How do some FreightTech startups come up with such catchy names? Sometimes it’s as simple as swimming laps.

When you name your company Flipturn, it’s a good bet aquatics had something to do with it. Sure enough, Katie Siegel swam competitively in her youth. Until mastered, a flip turn can be really difficult — kind of like bringing together all the disparate parts of electrification. Or it could be an Indie rock band from Fernandina Beach, Florida.

“It was a name that had a personal meaning,” Siegel told me of the software-as-a-service startup — its full name is Flipturn Connect — which pulled in $4.5 million in seed funding earlier this year. “It’s kind of like what we’re doing with electrification. We’re trying to go the other way with the impact on the climate and trying to electrify these fleets and help in any way we can.”

The former engineering manager at Samsara Inc. started her company in the summer of 2022 after leaving the San Francisco-based Internet of Things company in January last year.

“There’s a lot of solutions out there that are aiming to help solve the problem. It’s really hard to manage your fleet of EVs and your chargers, and you really need everything in one place to be able to manage it in a very fleet friendly way,” she said.

Certainly others are trying. Swedish startup Einride offers similar services to Flipturn, along with providing electric trucks that can be autonomously moved by teleoperation. Telematics startup Platform Science rounds up application program interfaces to declutter trucking. As one such API, Flipturn might find its way onto the company’s mix-and-match app product.

No tear up required

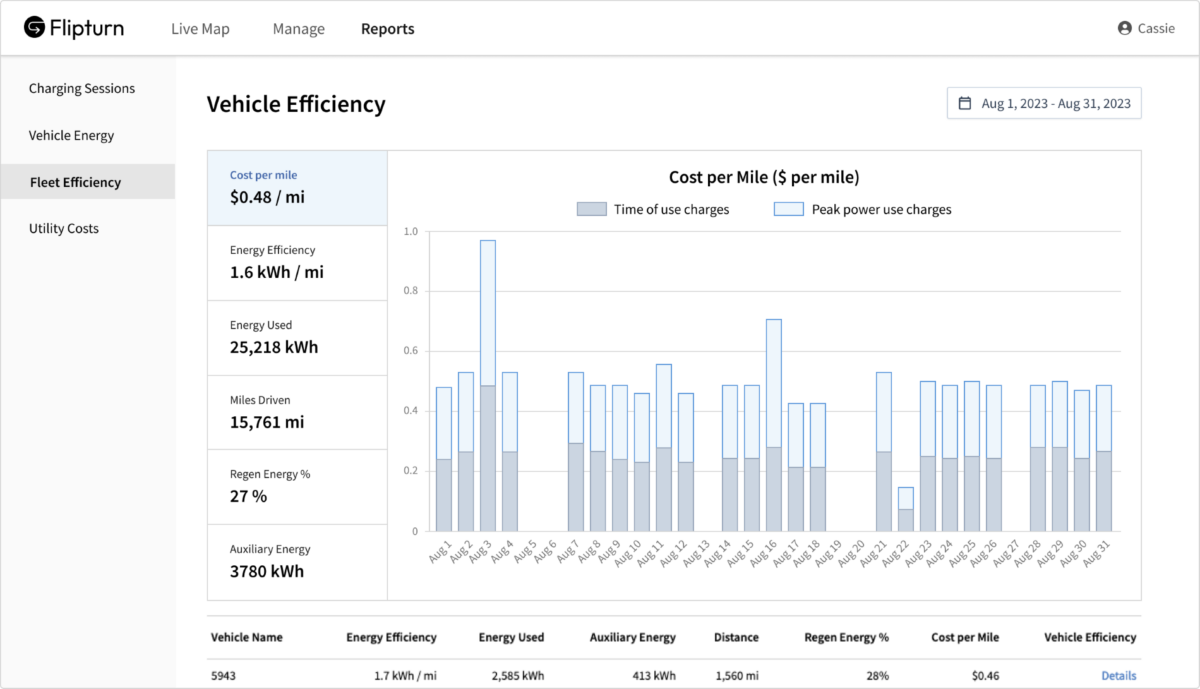

Flipturn’s goal is seamless integration of all things trucking electrification — where chargers are located, how long is the wait time, how much the juice will cost at a given time. And for the truck itself, what is its state of charge, how close is it to an available charger, etc. Analysis of kilowatt hours per mile, driver coaching and consulting come as part of a monthly subscription fee.

“You’re never going to have to rip out your telematics solution. You’re never going to have to rip out your TMS or your maintenance solution,” Siegel said. “The only piece that we do replace is the charger management system.”

Flipturn is compatible with more than 40 open charge point protocol chargers. Integrating with existing telematics systems via API creates a live dashboard experience for the driver and the dispatcher. Real-time reporting means delays no longer than 30 seconds.

“We connect directly to the onsite chargers, and we can show you all of their statuses in real time. So for example, in your telematics system, you couldn’t say which charger a vehicle is at. Because we are pulling in information from both, we can tell you exactly when a vehicle is charging, which charger it is at and when it is expected to reach full charge.

“You can understand, ‘Oh, this driver is getting off his break at this time, I’m going to tell him to take that vehicle.’ You can say, ‘Oh, actually my vehicle is running late. It’s not going to be charged on time for the next route, so maybe we should plan for another vehicle to take that.’”

Flipturn claims fleet operators can plan ahead and make better-informed decisions. Early customers include Knight-Swift and other large fleets transitioning to electric trucks because of California mandates that will take diesel trucks off the road by 2040. Whether or not to go electric is no longer an option to operate in the Golden State and others adopting its regulations.

Making the business case

Her company’s relatively small capital raise, which included more than 30 angel investors, is misleading, Siegel said. Flipturn has 10 employees so far.

“We’re honestly pretty good with funding,” she said. “We have a very ample runway, so we’re not really looking to raise more money in the future,” she said. “Eventually we will. But I think we have a pretty good path forward right now when it comes to taking on new business and growing the team, etc.”

Flipping a chassis

The massive Daimler Truck plant in Wörth am Rhein, Germany, has 10,000 employees who turn out 470 heavy-duty trucks a day on two shifts. The assembly line stretches 3,281 feet (1 kilometer) from end to end and covers two floors. Overall, the plant covers 2.9 million square meters or more than 400 soccer fields. The flipping of the chassis to allow its buildup into one of six models assembled in Wörth just has to be seen.

TuSimple completes its catchup

Autonomous trucking developer TuSimple completed a catchup of overdue financial reports on Wednesday, three days before a deadline that could have led to its delisting from the Nasdaq.

The bottom line showed a business that has more than tapped the brakes. It burned some cash — $10.5 million in severance payments to 650 employees laid off in December and May. But TuSimple still had more than $835 million of cash, equivalents and investments on its books as of June 30, according to a news release.

The company pared its first-half gross loss by 90% to $500,000 compared to the first six months a year ago. That was mostly achieved by pausing its autonomous fleet which cost more to operate than it generated in revenue.

TuSimple spent 47% less on research and development in the first half of the year compared to the same period last year.

On an adjusted earnings before interest, taxes, depreciation and amortization basis, TuSimple lost $90.6 million, $33.3 million less than the same period a year ago. Having fewer employees cost less in compensation but legal costs were higher.

In Asia-Pacific, the first-half adjusted EBITDA loss was $43.8 million, up $4.8 million versus the first six months of 2022. Most of the bigger loss — $22.9 million — came in the second quarter. The company spent more on R&D to further develop high-autonomy Level 4 capabilities.

Briefly noted …

Nikola commercially launched its hydrogen-powered fuel cell electric trucks on Thursday, achieving its target launch date despite numerous setbacks and three CEOs in the last year.

Navistar Inc. was recognized as a U.S. Environmental Protection Agency High Performer in the SmartWay Program’s shipper category.

Honda and Isuzu will show their hydrogen-powered fuel cell truck collaboration at the Japan Mobility Show, formerly the Tokyo Motor Show.

The $650 million electric Greenlane infrastructure joint venture by Daimler Truck North America, BlackRock Climate Infrastructure and NextEra Energy Resources now has a CEO.

Knight Transportation is seeing carbon reduction benefits from testing of Cummins’ 15-liter natural gas engine.

Air Liquide and Trillium Energy Solutions, a Love’s subsidiary, are jointly pursuing development of the U.S. heavy-duty hydrogen fueling market.

Daimler Truck Financial Services is working with electric charging infrastructure provider Electrada to develop a charging-as-a-service business.

Startup Harbinger Motors has raised $60 million in a Series A funding round to work on electrified chassis, powertrains and battery technologies for medium-duty commercial and specialty vehicles.

That’s it for this week. Thanks for reading. Click here to get Truck Tech via email on Fridays. And catch the latest in major events and hear from the top players on Truck Tech, airing live at its new time — 3 p.m. Wednesdays on the FreightWaves YouTube channel. The current episode from Berlin follows the record hydrogen fuel cell run by the Mercedes-Benz GenH2 fuel cell from Daimler Truck.

Allison Tielking

Great writeup!! Thanks Alan.