Even as orders for new trucks reached record levels in 2018, used trucks remained in demand, pushing up prices 10 percent for the year, according to ACT Research. The firm also said that volumes rose eight percent compared to 2017 as a combination of factors likely played a role in a banner 2018 for dealers.

“It’s been a ridiculously good year for all commercial trucks,” explained Steve Tam, vice president of ACT Research. He said it’s difficult to pinpoint an exact reason for the used truck increase, but “certainly the limited availability in the new truck market” played a role. Attractive pricing, quality of the used vehicles on the market, and the need of some fleets to get immediate access to trucks were all factors, he added.

The data is included in ACT’s State of the Industry: U.S. Classes 3-8 Used Trucks report. The report reported that used Class 8 same-dealer sales volumes fell 9 percent month-over-month in December even as it increased for the year. Average mileage was flat compared to 2017, while average vehicle age declined 3 percent in 2018.

“Dealers are reporting that used truck sales continue at a very high pace, with the only immediate dark clouds being that there are not enough trucks to meet demand,” said Tam. “However, dealers are also cognizant of slowing freight growth and the subsequent dynamics expected to play out in the new truck market. Ultimately, the industry expects an abundance of inventory that will inevitably put downward pressure on prices.”

Tam told FreightWaves that the economy played a significant part in commercial sales of all types that helped reduce the inventory available, thereby driving up pricing.

“The used truck buyer with secondary equipment participates in the same economy,” he said. “Because of the strength we saw in the economy and freight environment [overall], people were not trading in as many trucks.”

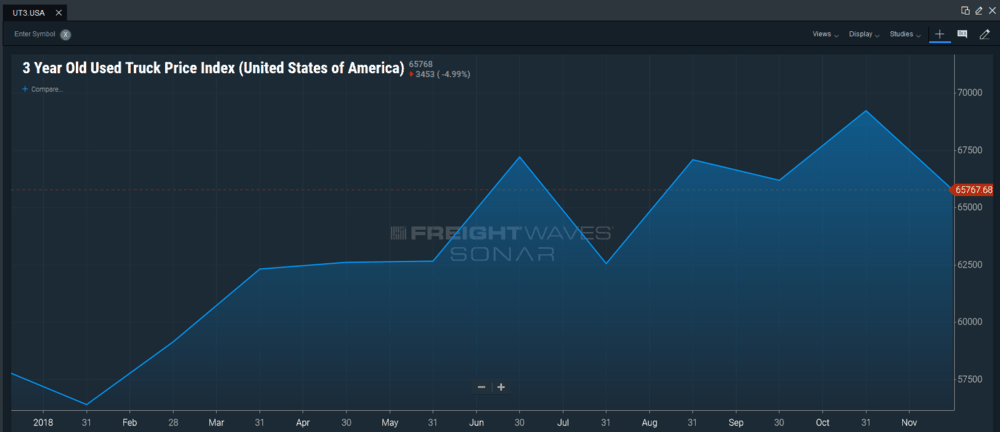

According to available data within FreightWaves’ SONAR platform, the price of a three-year-old Class 8 tractor rose from $57,906 on January 1, 2018, to $65,768 as of November 30. The same holds true for four- and five-year-old tractors, with four-year-old models climbing from $46,372 to $53,116, and five-year-old models jumping from $39,158 to $43,734.

Tam noted that total units sold in 2018 were about 280,000, up from about 270,000 in 2017. Dealers, though, remain concerned about the overall slowdown and are being cautious about adding excessive inventory, he said.

“When I was with dealers in 2017, they were very worried they were going to have a flood of inventory in 2018 and because of the economy that didn’t happen, but they remain [worried],” Tam said.

On a more granular level, Tam said that retail posted its first year-over-year decline in December since December 2016, but posted a 13 percent increase for all of 2018. Conversely, the auction channel posted an eight percent increase year-over-year in December but was down 4 percent on the year. Wholesale was flat for all of 2018, pulled down by a 30 percent drop year-over-year in December.