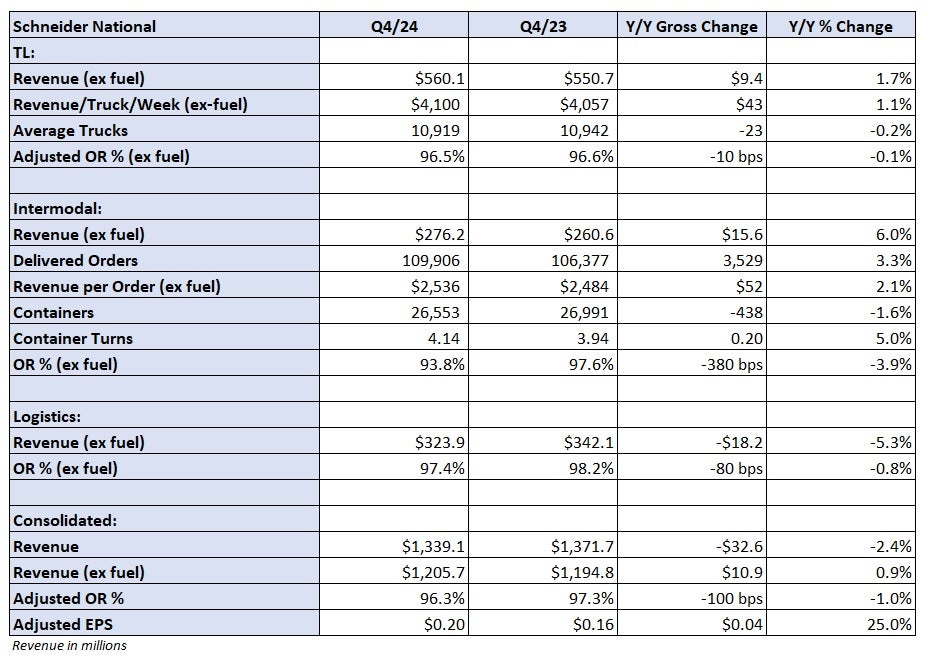

Schneider National’s fourth quarter came in as expected, as did its initial earnings outlook for 2025. During the recent quarter, the company saw year-over-year earnings improvement across all segments for the first time since the 2022 second quarter.

Fourth-quarter adjusted earnings per share of 20 cents was in line with the consensus estimate and 4 cents higher y/y. The number excluded costs from prior acquisitions, including the Dec. 2 purchase of dedicated carrier Cowan Systems.

Schneider (NYSE: SNDR) issued full-year 2025 adjusted EPS guidance of 90 cents to $1.20, bracketing the consensus estimate of $1.10. At the midpoint of the range, the guide was approximately 5% light of expectations.

Click for full article – “Schneider sees truckload tide turning”

“In the second quarter of 2024, signs of seasonality returned to the freight market and were even more evident in the fourth quarter,” said Schneider President and CEO Mark Rourke in a Thursday news release. “The year ended positively as carriers continued to exit the market and demand aligned more closely to seasonal expectations.”

Full-year 2024 adjusted EPS of 69 cents came in at nearly half of management’s initial expectation ($1.23 midpoint) as a second-half recovery never fully materialized.

Shares of SNDR were off 1.4% at 9:51 a.m. EST on Thursday compared to the S&P 500, which was up 0.7%.

Schneider will host a conference call to discuss fourth-quarter results at 10:30 a.m. EST on Thursday.

Click for full article – “Schneider sees truckload tide turning”