The ELD “hard” enforcement period began on April 1st amid widespread speculation that the trucking industry would be rocked with driver shortages as shippers plow through carrier lists attempting to cover their loads. That has not been the case, according to the FreightWaves Tender Rejection Index (TRI). If anything, the index is indicating the counter-argument, as loads are being turned down with less frequency. The reason for this is simply that the information has already been digested by the market and priced in.

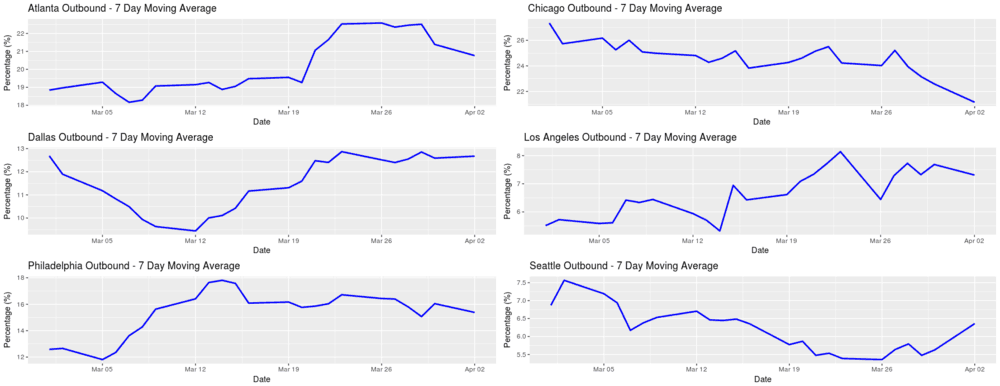

Looking at a composite of the six major outbound markets in the country, only a single market, Seattle, is showing an uptick in loads rejected after the April first enforcement period started. Admittedly, we’re still very early in the process, but this information was widely disseminated in the carrier market well before the punitive phase began and came as no surprise to anyone who has been involved in freight and has been awake over the last 6 months. The hype itself may have had more impact than the actual implementation.

In any market, new information is assimilated at a rapid rate once it is available and, in this case, there was even a “grace period” where truckers were only warned that they would be punished. This only gave the carriers more time to adjust to the impact of the new rule. In December there was a noticeable impact on the spot market as capacity dipped in the holiday season. One less publicized reason for the shortage of trucks was the initial impact of the ELD enforcement period. Drivers who were initially frustrated by having to abide by the new regulation and the technical difficulties that initially arose with implementation of the new devices left their trucks.

In many of the markets listed above, there is a sharp upward movement on load rejections in March. Not to suggest there is any correlation between markets, but there is certainly some relationship in the warmer weather and shippers moving into full capacity as manufacturing and agricultural products start moving with more frequency. This is common knowledge as most carriers are aware of seasonal pushes.

The trick with seasonality is that it doesn’t occur on the same day every year, which is one reason you see the spikes in turndowns. A sharp upward TRI movement is a good indicator of unexpected occurrences in the market. When volumes surge, the information is disseminated into the market at a slower rate than carriers can analyze. Simply stated surprises create more volatility than expected hurdles.

The freight markets had plenty of time and warning to adapt to most of the potential pitfalls with the ELD mandate given the soft enforcement period that was essentially a beta testing period for carriers. The fact that most larger carriers with fleet sizes over 500 were already moving down this path regardless of the mandate.

The smaller carriers were the ones that would see the most impact from this new rule. And according to CarrierLists, approximately 93% of the small to mid-size carriers surveyed stated they were already ELD compliant.

The ELD mandate implementation has had its share of problems, as any new process does, but it appears carriers have had enough time to address them.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.