In the middle of a crashing stock market Friday that by most analyst observations is being created to a large degree by the uncertainty of U.S. tariff policy, the FreightWaves State of Freight webinar for March confronted what tariffs would mean for the freight market and what consequences could be seen already.

Here are five takeaways from the online discussion between FreightWaves founder and CEO Craig Fuller and SONAR Chief of Market Intelligence Zach Strickland.

Tariffs are about to be here, along with the uncertainty

“Tariffs are not floating around,” Fuller said. “They’re on top of us. Gravity is weighing us down. It’s all about tariffs.”

Fuller said the specter of tariffs really began to impact markets around Valentine’s Day, when a dispute between the Trump administration and Colombia over deportation flights led to a threat of steep tariffs on Colombian imports and a rapid change in Colombian policy. With the midweek declaration by President Donald Trump that he would impose a 25% tariff on cars and parts made outside the U.S., tariffs became more of a threat to supply chains this week.

Uncertainty now is the biggest problem the trucking market faces. “We don’t have real good guidance now,” Fuller said. Referring to Trump’s declaration that April 2 will be “liberation day,” Fuller noted that “we don’t even know what that’s going to be like.”

Attempting to decouple quickly from suppliers in Mexico and Canada as part of an adjustment to the tariffs is the biggest challenge the market faces, Fuller said. “Auto supply chains take years to reposition.”

And trucking is right in the middle of that, he added. Fuller said the general estimate is that 8% of all truckload business is related to the auto supply chain, though it might be as high as 15%.

But looking backward, Fuller said most market participants assumed there would be new tariffs on China, which he said he mostly supported. “What we didn’t appreciate was that the first set of tariffs would target Mexico and Canada, and that Donald Trump is willing to rip up USMCA,” the successor to NAFTA that Trump negotiated in his first term.

“I think that’s a very different story than I had certainly expected coming into it,” he said.

The lack of a runway

Disruptions and uncertainty from the tariffs have been aggravated by the short notice of their imposition and their implicit demand that supply chains change quickly to adapt to them, according to Fuller.

Auto tariffs are of such a magnitude that Fuller said companies might need a year to “figure this out.” “So why not make it a hard firm date 12 months out?” he said. “Let them reconfigure their supply chain, because then they have a chance to do that.”

The rapid-fire implementation, Fuller said, without that gradual pace of introduction “almost feels like that’s not the goal. It feels like there’s chaos coming, but no real certainty as to what the actual outcome is.”

Fuller cited the goal of reducing fentanyl traffic as something raised early in the tariff debate that now is rarely mentioned. If the Trump administration set a reduction in fentanyl trafficking of 15% in the next month before implementing tariffs, Fuller said, “that’s a target that is now out in front of these businesses that they can deal with and can kind of start to formulate a plan around. And that’s just not happening.”

The earlier FreightWaves call on the end to the freight recession

Fuller’s earlier projections about the end to the freight recession, made in November, came up for discussion.

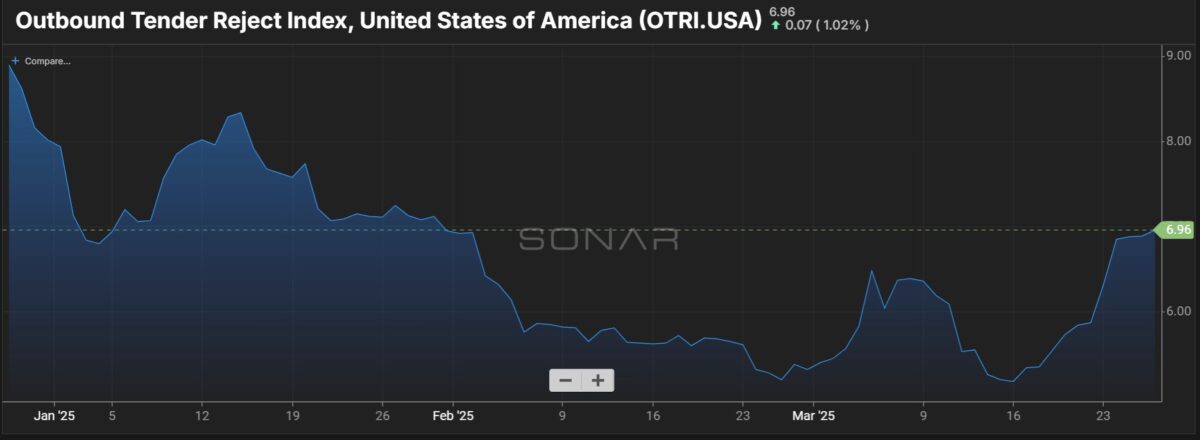

Fuller said his call was based largely on the fact that the excess capacity that had weighed on freight markets since 2022 was rapidly dissipating, and that would lead to a reversal. He said he stuck by that statement, citing the fact that the Outbound Tender Reject Index (OTRI) from SONAR remains significantly higher than it was a year ago.

Strickland and Fuller cited the OTRI, which has been trending higher in recent weeks and is above where it was last year, as affirmation that excess capacity is not the current issue in the market.

What’s happening instead, Fuller said, is like the start of a new recession. “You have a solid argument that the freight recession is coming back under a very different set of circumstances,” he said. Fuller added that he had always said an economic downturn could bring back recessionary conditions in the freight market, “and that’s exactly what’s happening.”

No big increase seen in LTL

Strickland, a veteran of the LTL industry, handled most of the answer to an outside questioner who inquired about the state of the LTL market and whether it was poised for a rebound.

“Not this year,” Strickland said bluntly. He said LTL has been riding an inflationary cycle that was kicked off by the bankruptcy in August 2023 of Yellow Corp. “That bubble has burst,” he said.

Strickland said LTL rates are “not coming down dramatically from that, but they’re starting to clear out.” “We’re not seeing the level of rate increases that we saw during that period,” he said, and the rate of increases in LTL now is less than they were at their peak.

The continued weakness in the truckload sector is slowing any increases in LTL, according to Strickland, “and until the truckload market tightens significantly we’re probably not going to see large amounts of increases in GRIs (general rate increases).”

Flatbed on fire

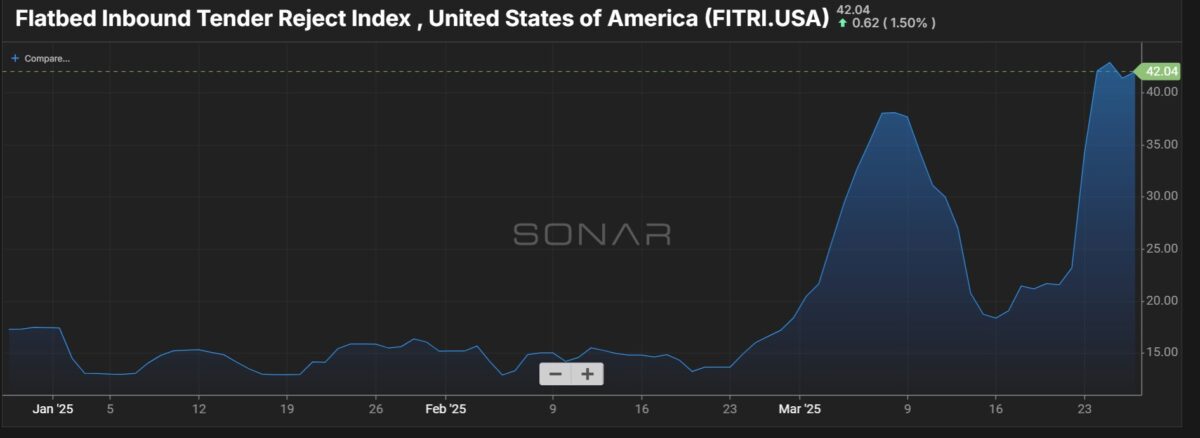

“We need good news today,” Fuller said. “Flatbed is good.”

He pointed to a SONAR chart that showed flatbed tender rejection rates hitting more than 40% in recent days.

But Fuller then conceded the number is “not as beautiful as what it could be.” It’s that high, he said, because “people are pre-positioning themselves for tariffs. So this is Canadian lumber. This is steel and aluminum. They’re getting it across the border as fast as possible.”

Companies are thinking to themselves, “Let me get my hands on every flatbed I can possibly get and then I’ll deal with this,” Fuller said. “I think that’s what is driving this.”

But since this is a new phenomenon, Fuller said, “if you are a flatbed carrier, you should be looking at the flatbed rejection rate.” But “given the fragmented nature of the trucking means that not all the operators have gotten the memo.”

More articles by John Kingston

Clash on legal status of California transportation waivers highlighted at TCA

Carriers big and small at TCA wait for signs of freight market turnaround

Orbcomm’s debt rating holds at Moody’s but is deep in speculative territory

0 replies