Click for full report – “ArcBest’s Q2 results muted by headwinds in asset-light unit”

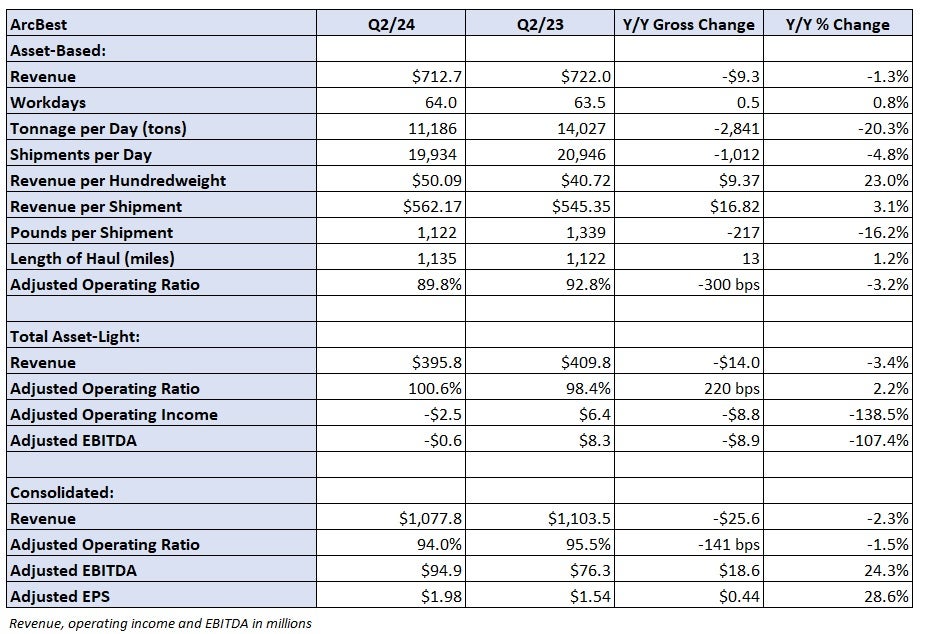

ArcBest reported second-quarter adjusted earnings per share of $1.98, 8 cents below the consensus estimate but 44 cents higher year over year. The result excluded items considered nonrecurring like costs tied to technology pilots and acquisition-related expenses.

ArcBest’s (NASDAQ: ARCB) asset-based segment, which includes results from its less-than-truckload subsidiary ABF Freight, reported revenue of $713 million, a 2% y/y decline on a per-day comparison. Tonnage per day was down 20% but revenue per hundredweight, or yield, increased 23%. The tonnage decline was the combination of a 5% decline in daily shipments and a 16% decline in weight per shipment.

The company is in the process of swapping transactional freight that carries a lower margin profile with shipments from its core customers, which carry higher yields. Shipments from core accounts increased 14% y/y (tonnage was 11% higher).

The unit recorded an 89.8% adjusted operating ratio, 300 basis points better y/y.

Asset-based revenue per day was up 1% y/y in July as tonnage fell 13% and yield improved 16%.

The asset-light unit, which includes truck brokerage, reported a $2.5 million adjusted operating loss in the period. Revenue was down 3% y/y to $396 million. Shipments per day increased 13%, with revenue per shipment down by a mid-teen percentage. A mix shift toward managed transportation and a weak overall truckload market are weighing on yields. The y/y declines in revenue per shipment narrowed as the quarter progressed and into July, which was down 10% y/y.

The company expects to book a similar operating loss in the unit during the third quarter.

ArcBest will host a conference call at 9:30 a.m. EDT on Friday to discuss second-quarter results. Stay tuned to FreightWaves for continuing coverage of ArcBest’s earnings report.

Click for full report – “ArcBest’s Q2 results muted by headwinds in asset-light unit”