FedEx announced Thursday it will move forward with a plan to spin off its less-than-truckload unit, FedEx Freight, into a separately traded public company. FedEx first floated the idea in June in conjunction with its quarterly report.

Under the new structure, FedEx (NYSE: FDX) will comprise of the company’s legacy air, ground and parcel segments, which generated $78 billion in revenue in its recent fiscal year ended May 31. The new business will house FedEx Freight, which is the largest LTL carrier in the U.S. with nearly $10 billion in annual revenue.

“A stand-alone FedEx Freight gives LTL investors another pure play“

The transaction is expected to occur within the next 18 months, creating incremental value for shareholders. FedEx said the split will provide enhanced operational focus at both businesses.

“This is the right time to pursue a separation as we respond to the unique dynamics of the LTL market,” said Raj Subramaniam, FedEx president and chief executive officer, in a news release. “Through this process, we will unlock value for our Freight business and position FedEx to create even greater value for stockholders.”

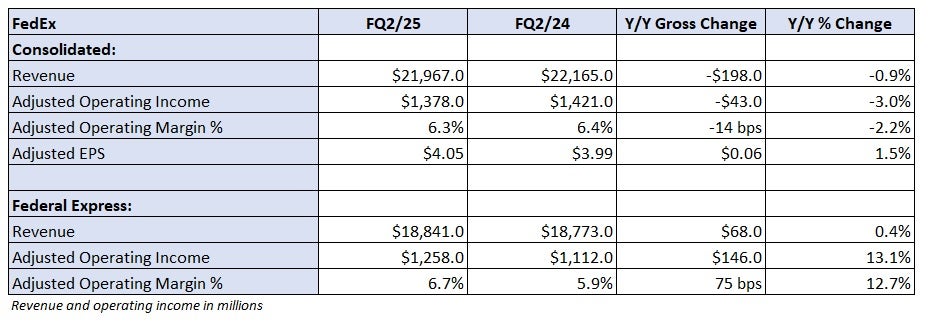

FedEx also reported fiscal second-quarter results after the market closed Thursday.

The company generated consolidated revenue of $22 billion in the fiscal quarter ended Nov. 30, down 0.9% year over year and nearly in line with the consensus estimate. Adjusted earnings per share came in better than expected at $4.05, 6 cents higher y/y.

“Our second quarter results demonstrate that our efforts to transform our operations are working,” Subramaniam said in a separate release. “The Federal Express segment delivered operating profit growth despite several headwinds, including the continued weak U.S. domestic demand environment as well as the expiration of our U.S. Postal Service contract.”

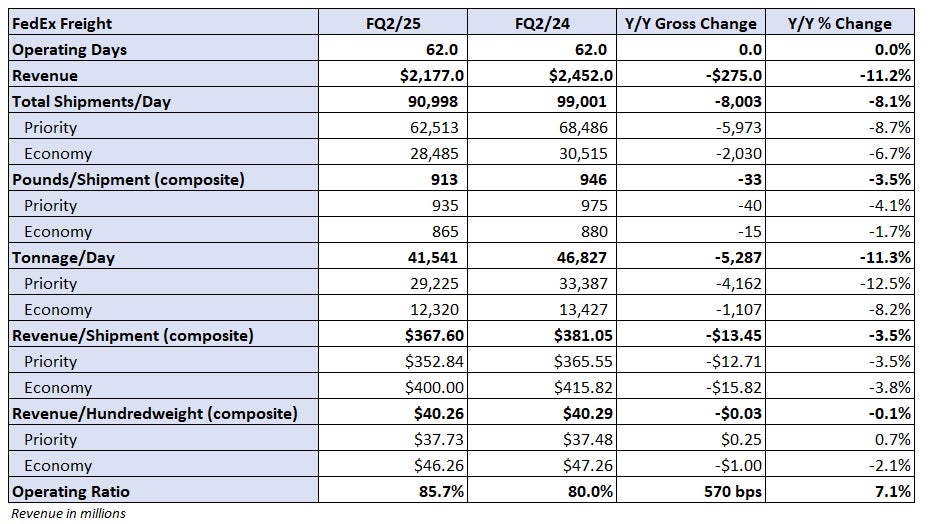

He noted the improvement was partially offset by weakness at FedEx Freight.

“A stand-alone FedEx Freight gives LTL investors another pure play“

FedEx again lowered its outlook for fiscal 2025. It now expects consolidated revenue to be flat y/y (versus the expectation of a low-single-digit increase previously), and $19 to $20 in adjusted EPS ($1 lower at each end of the range).

Shares of FDX were up 8.9% in after-hours trading on Thursday.

The company will host a call to discuss fiscal second-quarter results at 5:30 p.m. EST on Thursday.