Surge Transportation declared bankruptcy in July. Convoy shut down its freight operations in October. Winter has come to the freight brokerage industry.

While peculiarities in the operating models at Surge and Convoy may have contributed to their demise — chiefly, much higher tech spend as a percentage of revenue than industry peers — every other brokerage is subject to the same market forces. A glut of trucking capacity that has only recently peaked and begun receding has kept tender acceptance levels very high and spot rates very low.

To the extent that there’s broad-based price movement in the market, contract rates are falling and converging downward on spot rates, compressing freight brokers’ margins. Margin dollars per load — the money that brokerages need to run their own business — is down significantly year over year. And the cost of capital has squeezed brokerage profits, too. Because carriers need to be paid quickly but shippers pay (increasingly) slowly, freight brokers who want to grow their volumes are always short of cash and often finance their receivables, effectively borrowing against the creditworthiness of their shipper customers. The cost of receivables financing has increased significantly as the Fed has raised the rate at which banks can borrow money overnight, creating another source of pressure on freight brokerages, most of which built their financial models and operating playbooks in an era of near-zero interest rates.

I visited Edge Logistics in Chicago to find out more about how midsize freight brokerages were dealing with the tough business climate. Edge’s brokerage floor is on the 28th story of a vast skyscraper on south Wacker in the heart of the Loop in downtown Chicago, close to Willis Tower.

Edge was founded in 2014 by CEO William Kerr after a stint at Echo Global Logistics. Kerr bootstrapped the firm, eschewing outside capital, and built up Edge’s book of business the scrappy, old-fashioned Chicago way, concentrating on moving time-sensitive loads for the food and beverage industries with regional refrigerated carriers. Later, through a partnership with Lean Solutions Group, Edge built proprietary transportation management systems that include automated matching and pricing capabilities and an internal digital marketplace where trusted carriers can book loads directly from Edge’s customers. In 2022, the company generated $149 million in gross revenue.

This year, growing the business has felt like swimming against the current. Kerr has always been one of the more sophisticated analysts of the freight market, intuitively breaking down the contract market into tranches based on service expectations and commitment, and he saw that winter was coming. Kerr knew that growing into an adverse business climate would require a new level of focus and aggression, so he added some key players to his team, most of them veterans from Chicago-based brokerage AFN, which was acquired by GlobalTranz in 2018.

Mark Maggio, who spent 18 years in sales at AFN and then GlobalTranz, joined Edge as chief strategy officer in April; Jim Brown, another 20-year veteran of AFN/GlobalTranz, came on board as executive vice president of sales in the same month. Kevin Frawley, who worked in operations and account management at AFN/GlobalTranz, is now Edge’s senior vice president of customer success. Perhaps most notably, Blaine Barnett, who served as AFN’s president and the chief operating officer and chief strategy officer at Arrive Logistics, is now president of Edge. Rounding out the team, Kevin Green joined Edge as chief financial officer, having previously been executive vice president of finance at LoadDelivered Logistics and then Capstone Logistics.

Kerr reassembled a team of seasoned Chicago veterans, and they’re already getting results. Edge has added approximately 46 new enterprise shipper clients this year, slightly more than one per week, and has grown volumes by 47% year over year, an exceptional performance in a market so soft that major truckload carriers are effectively accepting every tender that comes their way. About half of the new volume came from existing customers and half from new customers added in 2023. But that impressive volume growth has only been good for 9% y/y growth in gross revenue, and margin dollars per load have fallen by 40% year over year.

I spoke with Kerr and Dave Rozkuszka, vice president of truckload, to understand Edge’s strategy and what it was like to execute under these conditions. Kerr launched right into his take on the market.

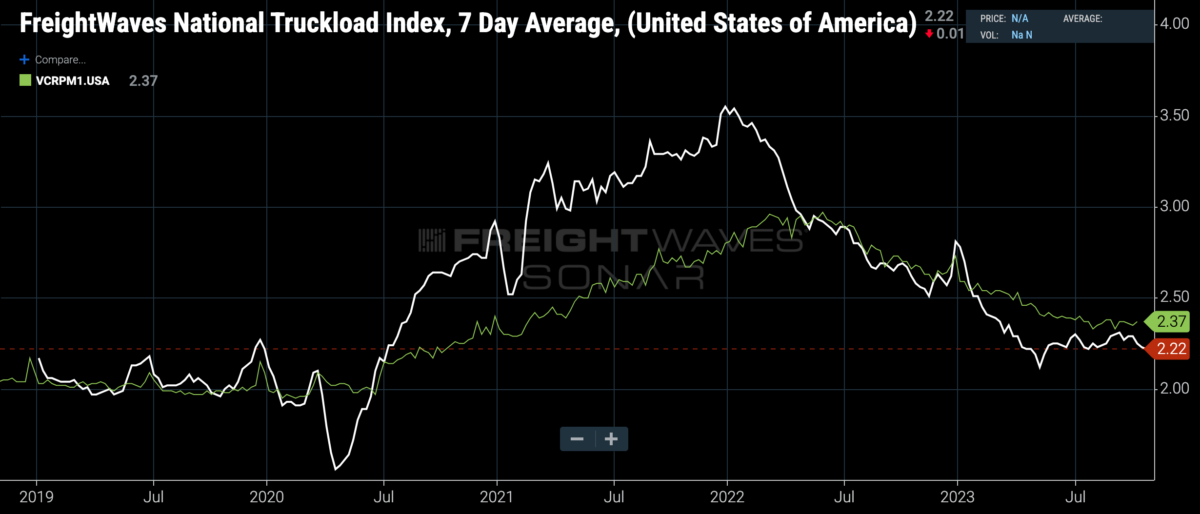

“In March-April-May, spot performance was really poor [in terms of profitability] and contract was good, but now they’ve come together and swung the other way,” Kerr said. “Now in October, spot performance is coming at much more normal revenue and margin per load, but contract freight is very strained. Since the Fourth of July, the market started to slip — the 100 days of summer was terrible: Volumes were bad, revenue per load was bad, spot freight performance was bad, contract performance started going down … . [C]ontracted freight has become more and more challenging.”

Edge has managed to win freight and buy well in this market, keeping its cost to cover a load down, by winning big contracts from enterprise shippers and peeling off select lanes to fill the backhauls of regional carriers. The better that Edge’s technology and carrier reps can match loads to a truckload carrier’s empty lanes, the more aggressive Edge’s salespeople can be in bidding on contract freight.

“Our core strategy hasn’t changed,” Kerr explained. “We’re hyperfocused on our ideal customer profile, continuing to build out a great freight network with shippers and carriers that are like-minded. We share a set of values with a major emphasis on active participation where everyone in the network wants to be there.”

Edge’s ideal customer is a large shipper with a regional or national footprint, a long-standing commitment to the broker channel, and “a sense of urgency in their network, whether that means they have both contracted and spot freight, or time-sensitive shipments, or they’re shipping direct to stores, those are the kinds of shippers we’re successful with and can bring a lot of value to,” Kerr said.

“My job is to bridge the gap between the power shippers and the regional carriers, not to aggregate hundreds of thousands of owner-operators,” Kerr said. “You go to Home Depot or Niagara or Pepsi or any of these big, big shippers, and the contracts, insurance, technology connections, not to mention the fines, are unmanageable for the carrier. The carriers want to do business with these shippers but they only want one lane — I can go to that carrier and say, ‘That’s perfect, I’ll get you that one lane from Pepsi that really works for you.’”

Kerr thinks that the freight market will get worse before it gets better — specifically, he thinks that contract rates will have to fall further and close the gap between contract and spot before we see any meaningful heat in the market.

“There’s a big gap between contract and spot obviously; everyone knows that, but if you look in the underlying data, the drop-drop contracted freight is higher, and live-live has already really come down towards where spot freight is,” Kerr said. “Drop-drop is much more of a commitment.”

Kerr’s theory is that “drop-drop” loads, or truckload shipments that involve picking up a preloaded (or “drop”) trailer and then dropping that trailer off, without waiting for it to be unloaded, are currently priced higher than shipments involving a live load and live unload process, where the driver waits at the dock. In theory, Kerr said, drop shipments should be cheaper than live shipments, because the volumes are more consistent and the carriers can more efficiently utilize their drivers’ hours of service.

But right now, drop-drop is priced too high, according to Kerr, because long-term contract pricing was put into place during the pandemic, when shippers were desperate to secure capacity. Drop trailers also had the added benefit of giving shippers’ warehouses and distribution centers more flexibility at a time when workforces were sick and difficult to manage, because freight could be unloaded at the shippers’ convenience, not according to the drivers’ schedules. Furthermore, while some shippers have long preferred drop trailer service due to the intrinsic characteristics of their freight — for example, much of Home Depot’s freight is difficult or awkward to unload — during the pandemic, many other shippers jumped into drop trailers because it solved short-term problems. That pushed up trailer prices to astronomical levels, and the carriers who had access to them charged a premium for taking care of their most important customers’ needs.

That market is due for a crash, Kerr argued. “There’s too much metal floating around — there isn’t even anywhere to put all of the trailers that have been deployed into the market,” he said.

“We could see drop-drop fall from $2.40-ish [per mile] to about $2,” Kerr said. “It’s worth it for carriers in certain situations, but it’s not always worth it. National carriers will participate in brokerage again. They dropped metal everywhere and stopped brokering out their freight. Drop-drop freight should be the cheapest, live-live contract will be next, and then spot live-live will be more expensive. Starting by April or May of next year, spot should go positive over contract — not hot, but positive. Tender acceptance will start to fall.”

Rozkuszka, Edge’s VP of truckload, agreed that the bottom will likely be in the first quarter of 2024.

“If I had to put a theme on this year, it would be ‘When does it end? Or how much lower, where’s the bottom?’ It’s probably going to be the first quarter of 2024,” Rozkuszka said.

Rozkuszka, responsible for truckload pricing to customers and contractual volumes, said that he’s “beginning to drown in bids,” but he’s thankful for the algorithms that Edge has developed that allow him to fill in thousands of lanes and then make slight adjustments to regions where he feels more bullish or bearish, or where Edge has better buying power.

“We’re seeing where we want to target and where there are traps,” Rozkuszka said. “Shippers are being very transparent: They want the rates down, they want their transportation costs even lower. They’re in a position to take advantage of it. It’s scary.”

The harshness of the freight winter has changed behavioral incentives for key players in the market, especially shippers and asset-based carriers. Shippers are openly aggressive about their desire to push rates even lower and freight brokers have to ride the market down with them in order to secure volumes. But those low rates push asset-based carriers into a corner, where they’re becoming increasingly desperate and are forced to start shopping for better rates anywhere they can find them.

“Regional carriers are getting through this the best they can,” Rozkuszka said. “They’re in the weirdest spot: If we’re not here yet, contract is going to be at or lower than spot soon, so they’re forced to ask, ‘Do we honor those relationships, do we honor those rates?’ We’ve definitely seen a higher number of bounces over the past couple weeks, but progressively more, and it has to do more with cost and rate shopping. Everyone’s beaten down to the last penny — everyone’s backed into a corner. Everyone’s making tough decisions, and for the driver that’s honoring their commitments.”

On the other side of the market, shippers are taking less risk in terms of pricing duration, preferring semiannual or quarterly bids to annual ones, pushing rates down incrementally where they can without introducing long-term risk into their networks.

“The length of the downturn is crazy,” Rozkuszka said. “We’ve always been able to lean on historical data or market knowledge whenever there was a normal uptick, whether it was seasonality, hurricane, whatever, but that’s been completely thrown out the window. It’s a day-by-day, week-by-week life. Then if we do see a slight capacity crunch where the board has trouble moving, it’s random and no one knows why. Tons of customers are switching to quarterly bids — less than half the bids we have now are annual. Neither side wants to take the risk of annual bids.”

Hank

A few comments around the “Why?” behind the departure from GlobalTranz/WWEX. I think there are a couple of reasons here:

– EDGE wanted to get the band back together and it was a selective top tier group

– The Culture at GlobalTranz was greatly influenced by the merger with WWEX which saw a stronger lean to the WWEX model than the GTZ model. That model produces a heavier concentration on Parcel and LTL solutioning with a SMB/middle market target base.

Tom

Thanks to those idiots we drove for 1.5 per mile. 2.40 a mile is a solid rate? What the f is he taking?

So if he wats 2 per mile then he will pay 1.25 to us? What a bunch of ……

FD

That’s a lot of expensive new executives to pay for in such in a bad mkt.

I wonder why such people would leave Globaltranz?

John Ferguson

Guess it looks like leaving Globaltranz/WWEX was the best decision each of these people made. My question is what is happening with the leadership and culture at Globaltranz? What is causing so many tenured top sales people to leave and find better career paths? I would love to hear from any of these individuals who spent a decade at a company and what changes prompted them all to leave and rejoin at a new 3pl?

truck34

This guy must be new to the industry 2.40 a mile is solid.