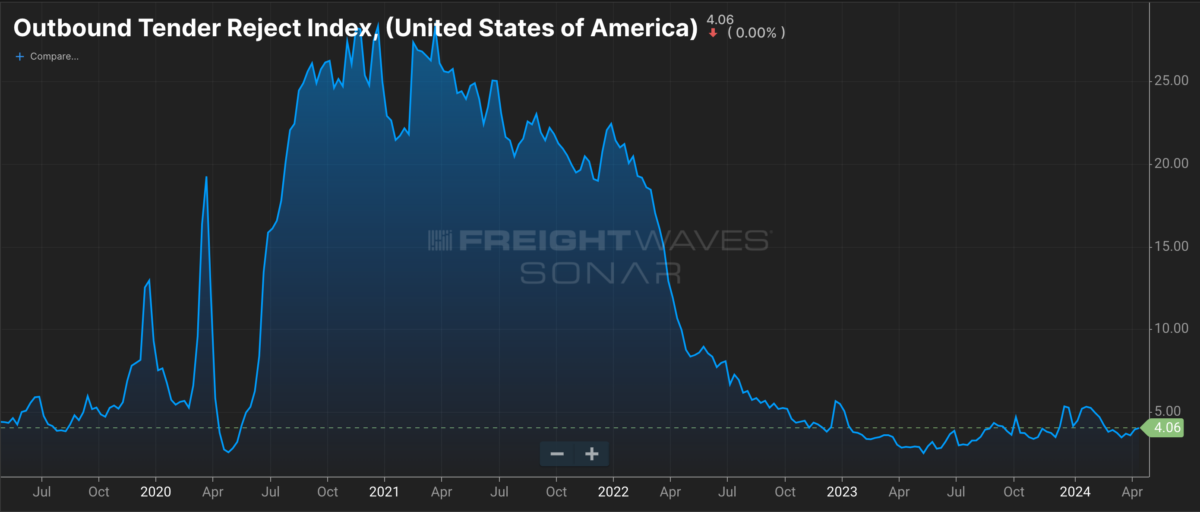

The freight winter that sent Surge into bankruptcy and shut down Convoy isn’t over yet, even if the bottom is likely in. Tender rejection rates are hovering around 4%, indicating that capacity is still loose and that asset-based carriers aren’t in a position to reject contracted freight.

J.B. Hunt’s first-quarter results, reported Tuesday after markets closed, revealed the pain felt by the largest transportation providers and their brokerages. Integrated Capacity Solutions (ICS), Hunt’s brokerage, said that gross revenues were down 26% year over year to $285 million on 22% fewer loads and 5% lower revenue per load; the operation as a whole is now smaller than it was five years ago, in the first quarter of 2019, when it posted gross revenue of $301 million.

Hunt has invested in improving the online marketplace that powers most of ICS’ transactions, J.B. Hunt Carrier 360, by removing sketchy carriers and covering more loads manually to avoid fraud and bad actors. But gross margins actually widened to 14.3% compared to 13.4% in the first quarter of 2023. ICS ended up burning $17.5 million, but $11 million of that was due to integration costs related to Hunt’s acquisition of BNSF Logistics, a freight brokerage that accounts for approximately $70 million of ICS’ gross revenues.

Wall Street wasn’t happy; Hunt’s share price is down more than 8% since it announced its first-quarter results.

“Speaking of BNSF, we once again received little incremental insight into integration progress besides there being challenges in the quarter,” wrote Stifel equity analyst Bruce Chan in an April 17 client note. “The acquisition is still somewhat of a black box, in our view, and we would really like to see more disclosure given that it constitutes a quarter of the segment right now. The company is still contending with acquisition and integration-related costs, but it seems like the deal could be less margin accretive than we had initially assumed.”

Chan noted that Hunt’s Dedicated business, which enjoys longer-term contracts and stickier pricing than typical contracted freight, has been under pressure for several quarters. Customer retention fell to 91% in the first quarter, a sign that margins on new business will be under pressure.

“Management is confident it can backfill downsizing with new accounts and hold [Dedicated] steady in 2024, but given incremental competitive pressures and potential for further bankruptcies, we are modeling more conservatively from here,” Chan wrote.

FreightWaves spoke to logistics industry expert Kevin Hill of Brush Pass Research about the state of the market and the freight brokerage industry. Brush Pass gathers intelligence on key decision-makers and technology stacks at freight brokerages for businesses — like FreightTech startups — that sell into brokerages.

“Brokers are saying, ‘It’s a brutal market,’” Hill said. “Signing up new shippers is a challenge, getting more loads is a challenge, and pricing something profitably is a challenge.”

Hill said that while there are 27,000 active brokers with motor carrier numbers operating in the United States, 88% of the industry’s gross revenue is controlled by the top 1,000 brokers. And the largest of those — the top 50 or so brokerages that compete with the largest asset-based truckload carriers for volumes — have suffered the brunt of the freight recession.

Small and medium-size brokerages managed to grow gross revenues year over year in 2023, even in the face of declining revenues per load, but the largest brokers, like J.B. Hunt’s ICS, experienced steep declines.

“The top 20 brokerages saw a 13% decline in gross revenues year over year in 2023,” Hill said. He attributed that to a predictable pullback from the industry’s unprecedented expansion during the pandemic. According to Armstrong & Associates, a mergers and acquisitions advisory firm focused on logistics providers, freight brokerage in the U.S. effectively doubled in size from 2019 to 2022, from $86.5 billion in gross revenue to $159 billion.

“You had a doubling in the pandemic of freight controlled by 3PLs,” Hill said. “What you have is that correction that we finally saw in the 2023 numbers.”

It’s unclear when the truckload market will heat back up because it’s been difficult to judge how quickly excess capacity is exiting, and while volume has grown year over year, there hasn’t been the kind of clear external catalyst to the market that kicked off bull runs in past cycles. Knight-Swift remains pessimistic about the market — the company’s management pre-announced poor results before the first-quarter earnings call and slashed earnings guidance for the first half of the year by 56%.

tom

If you are a well run freight brokerage, and your margins are 14%, you should be able to make a very nice net profit.

its just that companies like JB Hunt spend hundreds of millions on technology that doesn’t make them any more efficient than a brokerage with 10 employees. A lot of smaller brokerages do 3-4 million per employee,. At CH Robinson, its closer to 1 million per employee, and they are spending $200 million a year on tech.

Da da da

Breaking my heart. You realize though that this isn’t even a normal economy…..totally engineered by globalists and left wing billionaires.

Clinton Seals

Well go figure byway of our government allowing just too many inexperienced brokerages vying for freight and too many inexperienced carriers creating a vacuum of mass deteriorization of our industry and too much greed in most of these big brokers as well , when does this ever end and we truckers are just tired of it, hence leaving the industry or sitting it out.

If our beloved FMCSA doesn’t do some major changes in how Authorities are issued meaning necessary requirements such as experience in our industry of with at least a couple of years and at least a an American High School Diploma or equivalent and for our truckers vocation to be recognized as a Skilled Job instead of a Non Skilled Job we may be able to get some respect back and more qualified people back into our industry which would dramatically in time improve our dismal state if they don’t our industry will continue to get worse.

Nofreedom of speech

I love how freightwaves deletes certain comments. Sigh

Kenny G

Seems like they are doing the right thing by moving back from digital brokerage. It’s expensive for brokers to maintain and carriers want nothing to do with it. It will be interesting to see if this becomes a trend.

Reapwhateveryou sow

Womp womp, No one cares. Seriously. Convoy went out of business because of their poor business model and continuously screwing over carriers. Not providing Detentions/TONUS/Reimbursements for lumpars, reimbursements for drivers restacking because of their incompetent shippers. J.B Hunt is headed down the same path with how they ignore carriers and do not provide reps to help out their carriers.

Alot of these companies screwed enough carriers and owner operators that they are known. I won’t touch their loads with a mile stick.