Expeditors International (NASDAQ: EXPD), a 3PL that specializes in ocean and air freight, recorded strong but not spectacular growth during the quarter, showing no signs of either a tariff-related slowdown or a surge to get freight across the ocean before a downtown.

In its quarterly earning report, Expeditors’ reported that total revenues were up 17% compared to the second quarter of 2017, and its net revenues were up 14%, with a rise in operating income of 9%. That trend shows significant growth but a tightening of margins.

The company’s airfreight volumes measured in kilos rose 4% overall, with a 1% jump in April followed by 6% increases in May and June. Ocean freight volumes were more volatile, with a 2% decline in April followed by a 5% gain in May. June numbers were flat for an overall increase of 1%.

Expeditors does not have a conference call with analysts in conjunction with its earnings release.

The three individual segments of Expeditors performed in significantly different ways. For example, the airfreight services division saw its revenues climb 19.3%. The customs brokerage and other services division jump 32.6%. But the ocean freight and ocean services group was basically flat, and the numbers were reported on a day when marine shipper A.P. Maersk cut its 2018 earnings forecast, citing higher fuel prices. (Though those higher prices would affect airfreight movement as well).

In the company’s prepared statement, President and CEO Jeffrey Musser conceded some tougher times in the ocean freight business. “We experienced strong performance in our ocean forwarding and order management businesses, but ocean freight net revenues were down 5% on a 1% increase in volumes, as carriers took steps to mitigate the impact of volatile pricing, excess capacity, and higher fuel costs,” he said.

In an analysis of the company published late last week, CFRA analyst Jim Corridore projected revenue growth under with what the company recorded in the quarter (17%, with an 18% growth for the first half). “After a 13% increase in 2017, we see gross revenues as likely to rise 15% in 2018 and 5% in 2019,” Corridore said.

Although there was downward movement in margins in the report, Corridore projected a higher number for the year. “We see the operating margin aided by growth in volumes, partly offset by higher ocean and air transportation costs, reflecting tighter air capacity and efforts to raise rates by ocean freight providers,” he said. “Over the longer term, ocean freight rates will likely decline as new capacity continues to come on line.”

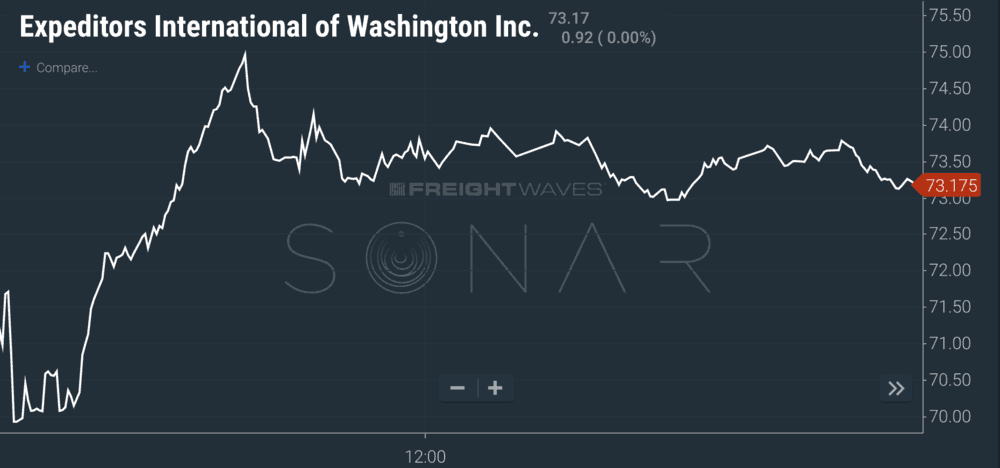

Although Expeditors’ revenue and EPS were both above estimates, the shares sold off Tuesday. At approximately 2 p.m., Expeditors stock on NASDAQ was down $3.86 to $73.63, a drop of approximately 5%. It was one of the worst performing stocks on the day in the trucking and 3PL sector.