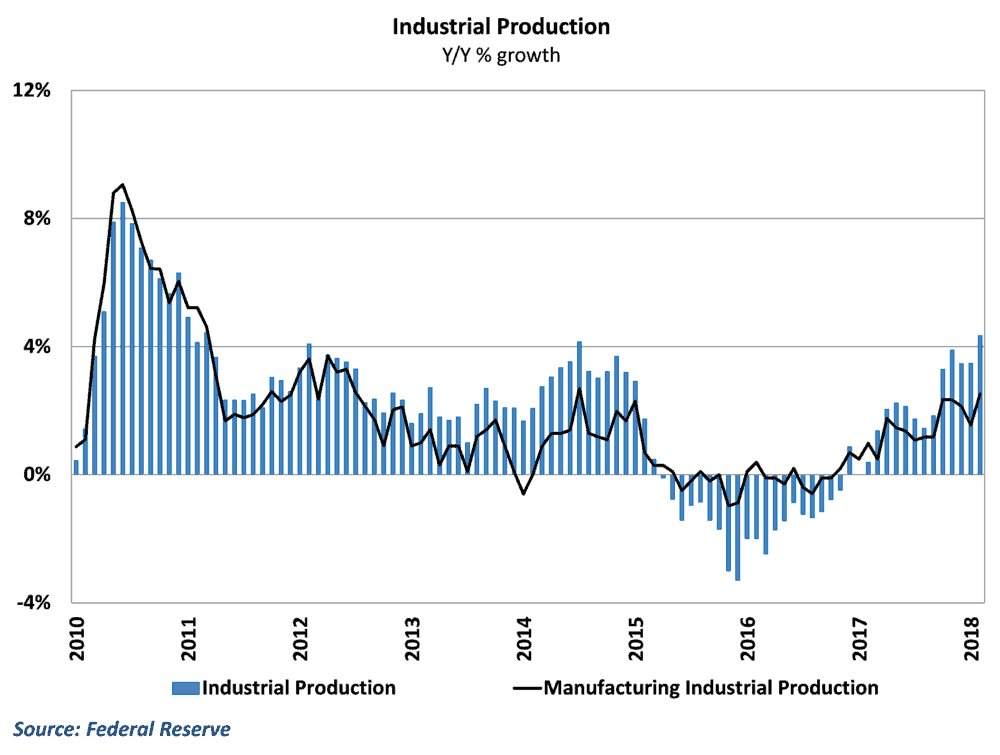

The Federal Reserve reported that total industrial production surged 1.1% in February from January’s levels, providing a nice rebound in activity after a 0.3% decline in the previous month. Year-over-year growth in total industrial production has now reached 4.3%, which is the fastest pace of growth in the economy in nearly seven years. Mining activity helped drive much of the activity in February, as expanded efforts in oil and gas led to the largest monthly gain in the sector in the post-recession era. This was offset, however, by a slide in utility production, as unseasonably warm weather led to a decline in heating energy demand.

Manufacturing industrial production, which strips out mining and utilities production from the total, enjoyed a healthy 1.2% gain during the month as yearly growth climbed to 2.5%. This is a particularly encouraging sign for the manufacturing sector, which looks to resume its acceleration after hovering around 2% growth for the past several months.

Trends in the manufacturing sector typically have close ties to freight markets, helping to set the underlying demand for transportation in the economy. Truck tonnage growth stumbled along with manufacturing production in 2015 and 2016 and has benefitted significantly from its resurgence in recent quarters. The fundamentals for domestic manufacturing are likely to remain solid going forward, with renewed appetite for business investment and continued consumer spending continuing to drive demand. As such, conditions continue to look healthy for this portion of the freight market.

Housing starts slip, driven by multifamily housing

Results on housing construction were far less favorable in February, as home starts fell 7% to a 1.24 million annualized pace. The volatile multi-family component of starts drove the decline during the month, reversing January’s 25.6% gain with an even larger 26.1% decline. Single family home starts rose 2.9% during the month, continuing their rebound from December’s large monthly decline.

Home starts remain on a generally improving trend after dipping in early-2017, and still looks to contribute to 1st quarter growth despite the large monthly decline. However, the pace of improvement has been generally disappointing given the tightness of housing supply in the economy.

This, again, has important implications for freight markets. Housing starts are one of the major factors that determine the demand for construction activity in the economy. This, in turn, influences the demand for flatbed carriers and the transportation of building materials in the economy. As home construction gradually improves, it should generate additional demand for these services in the economy.

Behind the Numbers

On the manufacturing side, the jump in production helps to bring some of the actual output numbers closer in line with the robust survey data. The ISM national purchasing managers’ data and regional Fed surveys have been saying that manufacturing activity is growing rapidly for quite some time. In that sense, it is a relief that some of the “hard” output data is starting to catch up to the survey data and not the survey data falling to match the more subdued previous growth in the manufacturing sector. The conditions are still ripe for US domestic manufacturing, as the relative weakness of the dollar, healthy domestic demand and generally healthy global conditions are all positive signs. Because of this, growth is likely to remain strong going forward.

In housing, the one-month decline is not a huge concern, as starts are generally a volatile series. The general trends remain below consensus expectations from a couple of quarters ago, however, and the rebound in housing has been largely underwhelming. Building permits also declined in this morning’s report, which would suggest some additional weakness going forward, but the underlying fundamentals of solid demand and tight existing inventory remain supportive.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.