid growth in the current quarter and continued expectations for growth going forward.

Data from the Dallas Fed’s Texas manufacturing outlook survey actually fell slightly in August, as the production index fell to 29.3 from 29.4 in the previous month. However, the readings coming out of Dallas have been elevated throughout the past year, dipping below 15 just once over that time frame. The Texas economy has been boosted by the resurgence of the energy sector in recent quarters, which has helped yield some of the strong manufacturing readings. As oil prices have stabilized over the past couple of months, some of the growth in energy investment may be tapering off. Still, the manufacturing sector in the state remains quite strong midway through the 3rd quarter.

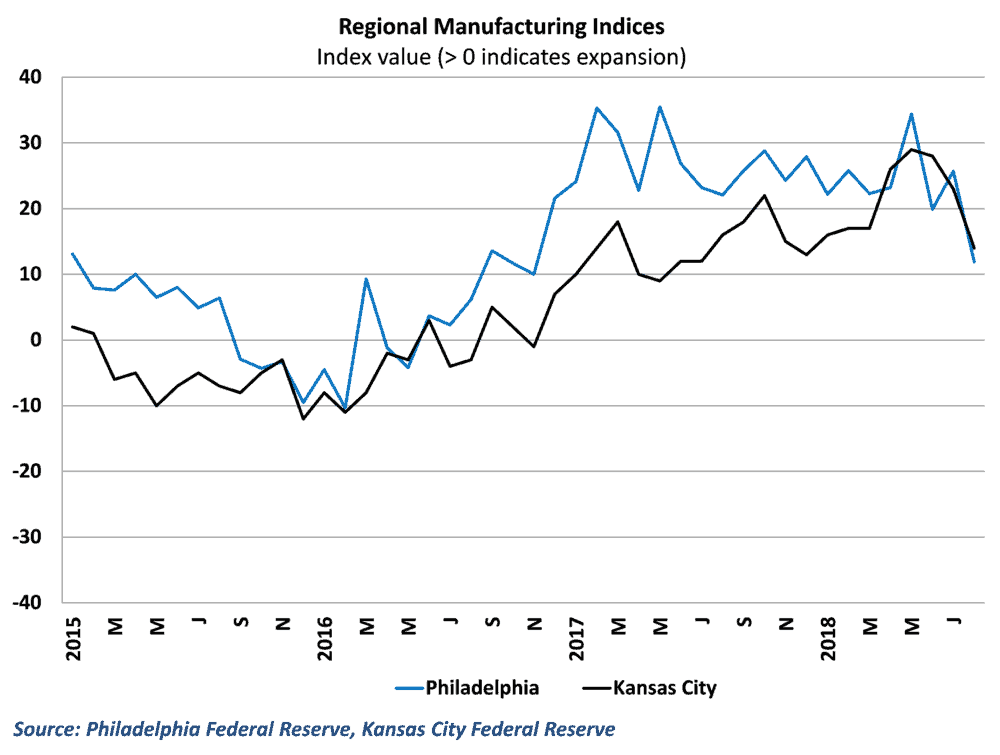

Weakness is Mid-Atlantic, Midwest

All was not positive on the manufacturing front however. The Philadelphia Fed’s manufacturing outlook index, which covers most of Pennsylvania and Delaware, plunged 14 points to 11.9 in August. This marks the lowest value of the index in nearly two years as new orders plummeted 22 points in this most recent release. Growth conditions still point to an expansion in overall activity, but the pace of expansion appears to have slowed considerably.

The Kansas City Fed reported a similar situation, as activity in America’s breadbasket decelerated in August. The Tenth District’s manufacturing index tumbled 11 points to 14 in August. This is down considerably from the gaudy numbers seen in the 2nd quarter, but is roughly in line with readings from earlier in the year where the manufacturing index hovered in the mid-teens.

All in all, the regional reports suggest a manufacturing sector in the US economy that is still expanding, but may be growing at a slower pace than what was seen earlier in the year. Considering how strong the economy was overall in the 2nd quarter, this is not necessarily a cause for alarm. Manufacturers appeared to be growing at an unsustainable pace in the middle of the year, and a slight pullback in overall activity is likely just a return to more normal solid growth.

Responses highlight tariff concerns, trucking capacity

A look at individual respondent commentary typically provides additional insight into manufacturing conditions in the economy. As has been the case throughout much of the past several months, tariffs took center stage across the different regional surveys, with many highlighting the amount of uncertainty being cause by announced tariffs. One respondent from the Kansas City district noted: “tariffs and threats of tariffs is causing raw material increases that are eating away the benefit of a lower corporate tax rate. We are unable to pass along tariff caused increases, for items under contract.” These sentiments were echoed in the Dallas district, where one respondent said: “Tariff threats are problematic. We cannot enter into purchase contracts. Actual tariffs would be a huge problem.”

Tariffs were not the only issue facing manufacturers however, as tight trucking capacity and the inability to find labor also drew the attention of survey participants. One respondent noted: “shipping costs have increased substantially in the last 3 months. So far we have not passed these costs on to our customers. At the same time lack of availability of LTL trucks has hurt our ability to ship on time.” Another participant from the Kansas City district highlighted labor shortages as a key issue, and not just for skilled labor. “It’s a struggle to find employees at all skill levels. Competition for employees is fierce and opportunities for higher wage positions seem to be readily available across the metro area.”

Still, despite the concerns over tariffs and labor, most noted the general strength in demand. Labor markets are likely to remain tight going forward, but with some recent positive developments in trade policy, it will be interesting to see if tariff worries become less important in upcoming months.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.