Data on producer prices shows that overall inflation pressure calmed in November, weighed down by declines in gasoline prices. Industry detail showed that trucking rates continues to surge, however, driven by another large gain in long-distance trucking rates.

The Bureau of Labor Statistics reported that the producer price index (PPI) advanced 0.1%. This exceeds consensus estimates of no gain and comes on the heels of a 0.6% gain in the previous month that was the largest monthly gain in six years. Price gains during the month were restrained by falling gasoline prices, which helped to offset increases in the service sector. The PPI excluding the volatile food and energy components rose by 0.3% in November and is now 2.7% higher than at this point last year.

Market watchers and policymakers typically use the PPI to gain some insight into what the underlying pressures of inflation are in the economy. The PPI measures the prices that businesses receive for the goods and services that they provide, and is often seen as a bellwether of upcoming increases in consumer prices.

Trends in inflation have taken on some additional significance over the past several months because of the implications for monetary policy going forward. The Federal Reserve has recently intimated that the pace of rate hikes may slow next year, but maintains that the future course of monetary policy depends heavily on results from the labor market and inflation. Today’s results would suggest that overall inflation pressure has eased slightly, but the gains in core prices raise some concern.

Trucking rates climb continue to surge, led by long-distance hauls

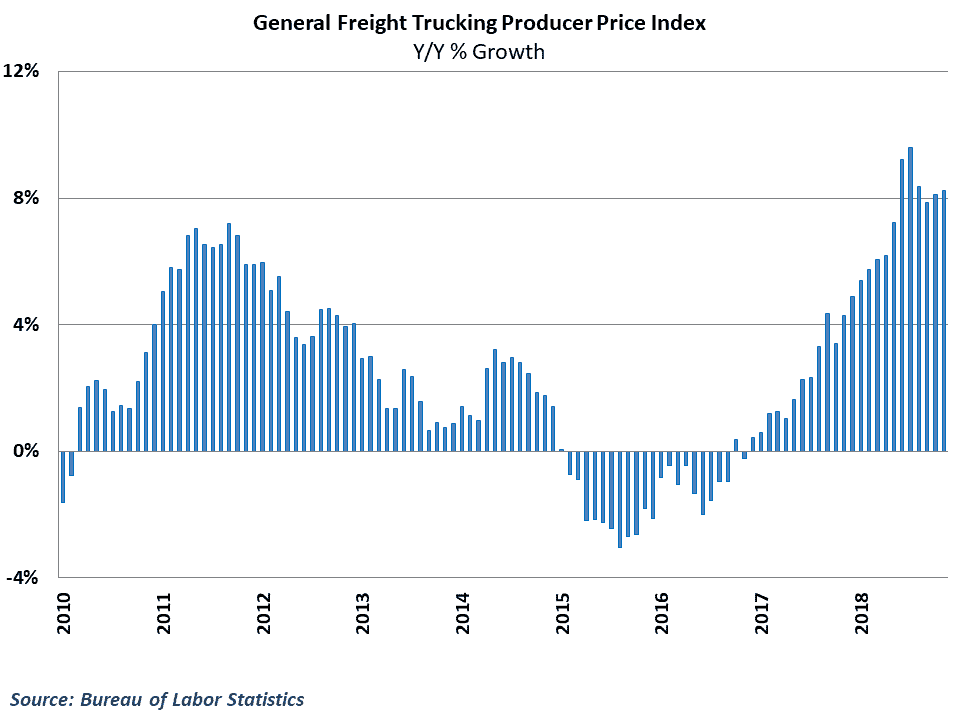

Industry detail in this morning’s release showed continued strength within trucking, as producer prices for General Freight Trucking rose 1.2% in November on the heels of a 0.5% gain in the previous month. This pace has been enough to keep year-over-year rate inflation above 8% in recent months, registering 8.3% in November despite difficult comparisons to last year.

Gains during the month were largely driven by long-distance truckload services, which posted a second consecutive monthly gain above 1% with a 1.3% gain in November. Both truckload and LTL services enjoyed healthy gains during the month, with rates rising 1.2% and 1.6%, respectively. Local trucking rates also experienced a respectable 0.5% increase during the month, and are now 10.1% higher than at this point last year.

Behind the Numbers:

Inflation numbers have gotten some renewed attention since Fed Chairman Powell hinted last month that policy might already be close to neutral and the pace of rate increases may die down after an expected 4th increase next week. There was little in this morning’s report to discourage a slower pace of rate increases; the softer headline number was largely expected after the massive decline in oil prices over the past couple of months, and the core PPI readings were a bit high but not alarmingly high. PPI readings, and data on consumer prices set for release tomorrow, remain important trends to monitor but for now suggest relatively muted inflation in the overall economy.

On the trucking side, there have been quite a few signs that capacity generally is gaining some ground and demand growth is slowing as we near the end of the year. The PPI data would suggest that carriers still retain some pricing power in this environment, and have been able to extract higher rates across many different types of freight. Year-over-year rate inflation probably will not reach the multi-year highs seen in July of the year, but the pace of rate increases is still well above average as we head into next year.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.