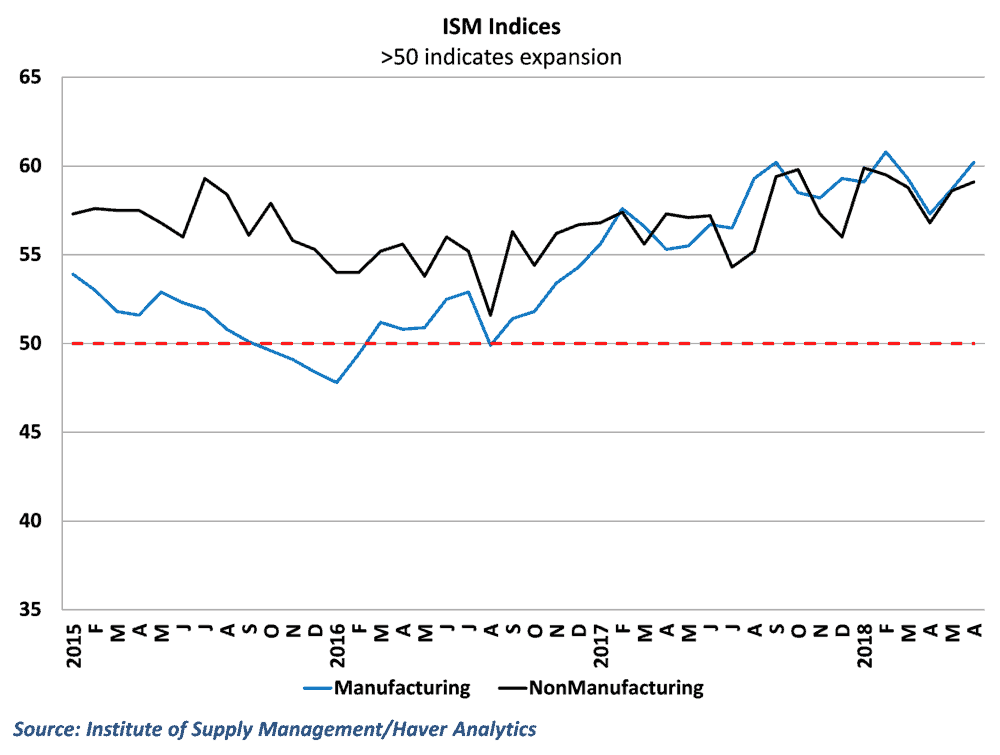

Survey data in both the manufacturing and service sectors continued to point to strong economic growth at the end of the 2nd quarter. Details in the survey responses continue to suggest that high transportation costs, labor shortages, and tariff uncertainty remain significant issues in the economy

Data from the Institute of Supply Management (ISM) showed that US factory activity expanded at a even faster pace in June, as the manufacturing purchasing manager’s index rose 1.5 points to 60.2. This slightly beat consensus expectations of a slight decrease to 58.5 and marks the 22nd consecutive month of expansion in the manufacturing sector. Of the 18 industries covered in the index, 17 reported growth with no industries reporting a decline. This serves as yet another indication that manufacturing demand remains broad-based headed into the 3rd quarter.

Data from the service sector tells a similar story, as the ISM nonmanufacturing index rose to 59.1 in June from 58.6 in the previous month. This exceeds consensus expectations of a decline to 58.4, as service activity continues to grow at a healthy pace. Like the manufacturing sector, 17 of the 18 service industries surveyed for the index reported growth in June, with only Agriculture signaling that conditions had softened in the industry. (Story continued below)

About the ISM Index

Each month, the Institute of Supply Management surveys purchasing managers in the manufacturing and service sectors on different aspects of business, asking whether or not their activity is expanding or contracting. Data is collected on things such as employment, production, prices, exports, inventories, and orders. Responses are then weighted to create the ISM manufacturing and nonmanufacturing indices.

Readings above 50 signal that more than half of the respondents to the survey believe that overall manufacturing activity is expanding during the month, while readings below 50 are a sign that activity is contracting. Historically, index results over 55 are a sign of above-trend growth in the manufacturing sector.

ISM data also gives some insight into trucking freight conditions. Manufacturing production is one of the key supports for freight demand in the economy, and readings from the ISM index typically are a leading indication on the amount of truck tonnage growth in trucking markets.

Demand in both sectors is high

The readings in both sectors remain firmly in expansionary territory, and have hovered around 60 for much of the past year in a half. Historically, this is a sign that activity is particularly strong and serves as a reminder of how healthy demand has been in the economy since the start of 2017. Details within the indices reinforce the idea of strong demand, as subindices such as Production, Business Activity, and New Orders are all well above 60 and have been that way throughout the 2nd quarter.

With that said, respondents have highlighted a number of challenges in meeting all of the existing demand for manufactured products and service. Chief among these issues has been trade policy and tariffs, which have contributed to swings in commodity prices and introduced significant uncertainty into the business environment. On the manufacturing side, one respondent noted: “the uncertainty of U.S. tariffs and the Canada/Mexico/E.U. retaliatory tariffs continues to cloud strategic planning efforts. Contingency planning (for tariffs) is consuming large amounts of manpower that could be used for more productive projects.” These sentiments were echoed on the service side of the economy, where one respondent in Construction said: “Tariffs, freight [issues] and labor shortages continue to have an inflationary influence on costs.”

Indeed, issues with the availability of carriers appear to be plaguing producers considerably on both sides of the economy. One manufacturer in the Furniture & Related Products industry highlighted this, saying: ”Transportation costs are going through the roof right now, which definitely impacts the decisions we’re making with regard to quantities we’re bringing in versus truckload and LTL.” Outside of manufacturing, a respondent in the service sector faced similar difficulties, noting: “Domestically, we are still experiencing a shortage of transportation providers that is getting worse each month when retiring drivers or drivers moving into other opportunities are not being replaced. Internationally, there is a shortage of flat racks [that] has caused late shipments.”

Behind the Numbers

The ISM results and the individual responses from the survey continue to highlight the difficulty that producers are having with filling all of the demand that exists in the economy. Order backlogs have come down some from the highs seen last month, but remain elevated as longer supplier deliveries and scarcity of transportation have been a thorn in the side of manufacturers for the past several months

What is interesting in this month’s results is that freight capacity has begun to dominate the service side of the economy as well. Throughout this year, struggles over transportation were a concern primarily for manufacturers (and construction on the service side of the economy). However, this lack of availability for freight was one of the more consistent themes in the June nonmanufacturing report

There is some evidence that these challenges are already holding back what would otherwise be spectacular growth on the manufacturing side of the economy. Manufacturing output continues to expand overall in the economy, but the pace of growth has been below what the high ISM readings would suggest for the sector. With these challenges spreading to the service sector, there are concerns that freight issues may hinder growth in that side of the economy going forward as well.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.