FedEx continues to pretty up the nation’s largest less-than-truckload business, FedEx Freight, ahead of a 2026 spinoff. However, a lackluster industrial complex continued to present a headwind during its recent fiscal quarter ended Feb. 28.

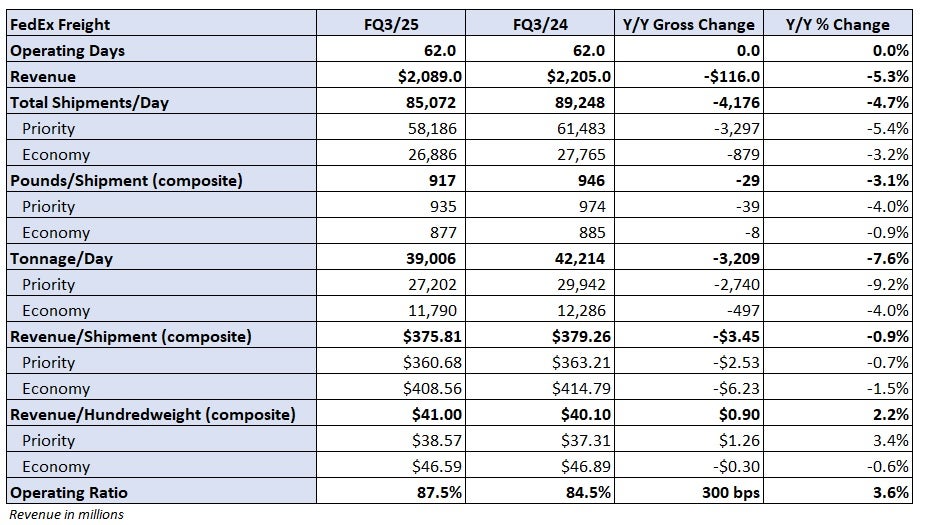

Revenue at FedEx Freight declined 5.3% year over year to $2.09 billion as tonnage fell 7.6% and revenue per hundredweight, or yield, increased just 2.2%. The tonnage decline was the combination of a 4.7% decline in shipments and a 3.1% decline in weight per shipment. A weak industrial economy along with lower fuel surcharge revenues were cited as the culprits.

Approximately 90% of the LTL unit’s top line comes from business-to-business transactions. Uncertainty around a rapidly changing trade landscape is weighing on capital investment and domestic manufacturing, which only recently punched through a two-year-plus downturn.

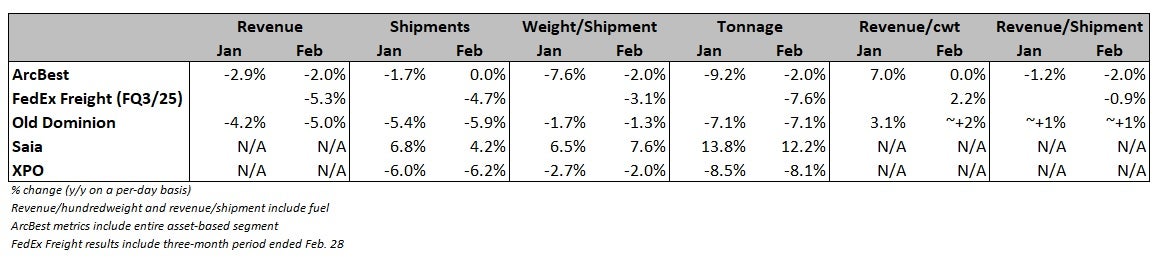

The Thursday update from FedEx (NYSE: FDX) showed trends in line with recent updates from other LTL carriers, which have reported mid- to high-single-digit tonnage declines to start the year. Saia (NASDAQ: SAIA) and ArcBest (NASDAQ: ARCB) are outliers to the trend given the idiosyncratic strategies they have in place: The former aggressively added terminals and freight following Yellow Corp.’s (OTC: YELLQ) 2023 collapse, and the latter is backfilling its network with truckload freight to offset LTL volume declines.

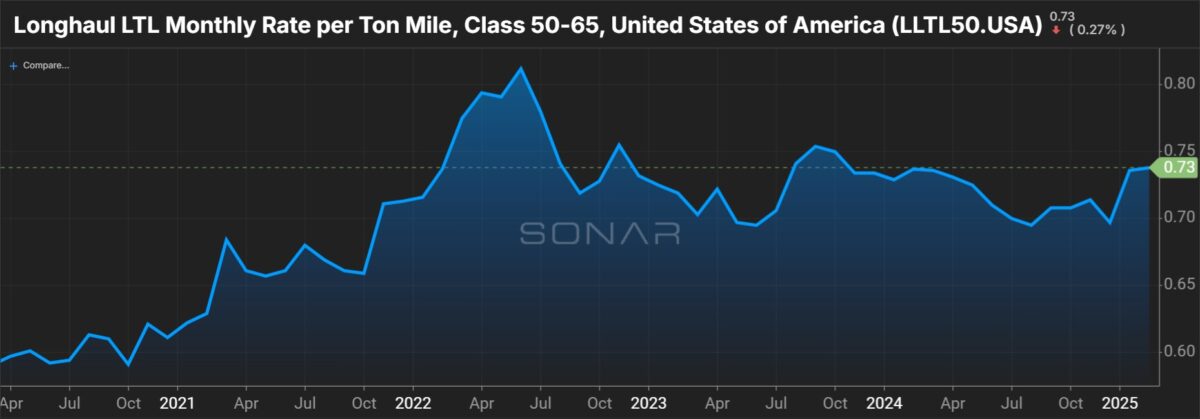

The LTLs have been the worst-performing group among transports since the beginning of the year. A 20%-plus sell-off in shares is tied to the tariff overhang and the possibility that Amazon (NASDAQ: AMZN) becomes a more meaningful player in the space. Valuation multiples are also resetting, giving back some of the froth captured during the pandemic, when the sector was rewarded for its industrial-focused, final-mile-type networks that played an important part in restocking inventories. The group also remained in favor due to advantageous pricing dynamics.

FedEx Freight’s fiscal second quarter (ended Nov. 30) may be the nadir for the y/y declines. (Tonnage was down 11.3% y/y in that period.) Management is hoping for a return in B2B volumes at some point but still expects sequential top-line improvement in the current quarter (fiscal fourth quarter ended May 31), albeit still lower y/y, regardless.

“At freight, we expect a continued revenue decline on a year-over-year basis in Q4 but also expect the Q4 decline to moderate sequentially,” said Brie Carere, FedEx’s chief customer officer, on a conference call with analysts. The unit is focused on increasing density and weight per shipment, which should produce a better margin in the fiscal fourth quarter.

The unit recorded an 87.5% operating ratio (inverse of operating margin) in the recent quarter, which was 300 basis points worse y/y. Weak volumes and lower fuel surcharge revenues were just partially offset by improvement in base yields and cost actions, which included “headcount management.”

Carere provided some positive commentary on yields.

“We remain focused on quality growth amid a competitive but rational pricing environment. I am encouraged by recent pricing trends. Holiday demand surcharges supported our results.” She also pointed to a “strong capture rate” on the 5.9% general rate increase implemented in January.

Spinoff is on track, looking for new LTL leader

Management said the plan to spin off FedEx Freight into a separately traded public company is on track to conclude by June 2026. The company recently established a separation management office and transition team. It also executed a $16 billion debt exchange and consent solicitation to facilitate the breakup.

“This will create more flexibility for both companies’ capital structures as we prepare for the separation, which will come in the form of a tax-efficient spinoff,” said CFO John Dietrich. “As our separation management office continues to advance our spin-related work, it’s business as usual for our other team members and all our customers.”

He said the unit remains focused on “revenue quality, network utilization and operational efficiency,” levers that will presumably support a favorable valuation when the transaction occurs. The company continues to bolster sales staff to improve the freight mix.

FedEx also said it was looking for a new leader to run the stand-alone business.

“We are conducting a very comprehensive search for the CEO of FedEx Freight, and I’m confident that through our thorough process that we will provide FedEx Freight with the right visionary leader who can help chart the course of this new stand-alone company,” said FedEx CEO Raj Subramaniam.

FedEx again lowered its outlook for fiscal 2025 on Thursday, reeling in adjusted earnings per share to a range of $18 to $18.60 – a 6% reduction at the midpoint. It said consolidated revenue is now expected to be “flat to slightly down y/y” versus the prior call for no change. The company reiterated cost savings from its Drive initiative to total $2.2 billion in the current fiscal year ($4 billion in aggregate).

Shares of FDX were off 8.2% at 12:19 p.m. EDT on Friday compared to the S&P 500, which was off 0.3%.

0 replies