As the West Coast spot market reaches its seasonal, Chinese New Year-inflected bottom, brokers matching loads in those lanes are reaping big margins. It makes sense: a broker contracts with a shipper to move a load, and then goes out and looks for a truck. In a softening market, truckload capacity prices go down over time, so the broker will be able to get the truck for a discount compared to the rate he’s getting from the shipper—he pockets the difference. The faster rates drop, the better the broker’s margin. FreightWaves has confirmed with a major digital broker based in California that margins are extremely robust right now. There was more capacity than freight in Los Angeles, and shippers took advantage of the favorable rate environment to move loads.

We don’t expect these conditions to last. FreightWaves predicted on January 25 that the relatively late date of this year’s Chinese New Year meant that normal port traffic would resume in mid-late March, coinciding with California’s strawberry, lemon, artichoke, and asparagus season. In fact, we’re already starting to see a recovery in spot prices and lengthening tender-lead times, which together signal the end of easy broker margins for the time being.

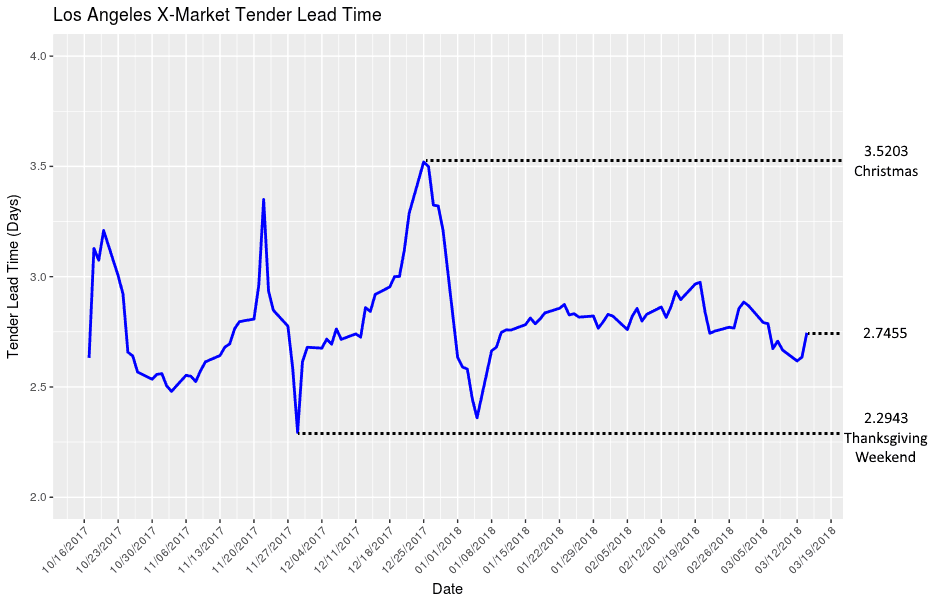

This thesis is supported by three different data sets. The first piece of information is DAT’s spot rate data. The other two sources—turndown rate (rejected loads as a percentage of total loads posted) and tender-lead times (duration between a load being posted and when the shipper actually wants it to be picked up)—were indexed by FreightWaves’ data scientists.

Let’s use the Los Angeles to Dallas dry van lane as a proxy for West Coast spot rates. During the peak holiday season in November, rates reached a peak average of $2.40, declined slightly to an average of $2.38 in December, then fell sharply to $2.03 in January and $1.69 in February. Brokers made good margins finding cheap trucks during the downturn, but DAT data shows that in the past seven days, rates have firmed up to $1.90.

Turndowns—the rejected load rate—in the Los Angeles market also fell over the same period as trucks were forced to accept low rates for a relatively small volume of freight. Yesterday the turndown rate was 4.8% of all loads, compared to ~17% three months ago.

The tender-lead time index is the third metric that tells us what’s going on in West Coast freight markets. This index, which tells us the time span between a load being posted and when it should be picked up, indicates shippers’ attitudes toward market volatility. The national average tender-lead time can be anywhere from two to four days. In North Dakota, though, the average tender-lead time is fairly stable at about 7.5 days, which is interesting because it could indicate several things. A long tender-lead time suggests that shippers aren’t worried about volatile rates and also that shippers are moving their loads at steady, predictable volumes.

Los Angeles tender-lead times fell from 2.9 days three months ago to 2.6 days as of two days ago. Shippers knew that trucks outnumbered loads and were not worried about finding capacity to move their freight, so they weren’t posting their loads very far in advance of when they wanted them picked up. Yesterday, tender lead times started picking back up, with loads being posted an average of 2.75 days before pick-up. FreightWaves’ data scientist believes that this indicates that capacity (supply) and loads (demand) are getting closer to an equilibrium—remember North Dakota’s stable market has extremely long tender-lead times.

We think this moment in the California freight market is the calm before the storm, the moment when the pendulum is motionless, just before it starts swinging back in the other direction. FreightWaves believes that the next two weeks will see strengthening spot rates that compress broker margins. Tender-lead times for Los Angeles loads will be determined by the nature of the freight: time-sensitive or ‘hot’ freight will see shorter lead times as shippers try to move their loads before rates climb higher, while less urgent freight may have longer lead times, as shippers become more willing to sit and wait for a truck willing to accept a lower-than-market price.

The imminent return of normal container traffic and the onset of California produce season mean that price power will return to truckload carriers.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.