Each year, Fleet Advantage—a provider of fleet management analytics and solutions—publishes their Truck Lifecycle Data Index (TLDI). According to Fleet Advantage, “The TLDI serves to provide a snapshot of the cost savings involved, based on actual fleet truck utilization data, when replacing older trucks with newer, more efficient vehicles.”

Its 2018 TLDI was released at the start of the month, and FreightWaves spoke to John Sternal, Director of PR and social media for Merit Mile for Fleet Advantage to contextualize their findings.

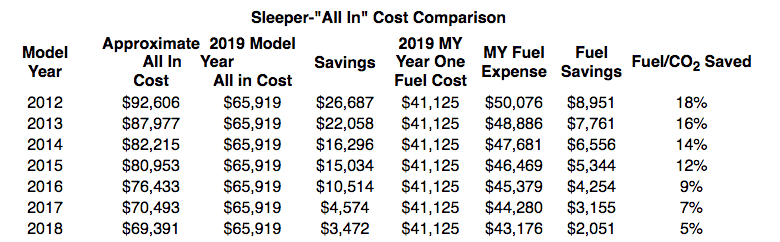

This particular TLDI compares “all-in operating costs of early-model Class-8 trucks to 2019 model-year replacements.” It uses a diesel price of $3.29 as a baseline, calculating that fuel is 61% of the total cost of truck ownership. Below is the data published by Fleet Advantage:

Fleet Advantage’s data represents “a 15.5% increase in savings compared with a similar analysis a year ago upgrading to a 2018 model when diesel prices registered $2.57,” according to Sternal. It also speaks to the environmental advantages of switching to newer vehicle models. “Fleets will also achieve an estimated 18% reduction in CO2 emissions and 46% reduction in NOx output when upgrading from a 2012 model-year sleeper to a new 2019 unit,” Fleet Advantage’s TLDI reports.

“Diesel prices and fuel economy play a critical role in the decision to replace an aging truck with a newer, more efficient unit. However, other factors are an important part of a fleet’s truck procurement strategy” the release states.

“Truck acquisition strategies are undergoing a major evolution currently, as fleets are beginning to leverage data analytics to better understand actual truck utilization rates comparing older units with newer, more efficient ones,” said Jim Griffin, COO and CTO of Fleet Advantage.

“Our ability to track accurate, live data from our clients’ trucks is a leading reason why so many fleets are now basing their truck procurement strategies off our ATLAAS platform, saving them millions on their bottom line,” Griffin concluded.

Stay up-to-date with the latest commentary and insights on FreightTech and the impact to the markets by subscribing.