Supply chain investments are helping retailers meet the inventory challenges of a growing market, the National Retail Federation (NRF) reported today in its 2019 retail sales forecast.

Founded in 1911, the NRF is the world’s largest retail trade association. It provides its members with information that helps grow the retail industry. Its annual retail sales forecast reported positive expectations retail sales in the U.S. for 2019. Total U.S. retail sales are expected to be more than $3.8 trillion this year, a growth of 3.8 to 4.4 over retail sales in 2018.

The forecast said that retail sales are higher because of the Tax Cuts and Jobs Act of 2017; consumer spending and confidence remains high. However, the retail supply chain faces the challenge of supplying the volume of goods demanded by consumers, according to Ibrahiim Bayaan, chief economist at FreightWaves. The inventory to sales ratio (the amount of inventory held by retailers as a numeric ratio to the amount of inventory sold each month), collected by the Federal Reserve Bank of St. Louis, decreased around 3 percent from 1.49 (monthly inventory was at 149 percent of monthly sales) in August 2017 to 1.44 (monthly inventory was at 144 percent of monthly sales) in August 2018.

The NRF forecast said that retailers that implement long-term investments in supply chain management will see increased productivity through improved inventory management.

“We’ll see continued innovation,” said Matthew Shay, NRF president and chief executive officer. “The efficiency that can be gained from new methods of inventory fulfillment is not lost on retailers.”

Blue Ridge, a cloud-based retail supply chain solutions provider, also said that technology must be added to retail supply chains to improve inventory management. Blue Ridge said that retailers will require machine learning systems to manage restocking data, enabling them to avoid supply inefficiencies.

Blue Ridge conducted a survey of 156 retailers on what they believe to be their top challenge for short-term supply chain operations. The survey found that 75 percent of those surveyed said increasing volatility in consumer demand is one of their top challenges in 2019. This demand volatility is caused by new competition and customers in the marketplace, according to Blue Ridge. Volatility is a challenge for retailers because they might run out of stock during periods of high demand or hold excess stock during periods of low demand.

Retailers need to improve their supply chain efficiencies to match the strong sales market.

Jack Kleinhenz, NRF chief economist, said in the forecast that economic indicators including the recent jobs report from the Bureau of Labor Statistics (which showed an increase of 304,000 jobs in January) support the NRF’s forecast that the retail market will grow in 2019.

“Consumers are in better shape than any time in the last few years,” said Kleinhenz. “Most important for the year ahead will be the ongoing strength in the job market, which will support the consumer income and spending that are both key drivers of the economy.”

The jobs report also showed that retail employment increased by 21,000 jobs in January while transportation and warehousing employment grew by 27,000 jobs.

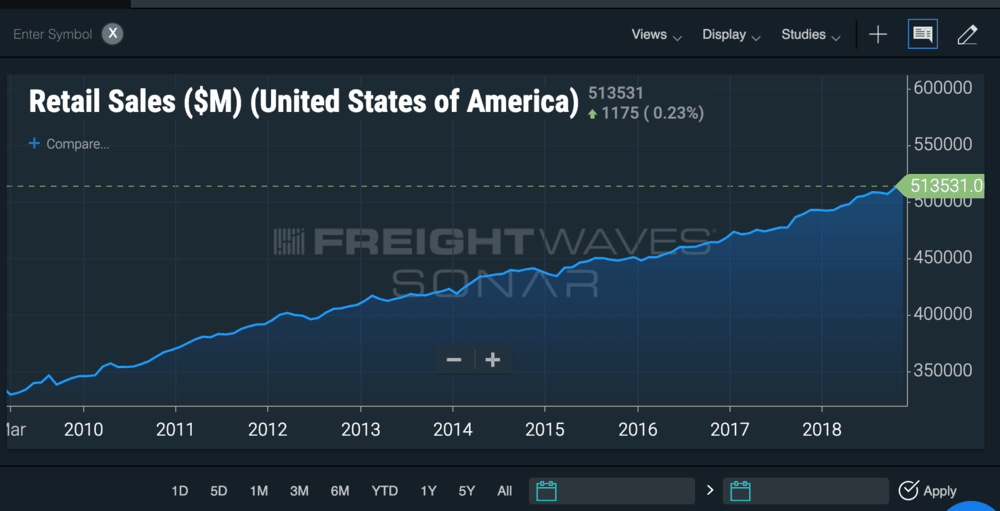

According to FreightWaves Sonar, monthly U.S. retail sales surpassed $500 billion for the first time in May 2018.

The NRF remains confident that the U.S. retail market will grow in 2019.