Data on producer prices shows that overall inflation pressure calmed at the start of the 3rd quarter. Trucking prices continued to climb during the month however, particularly for long distance trucking where rate inflation has pushed to a new record high

The Bureau of Labor Statistics reported that the producer price index (PPI) was flat in July, falling short of expectations of a 0.2% gain. Year-over-year wholesale inflation slipped to 3.3% during the month after reaching multi-year highs in June

Overall wholesale inflation was restrained by declines in food and energy prices during the month. In addition, a sizeable decline in the volatile trade services component, which measures profit margins for retailers and wholesalers, helped to keep inflation tame in July. The core PPI, which strips out food, and energy, actually rose 0.1% during the month and is now 2.7% higher than at this point last year.

Many have been paying attention to producer price data in recent months in search of signs that recent trade spats and rising commodity prices would begin filtering into the broader economy. This morning’s results would suggest that, though there is still some pricing pressure in certain industries, overall inflation is likely to remain under control in upcoming months.

Trucking continues to surge as long-distance rate increases hit record high

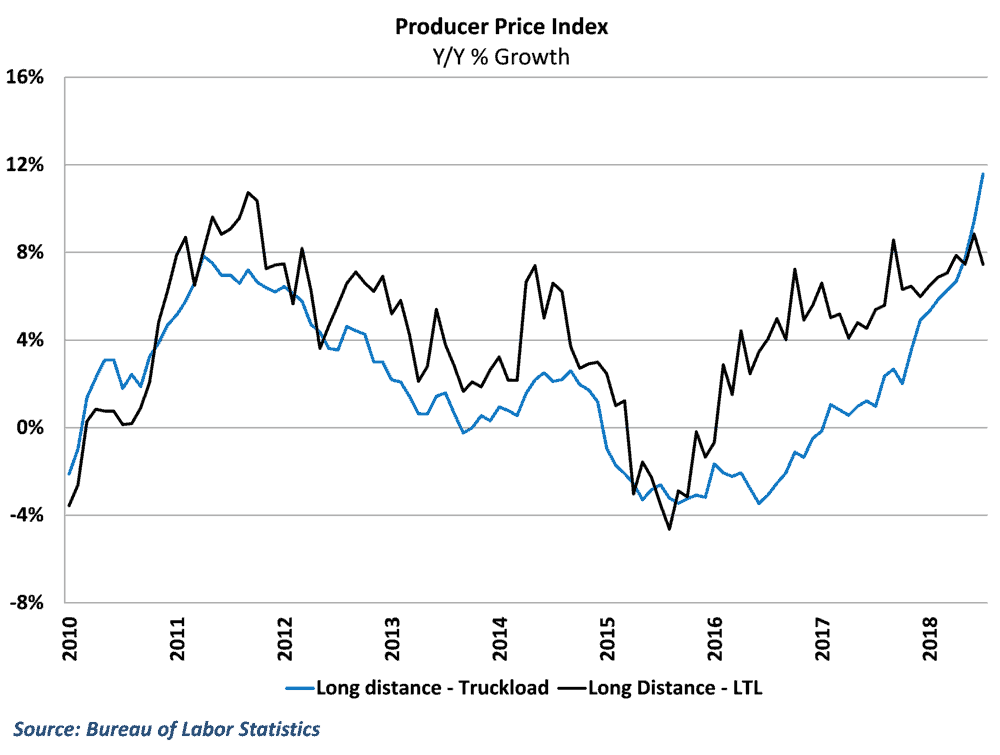

Data on trucking rates show no sign of calming down, however, as the industry posted a third consecutive large monthly gain. Rates for general freight trucking climbed 1.2% in July from June’s levels as the industry continues to deal with healthy freight demand and tight capacity. Rates are now 9.8% higher than at this point last year, which marks the fastest pace of inflation in a decade.

As has been the case for the past year, rate increases in July were primarily driven by long distance truckload freight movements, which rose 2.0% during the month. Year-over-year growth has now pushed to 11.6%, which marks a record high for the index which began in late-2003.

Other areas of trucking saw more modest gains. Local trucking rates, which have grown at a slower pace in general over the past couple of years, rose 0.8% in July from June’s levels. LTL carriers actually saw a decline in rates during the month, though year-over-year growth remained near 8% at the start of the 3rd quarter.

Behind the Numbers:

The headline PPI numbers were pretty tame, with the downward surprise being driven by the volatile components that can lead to misses in one direction or another. The core PPI readings still point to some modest inflation pressures in the overall economy, but nothing to sway policy towards any significant change of direction.

The real story again has come from freight transportation, where rates show little to no signs of slowing. Indications around the economy overall suggest that growth is likely to be slower this quarter than it was in the 2nd quarter. It is worth remembering though, that the slower pace of growth is still a solid pace of growth in economic activity.

We have discussed previously how trucking capacity does seem to be gradually returning to the market, and some had suggested that freight markets had peaked during the 2nd quarter. The PPI data would suggest that tight capacity remains, and carriers still have considerable pricing power in the market.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.