FLEETCOR Technologies, Inc. (NYSE: FLT), a fuel-card and business-payments provider, announced fourth-quarter 2019 adjusted earnings per share (EPS) of $3.17, 14% higher year-over-year and $0.03 better than the consensus estimate.

Total revenues increased 9% to $698.9 million in the fourth quarter of 2019, compared to $643.4 million in the fourth quarter of 2018.

However, net income decreased 22% to $235 million in the latest period, compared to $302 million the year before.

“Some of our assumptions include the continuation of a soft macro environment, primarily unfavorable foreign exchange rates compared to 2019, mostly in Brazil, and market spreads projected to be slightly worse than the 2019 average,” said FLEETCOR CFO Eric Dey during the earnings callon Thursday..

Revenue from the company’s fuel-card program increased 0.2% to $299 million. Toll net revenue increased 6.9% to $93 million as average tags per month increased 10%, while net revenue per tag decreased 2%.

Ron Clarke, chairman and CEO of FLEETCOR, said during an earnings call, “We’re out looking at a pretty promising 2020 in the fuel segment. We see a bit of a mixed bag. Some markets like Russia, Mexico, Brazil and Australia are expecting to all be double-digit growers in 2020. But the core U.S. and UK businesses will rely on help from beyond the fuel initiatives. We are also expecting continued weakness in trucking.”

The company increased its full-year 2020 earnings guidance to an adjusted EPS range of $13.35 to $13.75 (versus $11.68 to $11.78 previously), on revenue of $2.9 billion-$2.96 billion, in line with the consensus forecast for $2.93 billion.

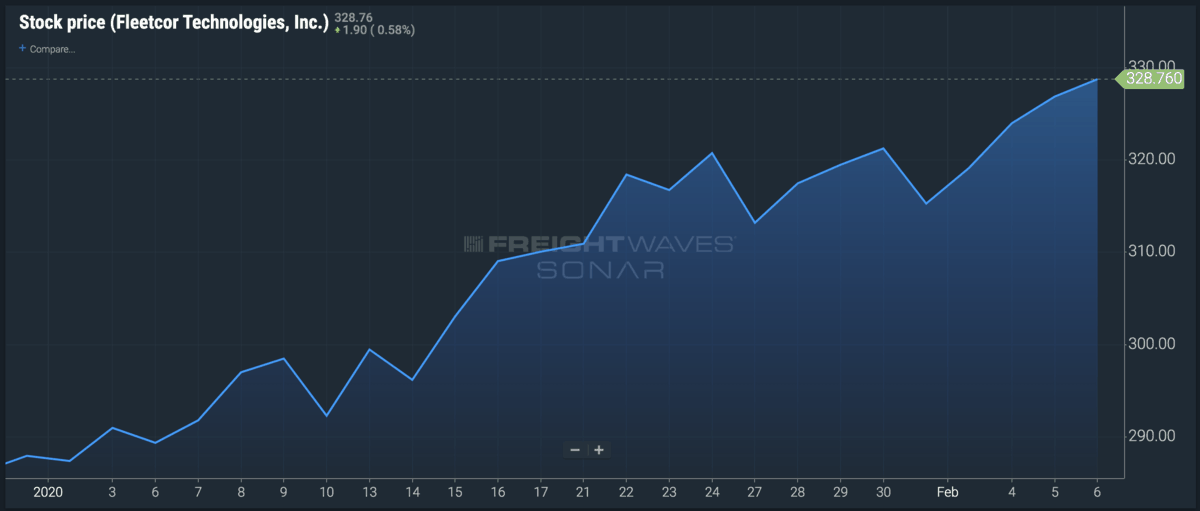

FLEETCOR shares closed at $328.76 during trading on Thursday.