Retail sales unexpectedly declined in February despite rebounding activity in motor vehicle and gasoline sales. Poor weather and shrinking tax returns sapped momentum from the retail sector, in yet another sign that the economy slowed in the first quarter.

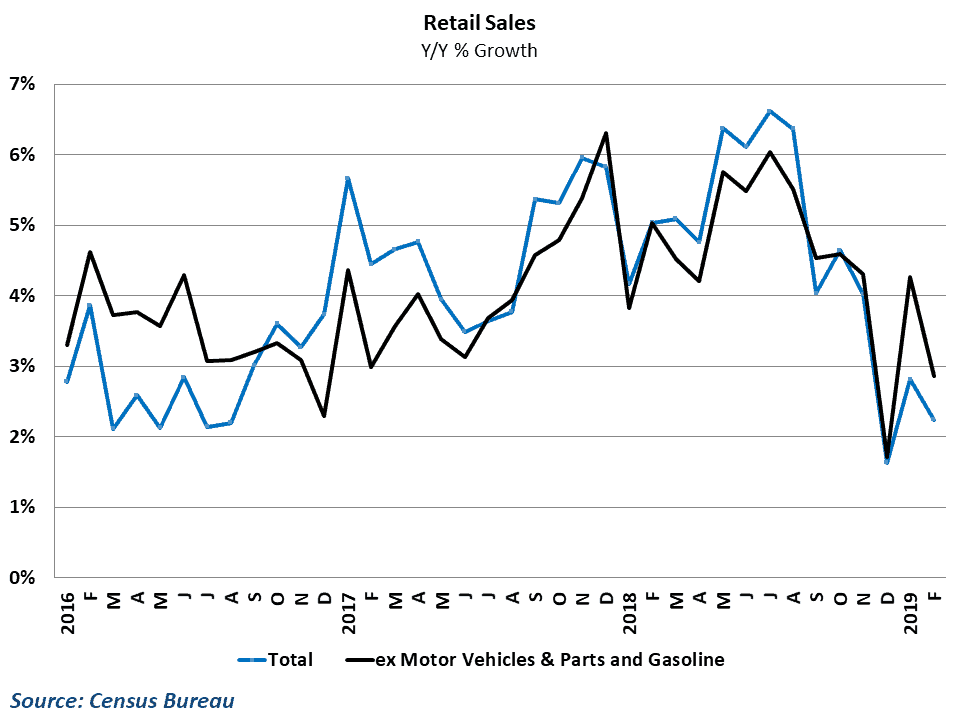

The Census Bureau reported that total retail sales fell 0.2 percent in February on a seasonally adjusted basis from January’s levels. This was well short of consensus estimates of a 0.3 percent gain, but follows growth in January that was stronger than initially reported. Year-over-year growth in the retail sector fell to 2.3 percent in February as a result of the decline, down from 2.8 percent in the previous month.

In a reversal of January’s retail picture, the decline in February came despite solid gains in both motor vehicle & parts sales and gasoline sales, which rose 0.7 percent and 1.0 percent, respectively. Core retail sales, which excludes these categories, fell by 0.6 percent during the month, dropping year-over-year growth to 2.8 percent.

Unseasonably cold weather was likely behind some of the poor performance in February. Building materials and garden equipment sales were down by a whopping 4.4 percent during the month, marking the largest monthly decline since 2012 as major snowstorms in the North and record rainfall in the Southeast likely disrupted normal seasonal purchases.

However, declines during the month were broader than the weather-sensitive areas of the economy, as seven of the 13 major industries reported declines during the month. This is another sign that the economy has lost some momentum in the first quarter, and consumer spending is likely to make a smaller contribution to growth when GDP numbers are released at the end of the month.

Behind the numbers

The retail sector continued it recent choppy performance with another unexpected decline in February. When taken in tandem with the upward revision to January growth (from 0.2 percent to 0.7 percent), however, the February surprise does not look so bad. It seems fairly clear now that retail activity has taken a step back over the past few months, and sales figures still haven’t fully recovered from the big decline in December 2018.

The real question now is whether or not this recent weakness is temporary or part of a lasting deceleration in the economy. There is certainly evidence for both sides. On one hand, the weather conditions during the month were far from favorable for spending, and may have also played a role in weaker jobs numbers in February, which further restrained spending. On the other hand, business confidence has clearly retreated since the start of the year, which has already apparently weakened investment spending in the economy and could lead to a slower trend of hiring going forward. Updated jobs numbers for March are scheduled for release on Friday, April 5, and will help clarify how much long-term trouble the retail sector is in.

The role of income tax refunds in the February results should not be ignored, either. Early results from tax filing season showed that the average size of returns was down by as much as 16.8 percent as of mid-February. Early filers tend to be those that expect sizeable refunds, which then translates into consumer spending. Data from the past few weeks suggests that the size of refunds has improved since then, which would further support a rebound in activity in March retail spending

Going forward, FreightWaves expects that the retail sector will regain some momentum in upcoming months. Like other areas of the economy, retail spending has been hit by some temporary factors that have made first quarter performance particularly soft. Now that the government shutdown is in the rear-view mirror, equity markets have stabilized, and interest rates have come back down, consumer spending should begin to revive. Growth is unlikely to recapture the pace seen in the middle of 2018, but should contribute more to growth than it did during the first quarter.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.