The Advanced Clean Transportation Expo nearly doubled attendance from just eight months ago and the conversion of diesel trucks new and old to batteries and fuel cells emerged as an undeclared theme. Also, some evidence that in the still early days of Class 8 electric trucks, driving range matters more than battery weight.

An electric trucks blowout in Long Beach

Last August, the ACT Expo was the first, albeit heavily masked, in-person industry conference to see a significant turnout. In a pandemic lull, 5,000 people fist-bumped and smiled behind face coverings. Many seemed practically giddy at seeing three-dimensional beings mostly relegated to Zoom and Microsoft Teams chats for more than a year and a half.

When the Expo returned to its regular schedule this week, organizers expected an uptick in registrations. The already-planned move to larger quarters in Anaheim, California, in May 2023 received validation when more than 8,500 people crowded the Long Beach Convention Center.

The upsizing likely resulted from relaxed COVID restrictions and growing interest in the transition to electric trucks. Though some attendees still donned masks, the event felt pre-pandemic normal. The on-site COVID test van from last summer was nowhere to be found.

ACT of ‘repowering’ to electric trucks

Conversions of diesel-powered trucks — some call it repowering — dominated displays in the exhibition hall. The two words are synonymous — stripping out engines and transmissions and replacing them with electric axles, motors and power electronics that eliminate tailpipe emissions. And tailpipes themselves.

In California, where diesel is a byword for pollution, startups and legacy companies alike displayed electrified chassis. Even longtime school bus maker Bluebird got into the act. It teamed up with startup Lightning eMotors to reveal a Class 6 chassis for vehicles with a gross combined vehicle weight up to 26,000 pounds.

The move effectively doubles Bluebird’s potential market. Think step vans, recreational vehicles, even food trucks.

Competition is flooding the space. Legacy frame makers like Freightliner Custom Chassis Corp. and Ford divvied up the market just a few years ago. Credit the growth in last-mile pickup and delivery — and the desire to do it with zero emissions and nearly silent operation.

“As time goes by the market is going to be so great that even with all the manufacturers playing, I don’t think we’ll satisfy the demand in five years’ time,” Dan Bennett, Lightning eMotors Systems’ marketing manager, told me. “Right now, there’s plenty of room for all the players. Three or four years down the line, we’ll see which players are still standing.”

Change partners?

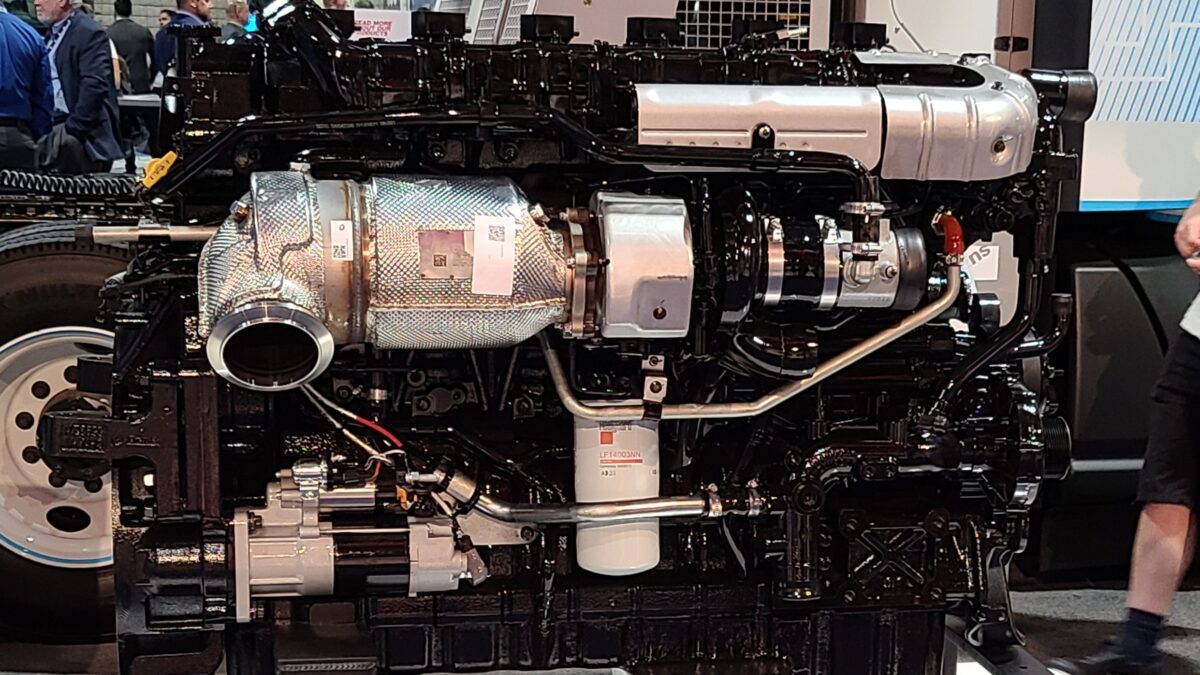

Cummins Inc.’s announced it would build hydrogen-powered fuel cells into Freightliner Cascadias with Daimler Truck North America. It put the two familiar corporate giants in a new business venture. Ironically, Cummins displayed a Kenworth T680 fuel cell conversion in its display. And CEO Tom Linebarger declared the deal with Daimler is nonexclusive.

It wouldn’t be surprising to see the Paccar Inc. brand adopt Cummins’ fuel cells to satisfy early customers eager to try hydrogen. Ten Kenworth trucks served as host bodies for Toyota Mirai fuel cell stacks as part of a zero-emissions Port of Los Angeles demonstration program. Toyota plans to build fuel cell stacks for trucks next year in Kentucky. So we’ll see.

Linebarger: Partial solutions for electric trucks is the right road

Cummins is throwing its considerable weight around in more than fuel cells. It displayed mockups of its ubiquitous X15 internal combustion engines — one painted black for natural gas and one in its traditional red with white accents signifying the coming X15H variant fueled by hydrogen.

The decarbonization challenge in transportation is too great for a single solution, Linebarger said in a keynote address on Wednesday.

“Coming up with partial solutions today is not as politically popular and not as exciting as the battery-electric solution,” Linebarger said. “But I can’t give you a battery-electric solution for a heavy-duty truck that has the range you want at the price you want. What I can give you is a natural gas engine, a renewable natural gas engine if I get enough renewable fuel.”

The Cummins X15N coming in 2024 already threatens the original EX hybrid electric assist from startup Hyliion. The graphics-adorned bright green ERX natural gas-electric hybrid Peterbilt 579 was back on display at the Expo where it debuted last summer.

In another repowering move, Hyzon Motors will work with Fontaine Modifications to replace diesel engines in trucks with sufficient remaining life to run on hydrogen fuel cells. Coincidentally, Hyzon retrofitted a few Cascadias, including one tested by Total Transportation Services Inc.

Would TTSI bypass Hyzon and order Cummins’ fuel cells from Daimler? We’ll see about that, too.

Order counts

Volvo Truck North America shared a report card on its progress in piling up orders for the VNR Electric tractor. NFI Industries (60) and Quality Control Distribution (30) are the latest.

“This development to zero emission is going on, and it’s going fast,” Peter Voorhoeve, VTNA president, said Monday. “Every time we try to predict what’s happening we’re wrong because it goes faster than what we think.”

Take it to the max

NFI expects a second-generation Freightliner eCascadias to arrive in September in exchange for one of 10 first-generation eCascadias it has been running in port drayage since early 2020.

NFI ordered 30 eCascadias, which Daimler Truck North America touts as having a typical single-charge range of 230 miles.

That range “won’t get us what we need in this [drayage] fleet,” Bill Bliem, NFI senior vice president of fleet services, told me. NFI wants two 130- to 150-mile round trips miles per charge.

Volvo’s second-generation VNR Electric added battery weight to stretch its single-charge range to 270 miles. The extra mass is OK, Bliem said.

“The nice thing about [the Volvo trucks] is if we do run a little bit short, we can charge at a higher rate of speed,” he said. “We can put a 20-minute charge on ’em and get ’em back down to the port.”

The third OEM in NFI’s mix is Nikola. NFI is starting a 90-day demonstration with a battery-electric Tre next week. With nine battery packs, the Tre cabover claims up to 350 miles on a charge.

“As long as that demo works out, we’ll take delivery of 10 of ’em by the end of the year,” Bliem said. “All three [battery-electric trucks] have their own nuances. The Nikola has a 300-, 350-mile range but it weighs 29,000 pounds. We’ll have to be careful on our loads with the Nikolas.”

Bliem continues to believe that fuel cells are the answer above 300 miles.

Hiding in plain sight

Sitting inside Navistar’s NEXT trailer outside the convention center, I asked CEO Mattias Carlbaum when the Traton Group subsidiary would bring a full-size electric truck to market. He passed on the subject in a keynote earlier Tuesday.

“We haven’t announced it, but we have it in [the pipeline],” Carlbaum said. “I wasn’t allowed to say it today. That’s a secret.”

Not so much as it turns out.

Outside the trailer, a prototype of a battery-electric International RH regional haul tractor, painted dark blue and adorned with space-age graphics, attracted less attention than a marketing giveaway nearby. I walked by the RH, oblivious to the battery packs along the sides.

When Mike Roeth, executive director of the North American Council for Freight Efficiency, posted a photo on LinkedIn, I saw what I missed.

That was the intent, Jason Gies, Navistar vice president of eMobility, told me later Wednesday during a chance encounter. Look for the real deal early next year.

That’s it for this week. Thanks for reading. Click here to get Truck Tech delivered via email on Fridays.

Alan