Container ship bookings for US imports still strong, but falloff may hit soon

(Chart: SONAR)

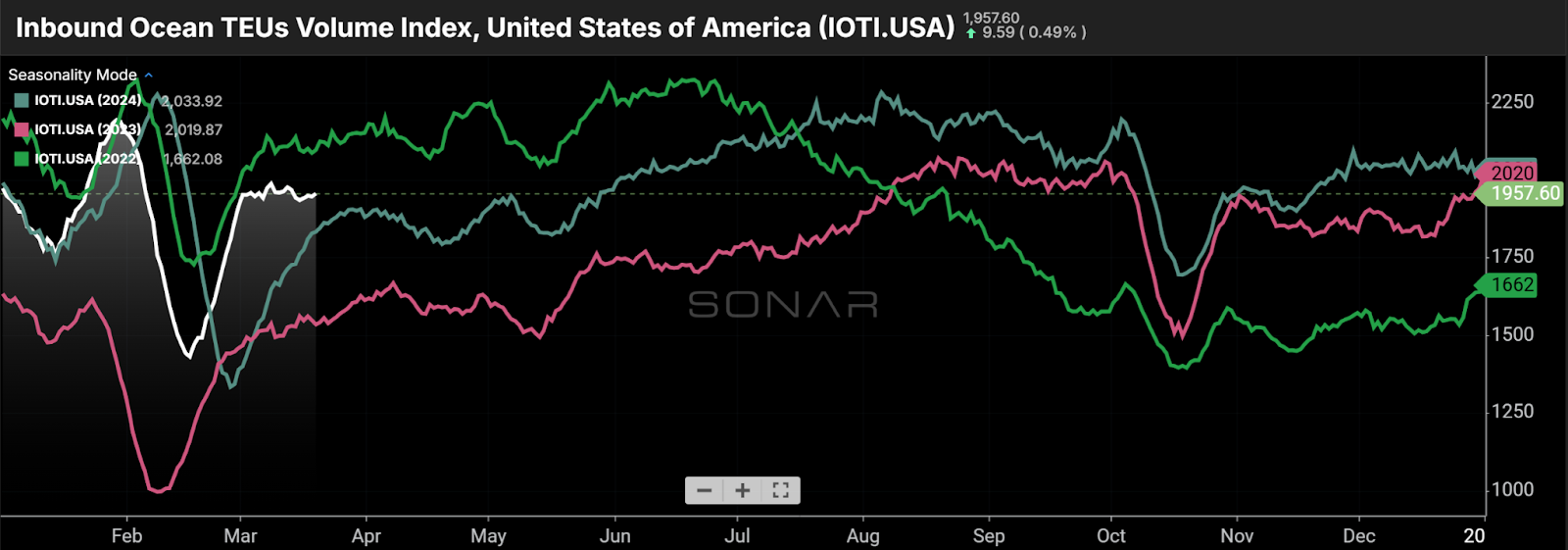

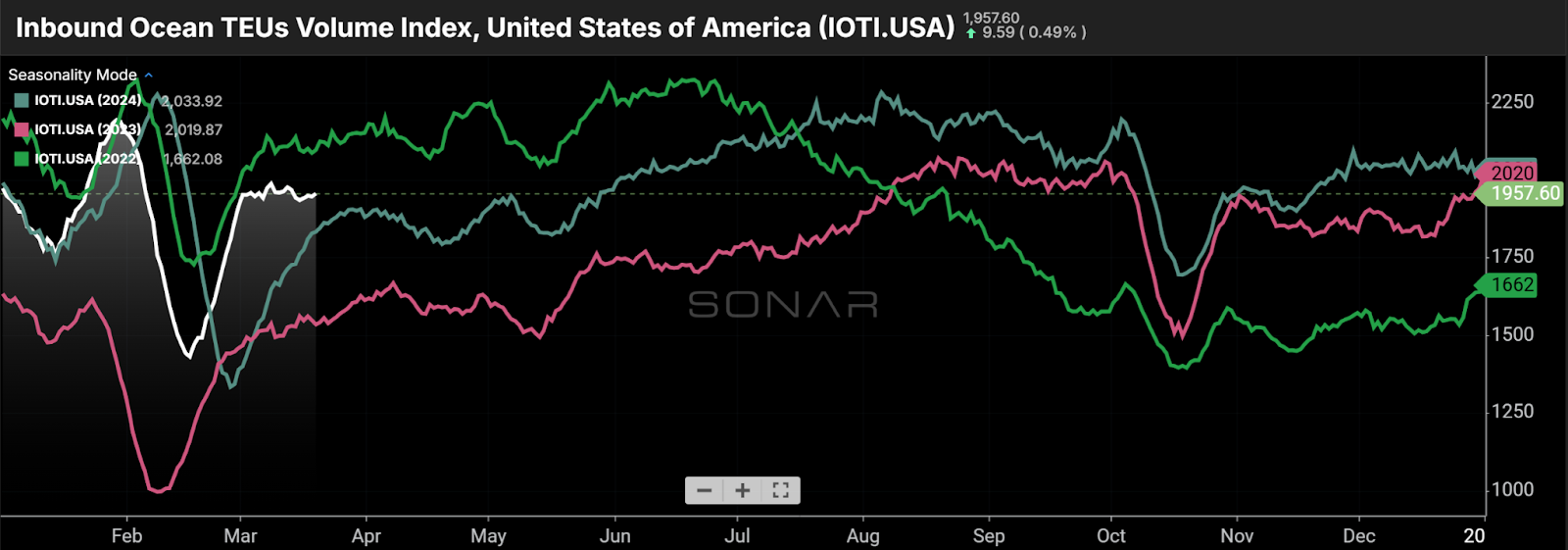

One of the most watched SONAR datasets currently is the Inbound Ocean TEUs Volume Index of U.S. imports (IOTI.USA). It represents a daily index of container bookings on vessels headed to the U.S. at the point of overseas origin, making it a leading indicator of import volume. The index provided an early look at import weakness in mid-2022 (light green line).

Currently, IOTI shows continued strength in U.S. import demand, up 6.5% year over year against a fairly difficult year-ago comparison. Major shipper industry groups, like the National Retail Federation, and major carriers, such as Class I railroad Union Pacific, say they have seen a significant pull-forward of imports to avoid rising tariffs. The question becomes whether there will be a subsequent drop in import demand because containers had already been pulled forward and/or because a drop in consumer spending is causing inventories to become bloated. While those appear to be real possibilities, SONAR data is not yet showing that.

In a recent article, Stuart Chirls added the NRF’s outlook. The trade group, which is against higher tariffs, expects tariff-driven frontloading to remain high through the spring but says it could see year-over-year declines this summer. According to Jonathan Gold, NRF vice president for supply chain and customs policy, “retailers are continuing to bring as much merchandise into the country ahead of rising tariffs as possible.”

Ocean container rates have fallen sharply this year. However, Drewry argues for a higher new normal for container rates, citing current rates that remain above pre-pandemic levels. (Chart: SONAR)

Will made-to-order e-commerce survive the end of de minimis?

Airfreight rates from Hong Kong to LAX have fallen to multiyear lows. (Chart: SONAR)

It’s easy to see the impact that changes to e-commerce business models are already having on airfreight rates, such as in the SONAR chart above. And, there have been plenty of headlines of cargo airlines downsizing operations in response to falling demand. But in a recent article, Modern Retail argues that the likely elimination of the de minimis exemption, which exempts imports of $800 or less from tariffs, will not put an end to the direct-to-factory business model most closely associated with Shein. The rationale is that the made-to-order business model does not rely on the de minimis exemption because there are many other benefits. Those positive factors include improved speed (between when the factory order is placed and delivery) and working capital efficiency. Meanwhile, the main drawback to direct-to-order is fulfillment speed, assuming the finished goods are already available at a local warehouse or fulfillment center. Another option is for apparel brands to adopt a hybrid approach in which they utilize air cargo to ship seasonal and in-demand items while relying on ocean shipping for more basic items.

Outbound from LA, intermodal outperforms truckload

(Chart: SONAR)

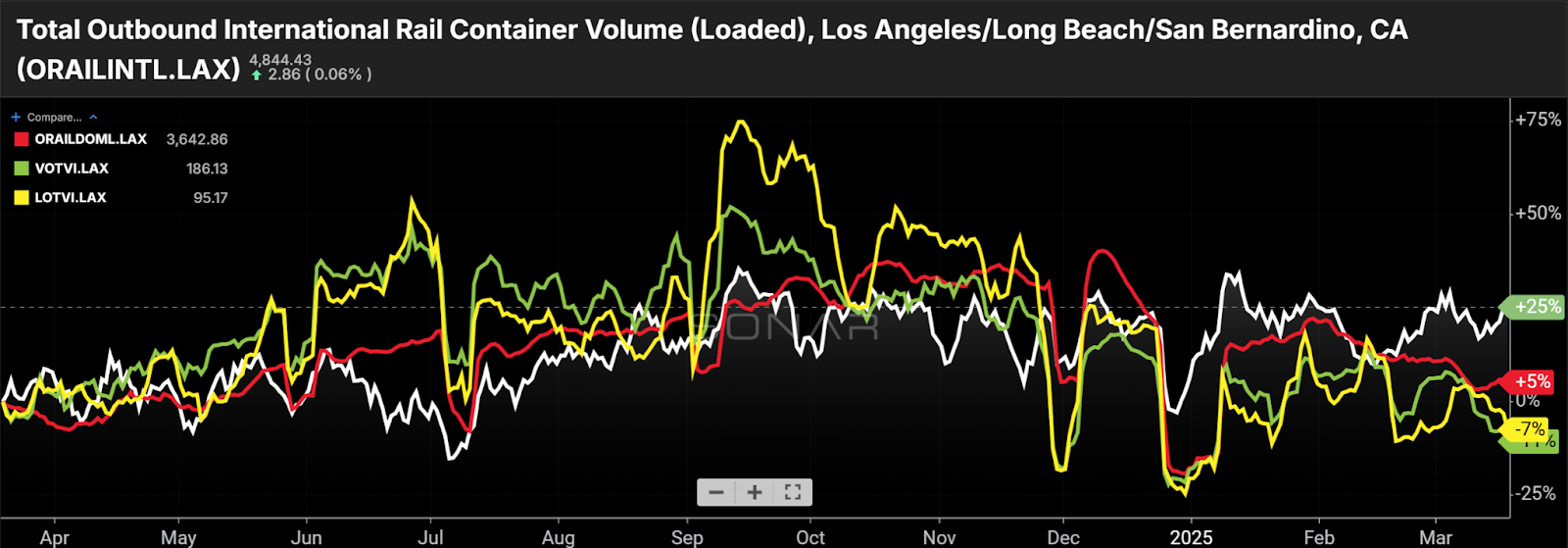

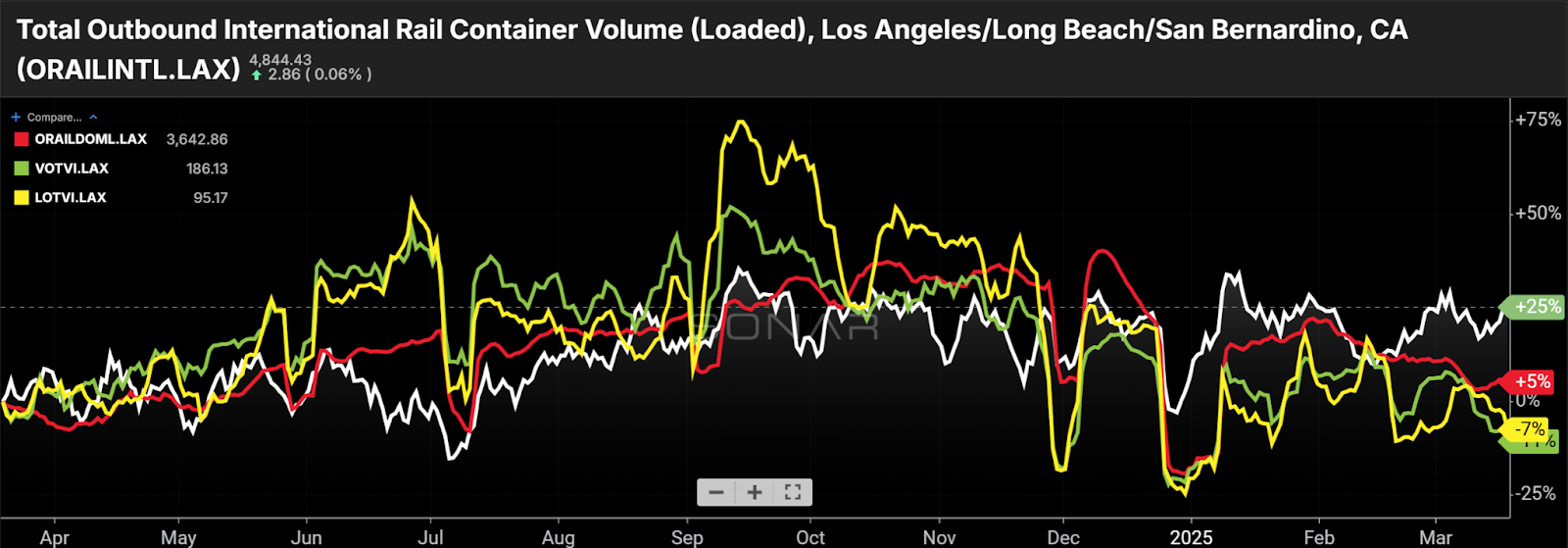

The latest outbound LA volume data in SONAR shows international intermodal (white line above – loaded only) outperforming domestic intermodal (red line – loaded only). They are up 25% and 5%, year over year, respectively. In addition, both intermodal segments are posting year-over-year volume changes that exceed the growth in truckload tenders that may compete with intermodal. To limit the truckload tender volume to loads that may be competitive with intermodal, the chart above shows long-haul LA outbound loads (greater than 800 miles – yellow) and dry van LA outbound loads (green), which are down 7% and 11%, year over year, respectively.

This apparent market share gain for intermodal versus truckload and the share gain for international intermodal versus domestic intermodal appear to reflect strong import volume and also a lowered degree of time sensitivity of goods that have been pulled forward to avoid tariffs. In short, the slower shipping options are seeing more volume. That suggests that, when posting first-quarter results, Union Pacific may again see a headwind on its margin due to mix – international intermodal is relatively low-margin for railroads – and the domestic intermodal companies may post volume that is less than that reported by the Association of American Railroads since its dataset conflates the international and domestic intermodal segments.

The Stockout Show: Allianz Trade – what’s pressuring the economy?

(Image: FWTV)

On Monday’s The Stockout show, Dan North, senior economist, Allianz Trade North America, discussed the many factors pressuring the macroeconomy. Those factors include rising inflation concurrent with a softening job market, which is sidelining the Fed. History shows that tariffs destroy economic value and lead to a net reduction in jobs. Consumer confidence has been shaken following a reduction in consumers’ ability and willingness to spend. Meanwhile, the industrial economy is in low-growth mode. Taken together, the economic outlook is at least for a slowing of macroeconomic growth, if not worse. Fortunately, North does not expect a return to stagflation, since that would require the unusual degree of economic shocks experienced in the ’70s. Monday’s show is available on The Stockout YouTube Page.

0 replies