Data on producer prices shows that overall inflation pressure cooled in the economy last month, as big declines in food prices offset gain in other areas of the economy. Trucking prices remained essentially unchanged for the second consecutive month, but remain elevated relative to this point last year.

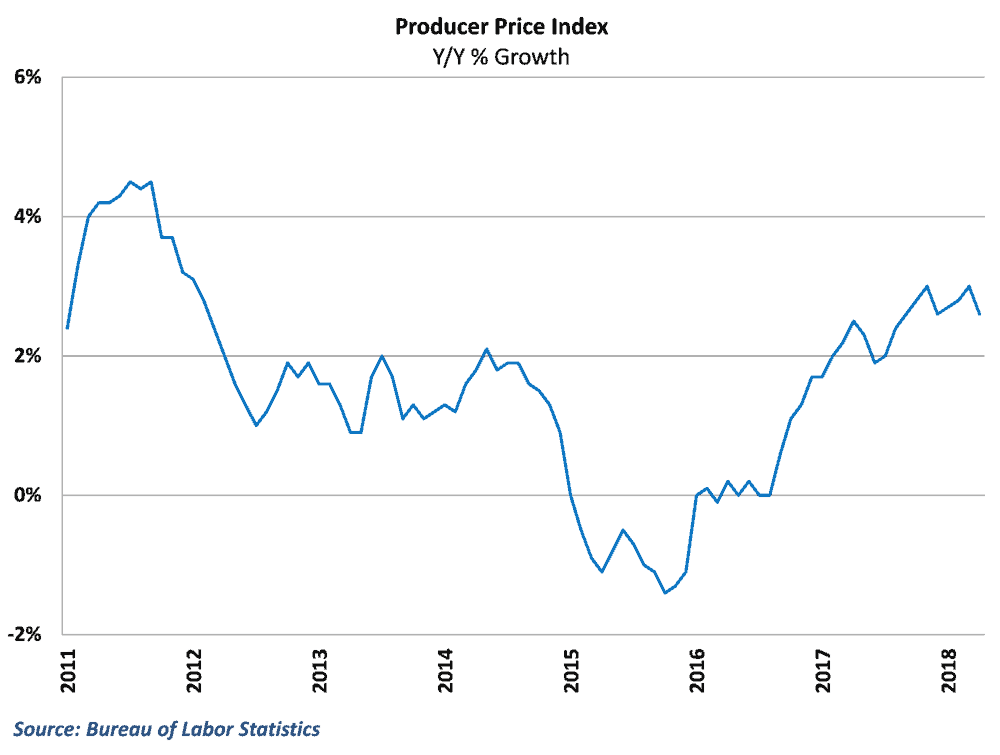

The Bureau of Labor Statistics reported that the producer price index (PPI) rose 0.1% in April from March’s levels, falling short of consensus estimates of a 0.3% gain. Year-over-year wholesale inflation fell to 2.6% in April, easing some fears of mounting overall inflation pressure after the previous month’s jump to 3.0%.

Much of the softness in producer prices during the month was driven by a decline in food prices. The volatile food component of the PPI fell 1.1% in April from March’s levels, partially erasing the surge experienced in the previous month and leaving goods inflation unchanged during the month. Core goods producer prices, excluding food and the also-volatile energy component, rose 0.3%.

Trucking rates stay flat for the 2nd straight month

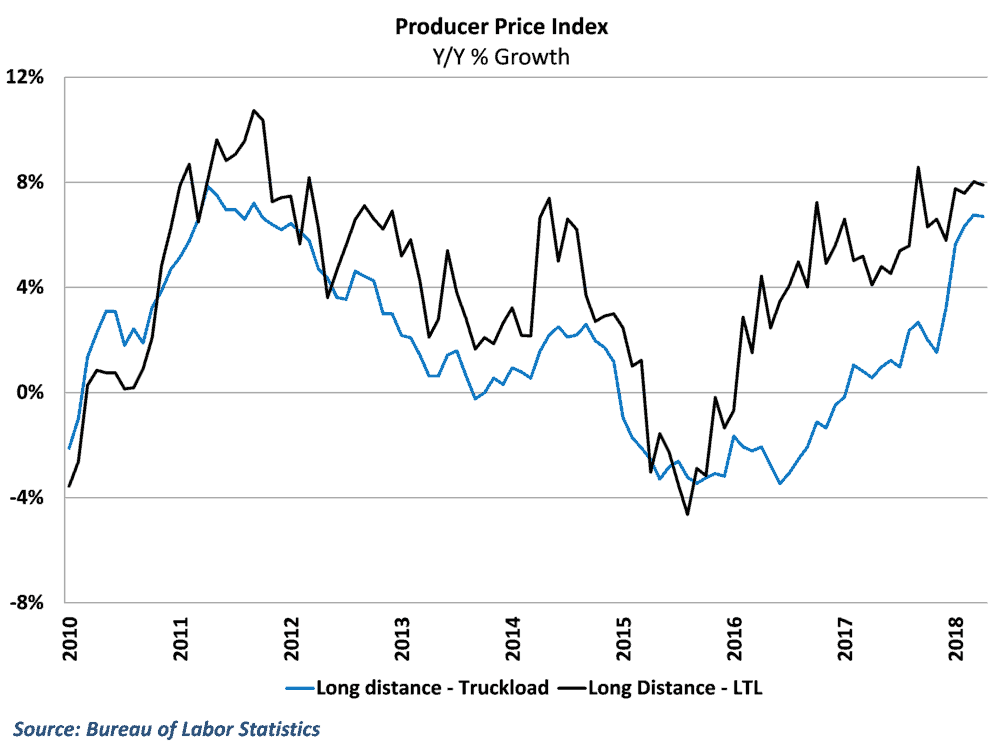

Details within the trucking industry showed more signs of calming in April, signaling that rates are normalizing after big monthly gains in January and February. The producer price index for general freight trucking services remained unchanged in for the second consecutive month in April, with both long-distance truckload and LTL registering only small changes in March. There is evidence elsewhere that suggests that contract rates have increased some over the past couple of month within the trucking industry, but softening in spot market rates have helped offset some of those gains.

Despite the flattening over the past couple of months, trucking inflation remains elevated in general in the economy. Year-over-year growth in long distance truckload prices remain near multi-year highs, registering 6.7% in April. Yearly inflation in the LTL space also climbed during the month, remaining near 8% in March.

Behind the Numbers:

The surprise in the headline PPI number was almost entirely driven by food prices during the month, and shouldn’t cause any change in the overall view of inflation in the economy. The bigger deal in this morning’s release was the relative absence of any signs of price increases in response to tariffs. Last month’s report showed some pretty clear signals of higher prices for steel and aluminum products. Carbon steel scrap showed some pretty sizeable increases during the month, but there was little sign of adverse effects elsewhere in the data.

On the freight side, the calmness in the month-to-month changes in trucking prices continues a trend of normalizing prices after abnormal winter conditions in the trucking industry. Intermodal rail had been seeing some spillover effects and surging rates in recent months, but there were some signs of normalization in that industry also as prices fell over a full percentage point in April. Make no mistake though, year-over-year inflation remains very high and is likely to stay that way in upcoming months. Long distance truckload rates are up nearly 7% year-over-year, LTL rates are up nearly 8%, and intermodal rates are up over 12% despite the monthly decline. High transportation costs may be calming down, but they will remain an issue for the economy going forward.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.