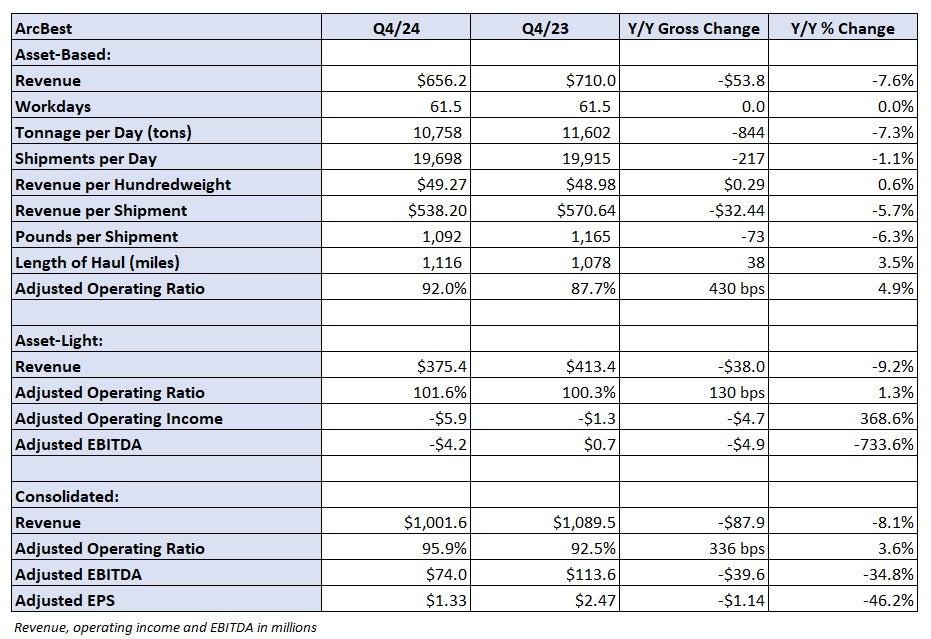

Transportation and logistics provider ArcBest (NASDAQ: ARCB) reported fourth-quarter adjusted earnings per share of $1.33 on Friday, 28 cents better than the consensus estimate but $1.14 lower year over year.

The adjusted result excluded 9 cents per share in items considered one-offs, like expenses tied to past acquisitions, costs from technology pilot programs, equipment and software write-downs, and a reduction in the expected earnout at truck broker MoLo, which was acquired three years ago.

“Throughout 2024, we made significant progress on controlling costs, improving productivity, and enhancing our service quality,” ArcBest Chairman and CEO Judy McReynolds said in a Friday news release.

Click for full story – “ArcBest, LTL industry short on volume”

ArcBest’s asset-based segment, which includes results from its less-than-truckload subsidiary ABF Freight, reported a 7.6% y/y decline in revenue to $656 million as tonnage per day was down 7.3% and revenue per hundredweight, or yield, was up 0.6% (up by a mid-single-digit percentage excluding fuel surcharges). A 6.3% decline in weight per shipment drove the increase in the yield metric.

Price increases on contracts that renewed in the quarter were 4.5% higher on average.

The unit recorded a 92% adjusted operating ratio (inverse of operating margin), 430 basis points worse y/y but approximately 100 bps better than management’s guidance. Cost and productivity initiatives were credited with stemming some of the demand weakness in the industrial sector.

Click for full story – “ArcBest, LTL industry short on volume”

A separate filing with the Securities and Exchange Commission on Friday showed asset-based revenue per day was down 4% y/y in January as tonnage per day declined 11%, which was partially offset by an 8% increase in yield. However, weight per shipment was down 8%, again driving the yield increase.

The asset-light unit, which includes truck brokerage operations, reported a sixth consecutive adjusted operating loss ($5.9 million). A 2.1% decline in loads and weak pricing in the truckload brokerage market were to blame. The unit is expected to record an operating loss of $4 million to $6 million in the first quarter.

Shares of ARCB were up 3.6% before the market opened Friday.

ArcBest will host a conference call at 9:30 a.m. EST on Friday to discuss fourth-quarter results.