Asset-light transportation provider Forward Air missed second-quarter earnings expectations and its guidance for the third quarter was worse than expected. Management admitted on a Wednesday call with analysts it needs to take a more conservative approach to forecasting.

“I do need to get better in forecasting in dynamic, challenging times like we’re in,” said Chairman, President and CEO Tom Schmitt. “In that spirit, we’re still cautious on the [Q3] guide.”

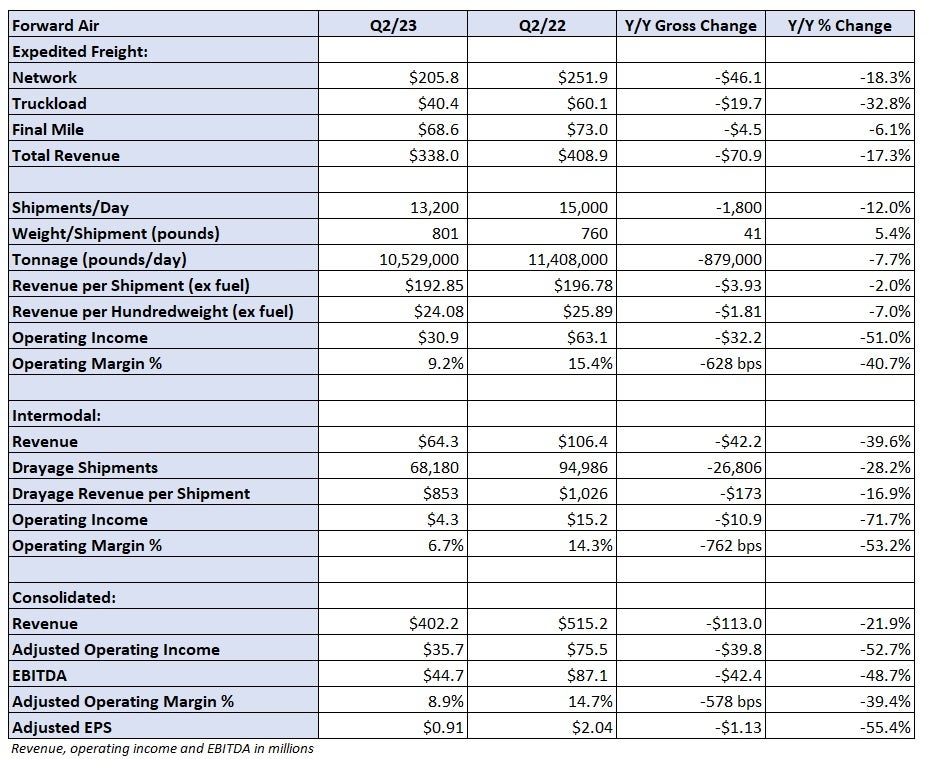

Forward (NASDAQ: FWRD) reported adjusted earnings per share of 91 cents in the second quarter. The result was well below Yahoo Finance’s consensus estimate of $1.28 and management’s guidance of $1.28 to $1.32.

The result excluded 15 cents per share in expenses associated with strategic initiatives. Those costs are not expected to recur. A higher tax rate was a 2 cent headwind in the period and higher interest expense (on only a modest increase in debt) was a 4 cent drag compared to last year.

The company cited soft demand for intermodal and truckload brokerage capacity as the reasons for the miss. Consolidated revenue of $402 million was 22% lower year over year (y/y) and below management’s outlook for a decline between 7% and 17%.

The company’s third-quarter guidance disappointed as well.

Revenue is expected to decline 11% to 21%, implying $428 million at the midpoint of the range. That was below the $462 million consensus estimate at the time of the print. Adjusted EPS was forecast to a range of $1.12 to $1.16, compared to the consensus estimate of $1.43 and the year-ago result of $1.93.

However, Schmitt did voice some optimism, saying, “We’re appropriately cautious at this point but [we] like what we see.”

LTL capacity shake-up provides U-turn in volumes

Schmitt’s optimism may be due to the capacity inflection the less-than-truckload market has experienced in recent days as carrier Yellow Corp. (NASDAQ: YELL) has ceased operations. The carrier’s exit has pushed more freight to Forward’s network.

A 7% y/y decline in LTL tonnage during the second quarter improved from the 12% y/y decline logged in the first quarter. However, daily tonnage during the past week is up 7% y/y.

“The Yellow impact will accelerate the momentum,” Schmitt said.

He said its core accounts, which were also customers of Yellow, are giving it more freight on long-haul lanes where time sensitivity is required. Forward has also seen an increase in business from 3PLs and domestic forwarders.

The business awarded by third parties is mostly door-to-door shipments, which carry higher weights but lower margins compared to Forward’s legacy airfreight-to-airport operations. While there might be a modest mix headwind, the company is still expecting to see operating ratio improvement in the LTL segment going forward.

Management noted little demand inflection in the overall market, excluding the Yellow impact. Total tonnage was down 5% y/y in July but only 3% lower y/y in the second half of the month. August is up 7% y/y and the third-quarter revenue guidance includes a 5% y/y increase for the full quarter.

That appears counter to the guidance for a mid-teen consolidated revenue decline (at the midpoint of the range) but management pointed to market forecasts for lower fuel prices in the third quarter.

Revenue in the company’s expedited freight segment, which includes LTL, truckload and final mile, fell 17% y/y in the second quarter to $338 million. Tonnage per day was down 8% and revenue per hundredweight, or yield, (excluding fuel surcharges) was down 7%.

The expedited segment reported a 9.2% operating margin, which was down y/y by 630 bps.

As a percentage of revenue, most expense lines increased. Salaries, wages and benefits were up 380 bps y/y and operating leases increased 190 bps. Purchased transportation declined 350 bps.

Management said the exit of LTL capacity won’t lead to a second general rate increase (GRI) this year, but it plans to increase its capture rate on the GRI issued in February. The increase is usually “relieved” when customers are willing to give more volume to Forward. However, the recent change in LTL dynamics will allow it to get close to a more normal 70%-plus capture rate compared to a rate that was “way below that” so far this year.

Forward’s intermodal drayage unit saw revenue fall 40% y/y as shipments fell 28% and revenue per shipment was off 17%. The unit posted a 6.7% operating margin, less than half the year-ago result.

Schmitt said the intermodal business is likely at the bottom of the cycle currently. Demand has been sluggish due to lower imports but he said a full sales pipeline is indicative of an upcoming volume improvement. He expects the TL brokerage business to remain under pressure.

“I do believe in every single one of our business lines we have seen the bottom and the momentum on the LTL side is perhaps the most pronounced of all of them,” Schmitt said.

Shares of FWRD were down 6.5% at 11:54 a.m. EDT Thursday compared to the S&P 500, which was off 0.1%.

More FreightWaves articles by Todd Maiden

- Abrupt layoffs center of lawsuit against Yellow

- Employees at Yellow Logistics terminated

- Schneider acquires another dedicated carrier