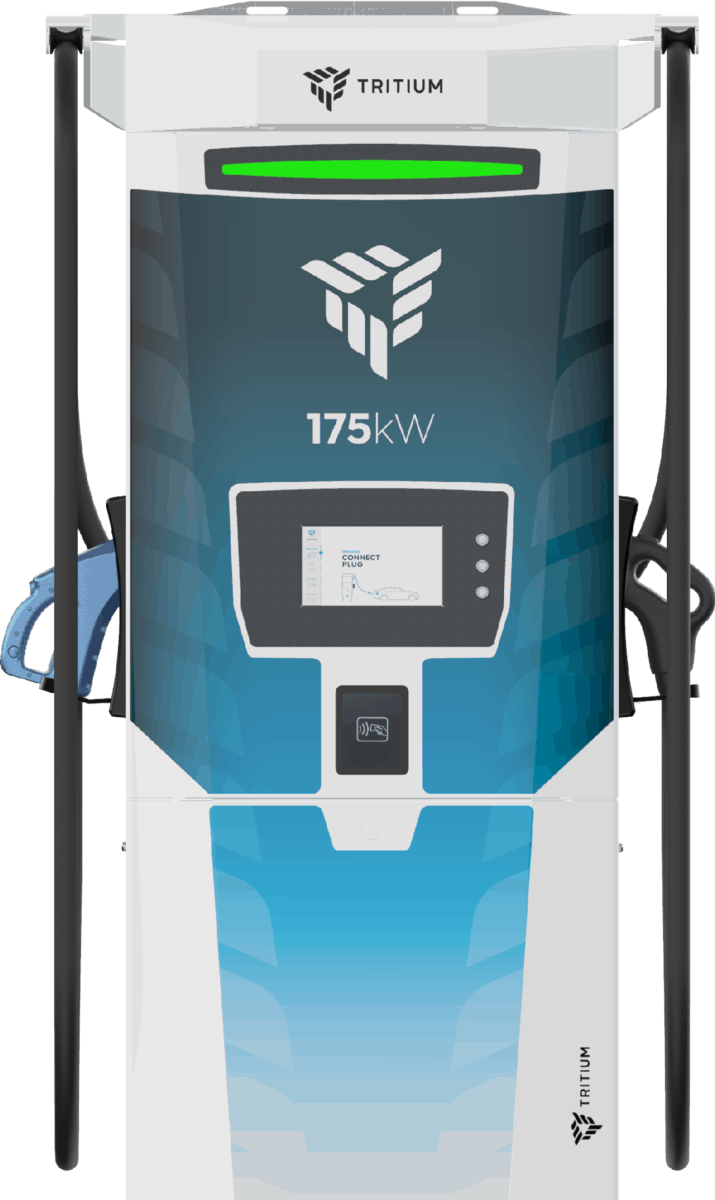

For commercial vehicle fleets to embrace electric trucks, recharging the batteries must be as fast as a diesel fill-up. Australian electric infrastructure hardware producer Tritium is drawing closer, announcing a 175-kilowatt (kW) charger on Tuesday.

The RT175-S can take a battery from 20% to 80% state of charge in 15 minutes with 95% average power efficiency. But the bigger the battery, the longer the charging time. For a Class 4-6 medium-duty truck, charging in less than 30 minutes is in sight. A Class 8 heavy-duty truck would take an hour.

“How fast you can charge is going to depend on the size of the battery based on their duty cycles,” Mike Calise, Tritium’s president of the Americas, told FreightWaves. “I don’t want to say [it’s] accurate for all the trucks out there because they’re all at different battery sizes. But this is ripping fast.”

The all-in cost to install a 175kW Tritium charger is around $100,000, Calise said. With permitting and construction, it could take three months to a year and collaboration with utilities and local government.

Fastest-growing market

Tritium has more than 4,500 DC fast chargers installed in 38 countries. Its biggest market is Europe. Its fastest-growing market is the U.S., which it entered in 2014. Main competitors are Swiss conglomerate ABB Ltd. (NYSE: ABB) and Santa Ana, California-based Broadband Telcom Power Inc.

Most of Tritium’s fast chargers are limited to 50kW. Because of their bigger batteries, commercial vehicles typically charge overnight. This works fine for trucks that return to base to recharge at the end of the day. It is less convenient for drayage trucks or others in continuous operation.

“We will see this at ports. We will see this at trucking depots. We’ll see this in corridor charging between cities,” Calise said. The Port of Long Beach will get one of the more powerful Tritium chargers to keep yard tractors that haul containers throughout the port moving.

“It’s a game changer when fleets realize how quickly they can charge,” Calise said.

Chicken-and-egg argument

The number of electric trucks on the road in the U.S. should grow from 2,000 in 2019 to 54,000 in 2025, according to a recent report by British consultancy Wood Mackenzie. The number of truck chargers should grow from 2,000 in 2019 to 48,000 in 2025.

“It could actually be conservative,” Calise said. “These are growing in an exponential way.”

That imbalance of electric truck to charger growth suggests the chicken-and-egg argument of which should come first is unsettled.

PACCAR Inc. (NASDAQ: PCAR) brand Peterbilt on Tuesday began taking orders for its Model 220EV medium-duty cabover model with customer deliveries expected by the end of 2020.

Peterbilt and sister brand Kenworth have 60 medium- and heavy-duty electric test trucks in use.

Navistar International (NYSE: NAV) is working on an electric version of its medium-duty MV.

A total of 23 heavy-duty VNR day cabs from Volvo Trucks North America and the Daimler Trucks North America experimental fleet of 38 electric trucks precede commercial sales in the next two years.

“The public charging infrastructure is not to the point where you can rely upon it to supply your fleet with energy on your regular routes,” DTNA CEO Roger Nielsen said Monday. “This is why we have charging on the grounds of our customers, just so we take away that hurdle.”

DTNA has 60 DC fast chargers with a total of 7 megawatts of power at customer locations. It plans 150 chargers with a total of 20 megawatts.

Penske Truck Leasing recently added two 150 kWh chargers to four it installed to support 10 medium-duty Freightliner eM2 and 10 Class 8 eCascadia trucks it is testing in Southern California.

Need versus greed for speed (of charging)

School buses are a growing application for electrification. Their frequent stops and starts generate electricity that can go back into the battery. They don’t often need DC fast charging, Calise said.

“That’s a classic AC (alternating current) application,” he said. “The majority of other commercial vehicles need uptime.”

At least 50% of Class 2-8 trucks need DC charging compared to just 20% of school buses, Calise said.

“The speed of charging is so important. It comes to the difference between the need for speed and the greed for speed,” Calise said. “Once you start to charge fast, you never go back. We’re a convenience mentality. Everything we do has to be quick because quick means productivity.”

Related articles:

Build electric truck infrastructure and they will come, advocates say

California approves world’s first electric truck sales mandate

Penske opens heavy-duty electric charging stations