For freight brokers, the story in the first quarter of 2019 was one of relatively normal freight volumes, loose capacity and margins that widened even as brokers bid aggressively on contract freight and undercut asset-based carriers.

Take J.B. Hunt’s (NASDAQ: JBHT) brokerage, Integrated Capacity Solutions (ICS), as an example. Hunt reported first quarter earnings on April 15. ICS posted volume growth of 15 percent year-over-year in the first quarter, but revenue per load dropped 11.5 percent to $1,041. In other words, ICS grew its volumes by cutting prices by double-digits. Still – and this is why market conditions were so favorable for brokerages this past quarter – ICS was able to widen its gross margins from 14.4 percent in the first quarter of 2018 to 16.5 percent in the first quarter of 2019.

Even as JBHT’s brokerage scooped up contracted volume and undercut the low single digit contract rate increases asset-heavy carriers were calling for, it didn’t chase the market all the way down and actually widened its gross margins. That largely tracks with the information FreightWaves reporters have heard from smaller, privately held freight brokerages in conversations over the past two weeks.

“Volumes are up, capacity is abundant and capacity is up more than volumes,” said Jamie Teets, CEO of Chicago-based brokerage Transportation One. “With that in balance, it’s very easy to source capacity. Right now is a good time not to be chasing the lowest-priced carrier, but to be building relationships. The market has allowed us to find well-priced capacity but also get service.”

Part of the reason why Transportation One’s volumes are up is because the company is still in high-growth mode with plans to grow gross revenues somewhere between 75 and 100 percent this year. On a national basis, freight volumes are off 2018 levels by about 3.5 percent.

Only a few regions in the country currently have tightening capacity, although brokers expect that to change any day now.

“It’s the Southeast, especially south Florida and south Texas – reefer capacity is the tightest in those markets,” Teets said.

Indeed, according to DAT”s RateView tool, reefer spot rates excluding fuel out of those markets are elevated. Reefer rates from Laredo to Dallas averaged $2.43/mile in March and are trending at $2.55/mile over the past seven days; from Miami to Atlanta reefers took $1.25/mile in March, but have charged $1.47/mile over the past seven days.

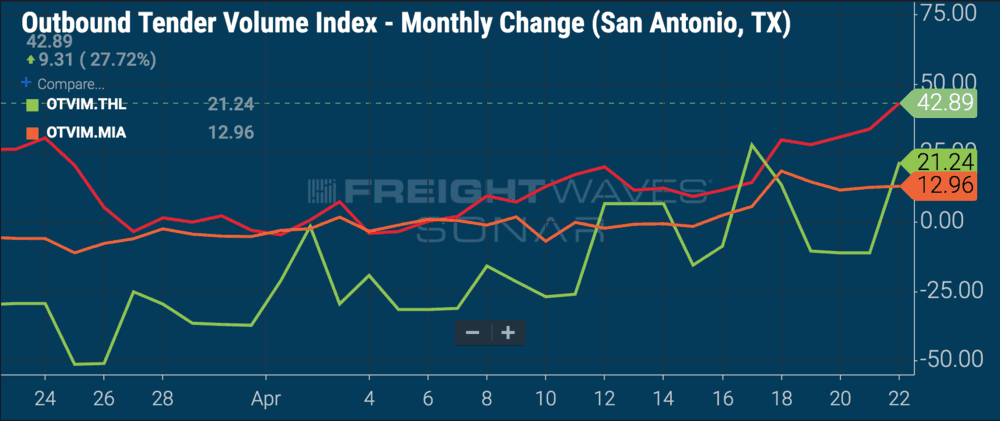

On the volume side, markets like San Antonio, Tallahassee and Miami have woken up. San Antonio volumes are up 42.89 percent compared to 30 days ago (OTVIM.SAT); Tallahassee grew 21.24 percent over the past month (OTVIM.THL); and Miami volumes rose 12.96 percent compared to a month ago (OTVIM.MIA).

As produce and food and beverage volumes grow and book reefer capacity, there could be a knock-on effect in dry van capacity. Reefers often haul dry freight in the off-season or on their backhauls, but if that overflow capacity disappears in the middle of produce season, it could be enough to affect dry van prices, Teets suggested.

Teets’ thesis is that freight brokerages will be forced to live on tightening margins in the future, so the strategy for Transportation One is to drive operational efficiencies to reduce overhead and increase broker productivity while doubling down on relationships.

“Now is a really important, telling time for us,” Teets said. “The market couldn’t be better to identify who your true partners are. It’s not necessarily a good idea to take advantage of carriers.”

Michael Feig, chief operating officer at White Plains, New York-based Capital Logistics, agreed with Teets’ characterization of the market.

“The first quarter was very good on the margin side,” Feig said. “Capacity was looser than expected. What’s interesting is that brokers are pricing everything like rates are going to keep going lower. I don’t know how much lower rates are going – I don’t think that much lower, to be honest.”

Already rates are starting to turn upward in the Southeast markets previously mentioned, as well as in southern California. Dry van spot rates from Los Angeles to Dallas excluding fuel averaged $1.24/mile in March but jumped to $1.41/mile over the past seven days. As Los Angeles looks more attractive, Feig has been able to make good money on upstream moves.

“I think we’re starting to see lower rates out of the Midwest going into the West Coast because the West Coast is getting pricier,” Feig said. “Rates have come back to earth a little bit in California, which is what we expected. The market has been favorable but we’re going to be there whether it’s tough or not.”

Capital Logistics has seen its dedicated team lanes out of south Texas move up 5 to 10 percent this week, Feig said, and they could keep going up.

“We’re in that lane every week with the same exact loads,” Feig said, “so our fluctuation is a little less and we’re not going to go as low when the market bottoms out. May seems to be one of the most expensive times of year there.”

Feig reiterated the need for a brokerage to have a thesis on the market driven by historical data and to keep from ‘chasing the market’ by quoting prices to shippers as if spot rates are going to continue falling.

“The biggest challenge is going to be who’s chasing freight at certain rates,” Feig said. “I really believe the truth is somewhere in the middle [between third-party logistics provider and carrier bids]. I don’t think the bottom is falling out from here.”

Ultimately the outlook for freight markets from here depends on two things – supply (trucking capacity) and demand (freight volumes). Setting mixed macroeconomic data aside, Feig said that he did not think that small carriers were adding capacity at the same rate they had in 2018.

New truck orders have fallen off precipitously now that enterprise carriers seem to have completed their replacement cycle orders. The number to watch is the average price for three- year old used trucks (UT3.USA), which has risen from approximately $55,300 at the end of October 2017 to $69,337 at the end of February 2019. If it’s true that capacity growth is slowing, used truck prices should fall as smaller carriers are no longer able to absorb the inventory cast off by the mega-fleets.

Joe Stephens

$1.25 – $1.41, this is why so many carriers are going out of business. I personally know 4 companies in TX that have closed and have equipment for sale. Carriers thought in 2018, things are looking up, we can make money, so they bought trucks, now at today’s rates they are having difficulty surviving. Maintenance, insurance, driver, and fuel costs are all up, as well as everything else. For instance we averaged 91.6 cpm, all miles in 1983 with an average maintenance rate of $50 an hour, even with today’s freight rates we now have to pay $150 an hour. Driver cost in 1983 was about 20 cpm, now it’s closer to 60 com. If these brokers and shippers don’t start paying a fair rate we are going to see more carrier defaults and a return to the capacity levels of mid 2018. Many smaller carriers are getting hit again with double digit increases in insurance costs, with these new trucks they purchased costing well over double of th 1983 cost. The good news for traders is to short carriers now, as there’s more money in shorting carriers in the market than running your own trucks. I expect another $15 off of JBHT stock if these rates don’t improve.