“I don’t remember a time when so many extreme events were happening in shipping,” said Stifel analyst Ben Nolan, who has been covering the sector for the past 16 years.

Container shipping led the charge, with rates soaring to stratospheric highs. Dry bulk shipping rates jumped next, to levels not seen in over a decade. Now liquefied natural gas shipping has joined the party. LNG spot shipping rates “surged 40% in one day — Friday — on already high levels,” Nolan wrote in his weekly report.

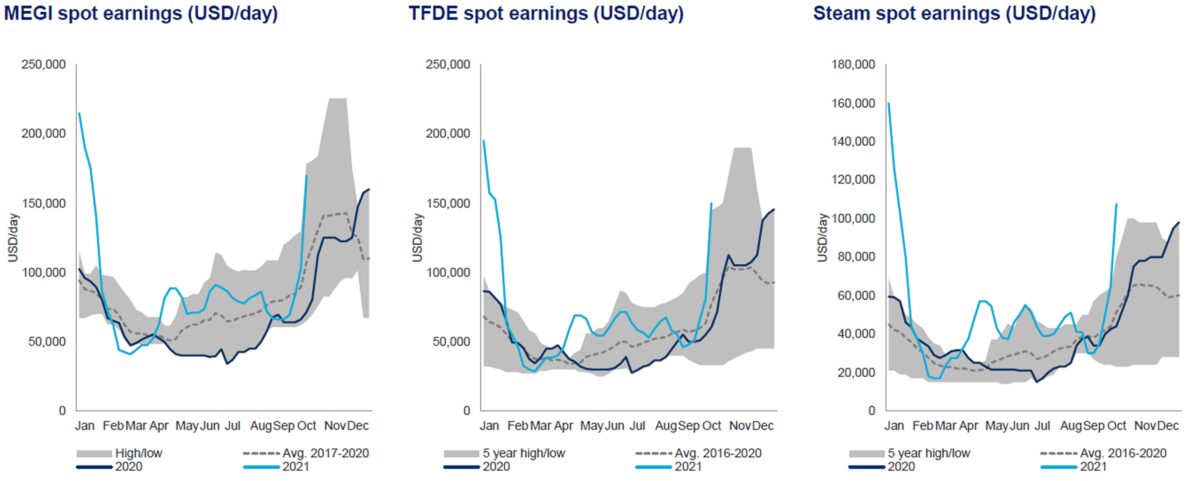

Clarksons Platou Securities reported that benchmark spot rates for tri-fuel, diesel-engine LNG carriers were $157,500 per day on Monday, up 86% week on week. Rates for MEGI-propulsion carriers were $180,000 per day, up 65% week on week. Even rates for older steam-power LNG carriers are in six digits: at $110,000 per day, up 60% week on week.

Multiple segments, rhyming patterns

Shipping rates for containers, LNG and dry bulk are simultaneously high due due to parallel disruptions in supply and/or demand. No matter what the product or commodity, there’s domestic production, inventories and consumption on one hand and imports on the other. Abrupt COVID-era stops and starts of demand (and in the case of container shipping, cargo supply), compounded by other factors, have left inventories short in many categories, stoking demand for imports and thus ocean shipping.

In the container sector, warehouses are full and U.S. inventories overall are higher than pre-COVID, yet U.S. consumer demand has risen even faster, leaving inventory-to-sales ratios historically low.

In the coal and LNG sectors, high power consumption in Asia lowered stockpiles, with environmental issues and weather playing key roles in European and Asian shortfalls.

In both container shipping and coal shipping, port congestion is constricting vessel capacity, a plus for rates.

There are connections between what’s happening in LNG, coal and container shipping. Some previously containerized goods are moving on bulkers. High manufacturing levels in China fueled by U.S. consumer demand have played a role in lower Chinese energy commodity inventories, supporting rates for LNG carriers and bulkers. Because LNG and coal imports can’t fill the gap fast enough, power shortfalls in China are slowing factory output, leading to longer delays and more inventory challenges for importers of containerized goods.

Yet another connection: Heavy ordering of container ship newbuilds has blocked yard slots and raised prices for newbuilds of LNG carriers, bulkers and tankers, which should limit vessel capacity and help support rates for non-container ships in the years to come.

LNG rates have room to run

LNG rates are widely expected to go even higher, as the winter peak is still months away. Spot rates topped $200,000 per day last January and one voyage was booked for a record $350,000 per day.

LNG shipping executives speaking during last week’s Capital Link New York Maritime Forum predicted that spot rates during the coming winter peak should be in the range of $200,000-$300,000 per day.

LNG shipping is different from dry bulk and tanker shipping due to its much higher level of long-term charter coverage — a difference that became even more pronounced this year.

Richard Gilmore, executive vice president of Maran Gas, said during the Capital Link forum, “This summer and into the fall, a number of charterers [signed] multiyear charters, trying to shift away from spot exposure and trying to get away from having to pay very high rates during the wintertime.”

According to Oystein Kalleklev, CEO of Flex LNG (NYSE: FLEX), “Interest in doing term [long-term charters] rather than spot has been unique. We’ve never seen such a strong term market before.”

Karl Fredrik Staubo, CEO of Golar LNG (NYSE: GLNG), said that there are very few owner-controlled ships left in the spot market. “Most are relets,” he explained, referring to LNG carriers on long-term contract deployed in the spot market by charterers, not shipowners.

The same shift to long-term charters has played out in container shipping, where there are virtually no vessels left to lease short term. Rather than paying $200,000 per day to rent a container ship for one or two round-trip voyages, liners and operators are paying $40,000 per day to lock up ships for three to five years.

Are crude and product tankers next?

Crude and product tanker shipping have not followed the COVID-era pattern seen in containers, dry bulk and LNG shipping. One reason is inventories.

In contrast to what happened in other sectors, crude oil and product inventories surged to excessively high levels during the onset of COVID: on the crude side due to the collapsing oil price incentivizing floating and land-based storage, on the product side because refineries couldn’t ramp down fast enough to match collapsing consumption amid lockdowns.

Tanker rates suffered over the past year due to drawdowns of bloated inventories combined with OPEC+ production cuts and pandemic-induced losses to jet-fuel demand.

But oil inventories have now been drawn down, the price of crude is the highest it’s been since 2018, and shortages of coal and LNG should increase oil demand in the coming months. Will crude and product tankers belatedly join the rate boom seen in other shipping segments?

“Not all energy markets are equal, as the tanker markets are still struggling with oil demand that has not recovered to pre-COVID levels,” said Nolan. “However, there is increasing optimism that a seasonal tanker rally could materialize spurred by heating oil and fuel oil given the spillover from high natural gas and coal prices.

“Furthermore, the higher oil and gas prices are expected to drive more production from both OPEC and the rest of the world, making a 2022 recovery in the tanker market a seemingly foregone conclusion.”

Click for more articles by Greg Miller

Related articles:

- Power crisis deepens in Asia and Europe: What it means to shipping

- Despite exodus of empty containers, US exports are hitting new highs

- If coal is dead, then why are ships so full of it?

- China bulker pileup dwarfs California container-ship gridlock

- New world record set for shipping rates: $350,000 per day

Michael R Berger

Scrap a bunch of small container ships and rates go up?

Would’ve have thought.