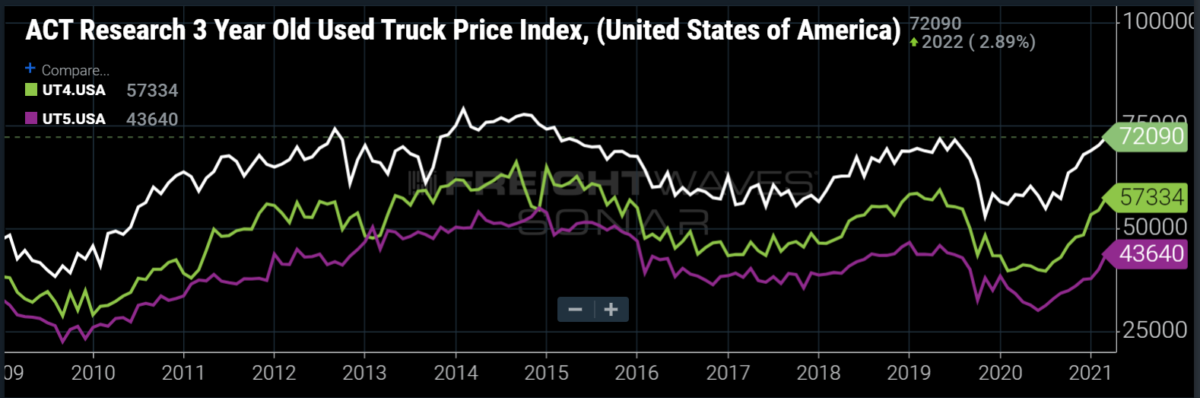

When it comes to the current state of used trucks, forget what Econ 101 teaches about supply and demand. Rather than one impacting the other, both are driving used truck prices to a post-Great Recession peak.

“On the supply side, ongoing new truck production constraints are causing many buyers to look for low-mileage used trucks as a substitute,” Chris Visser, J.D. Power Valuation Services commercial vehicles senior analyst and product manager, told FreightWaves. “On the demand side, the freight markets are still red-hot, encouraging truckers to upgrade to newer iron.”

Preliminary used Class 8 truck volumes by the same dealers dropped 14% in May compared to April. But they were 46% higher in May than the pandemic-influenced month a year earlier, according to ACT Research.

“U.S. GDP is forecast to hit nearly 7% in 2021, freight volumes are through the roof, and freight rates are just now starting to pull back from record highs,” ACT Vice President Steve Tam said.

Struggling to keep up

New truck production, beset by shortages of microchips that power critical vehicle functions, and through-the-roof commodity prices, is only beginning to recover but manufacturers are having difficulties hiring enough workers.

“It is in the context of this strong market that new truck production is struggling to keep up with strong demand and limiting the used truck market from realizing its full potential,” Tam said. “By all indications, demand continues to outpace supply, and for that reason, it should come as no surprise that truck prices continue to increase.”

Appreciation across the board

J.D. Power reported that trucks in most segments appreciated in May with Class 8 auction pricing up 11.9% over April. Retail pricing was up 7.1% month over month.

To learn more about FreightWaves SONAR, click here.

The newest available sleeper tractors are bringing pricing at or above the highest peak months in the post-Great Recession period, Visser said.

“We expect late-model pricing in June to clearly surpass the highest months in the post-Great Recession period.”

Chris Visser, J.D. Power Valuation Services commercial vehicles senior analyst and product manager

The average sleeper tractor retailed in May was 71 months old, had 416,232 miles and brought $63,518. Compared to May 2020, this average sleeper was four months older, had 45,606, or 9.9% fewer miles, and brought $23,285 or 57.9% more money.

All used Class 8 sleepers from 2016 to 2020 model years commanded higher prices in May. Model year 2020 led the way with a 9.6% higher price than in April.

Highest prices since Great Recession

“We expect late-model pricing in June to clearly surpass the highest months in the post-Great Recession period,” Visser said. “In times like this it’s easier to justify the expense of a newer truck if it means better reliability and fuel economy and possibly a warranty.”

Retail traffic pulled back as inventory was hard to come by. Dealers sold an average of 5.2 trucks per store in May, 0.4 fewer than in April. Year over year, the first five months of 2021 generated 1.6 more truck sales per dealership than during the same period of 2020.

“We expect traffic to remain relatively solid in the summer,” Visser said.

Looking ahead, he said, most trucks should see mild-to-moderate retail appreciation into the third quarter before moving lower later in the year as the supply chain rebalances and trucks become more available.

Scant availability typical for a cyclical lower period for trade-ins is causing moderate swings in average monthly prices of Power’s benchmark group of 4- to 6-year-old trucks.

“We have not seen any letup in actual pricing since the run-up began last year,” Visser said. “Compared to the first five months of 2020, this group is running 80.3% ahead. It’s no surprise that 2021 would perform much better than 2020, but our benchmark group is also bringing by far the highest pricing in the six years we’ve been tracking it.”

Related articles:

Seller’s market for used trucks is hot, hot, hot

Chip shortage pushing capacity-starved fleets to used equipment

Gary

Just stop! How many times have we went through this before? Yes we’re in a boom time for rates and low capacity but don’t over pay, don’t over order, just enjoy the ride, make some money and it will be gone as soon as it came.

Bill+Hood

And keep moving down the line, we aren’t training drivers at a level that will allow us to catch up with what was lost in the last year let alone keep up with drivers leaving the market.

At some point FW will be doing an article talking about how carriers now have trucks, but are down on driver count.

Gary

Exactly….we don’t have nearly the enough drivers to fill the trucks that are open now. Yes we’re in a boom time for rates and low capacity but don’t over pay, don’t over order, just enjoy the ride, make some money and it will be gone as soon as it came.

CM Evans

The drivers you seek are crossing the Tejas border as we speak, just be patient. The labor pool we be flooded soon enough to drive down your standard of living even further.