Despite higher trucking rates and tighter capacity in the last half of June, freight brokers are saying that conditions have eased again and that new pressure to gross margins is coming from customers.

In its second quarter earnings call, J.B. Hunt called out “flattish” rates for its trucking business as a reason for optimism and also said that intermodal volumes should trend positively for the rest of the year. On July 17, Morgan Stanley noted that “commentary stayed mixed this update as carriers continue to be notably more positive than peers as they see signs of an ‘adjustment’ to capacity in the coming months.”

Some industry commentators seized on late June data to tell a stabilization narrative about the freight markets where rates have reached their bottom and enough capacity has exited the market to meaningfully tighten the supply side.

Our channel checks with brokers, however, tell a different story. June was a weird month, to be sure, but this week management at Trident Transport, a Chattanooga-based brokerage on a $70 million run rate, described June’s market as an extended “hangover” from Roadcheck week. Volumes saw an incremental bump — normal seasonality — but capacity made a sluggish return to the market and drove rates higher. This had the effect of compressing brokerage margins.

“It was very difficult to cover loads and make margin, worse than it usually is, and no one knows why,” said William Kerr, president of Chicago-based Edge Logistics. “The market was a little shaky for a while and it was pretty hard to make money for the rest of June.”

The data and color from brokerage executives are now saying that market has flipped and is loosening back up. Shippers, meanwhile, are aware of conditions and are taking the opportunity to come back to their contracted carriers and ask them to re-bid lanes that have already been awarded — we’re back to paper rates.

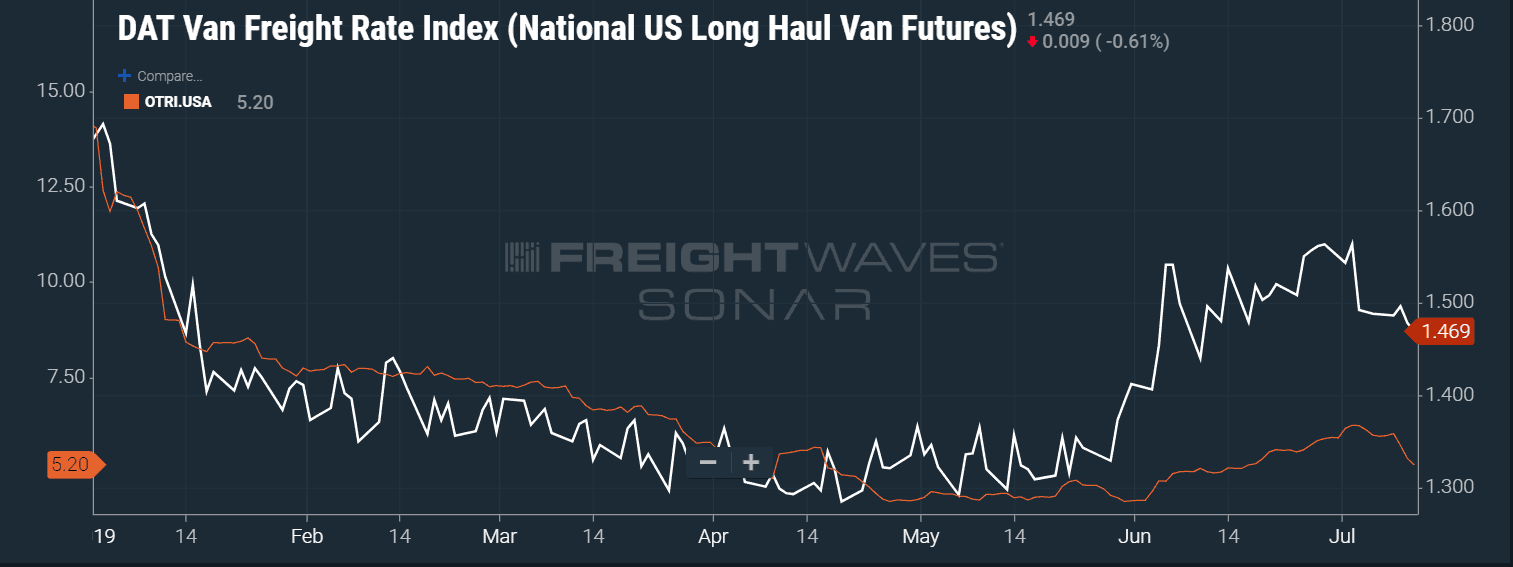

FreightWaves’ SONAR chart above lays out the modest tightening in June (OTRI.USA) and subsequent freeing up of capacity as well as the temporary support that spot rates found (DATVF.VNU).

“Most customers are realizing now they have a lot of the power back in their hands, and they’re putting pressure on us to get their rates down or they’ll give it to someone else,” said Jason Roberts, vice president of sales at Chattanooga-based Avenger Logistics. “We’ve had to cut some rates to keep the business. We had customers who had been sitting at higher margins, and we reduced the margins by 5 percent [i.e., 500 basis points] in some cases.”

Kerr said that his business has continued to see healthy volumes, even though on a national basis (OTVI.USA) they’re down by about 2 percent, but that could be due to his shop’s freight mix.

“I’m very food and beverage focused — that’s insulated us a little bit from the volume volatility,” Kerr explained. “We like to work with America’s largest shippers.”

“As far as capacity goes, it’s loose as a goose,” Roberts said. The competition for spot freight between brokers has heated up, and Roberts said that his customers are being offered such “wildly aggressive” rates that they have almost no choice but to take them.

Roberts believes that a mix of larger and mid-sized brokerages are bidding down lanes, and that often they find they can’t service the freight for the prices they’ve quoted. Larger brokerages may be trying to buy market share while the mid-sized brokers could be trying to make a splash with a major customer and get their feet in the door.

“In some cases they’ve gotten too aggressive and bit off more than they can chew,” Roberts said, noting that Avenger has picked up business from shippers who initially gave freight to the lowest bidder.

“I believe that capacity is going to stay loose for the entirety of the summer,” Roberts continued, “and rates will continue to fall. Volume is going to be there, but I think rates are going to plummet and people are going to be cutthroat about how they try to gain a piece of that market share.”

Another Chicago-based broker who spoke to FreightWaves called out falling spot rates and loosening capacity in July, saying “we’re finally making money again.”

Kerr also said that he did not see any indication that capacity was leaving the market. Freight markets have not been so loose, though, as to be completely unaffected by weather disruption, and Kerr said that he anticipated at least one major severe weather event that could inject some volatility into markets.

“I think we might see some serious volatility in the second half of 2019, based on how crazy the weather’s been,” Kerr predicted. “We’re not hoping for that, but it might contribute to some market fluctuations for the rest of the year.”

The trucking freight futures forward curve also suggests that rates have further to fall, bottoming out at a national average (FWD.VNU) of about $1.43 per mile for the August contract.

FreightWaves will watch to see if the longer end of the curve, which still calls for $1.55 per mile in December, flattens out as more information enters the market and sentiment evolves.

Art

one big thing these brokers are failing to note; a lack of their own assets. They are saying to keep the business they have to go down on their rates; they don’t they; just keep their income and pass on the discount to the carrier “quoting” cheap clients. How do you add brokers + more mouths to feed and justify everyone winning? Please explain how keeping the pie the same while introducing more people to the table is beneficial to the people working for the pie? Sometimes I wonder if there’s any logic in these logistics “firms”.

CM Evans

Independent Truckers used to call out one another for hauling cheap freight, and although some of it was cheap the broker was simply looking for a better margin. Now if I’m reading this correctly the brokers are bidding cheap freight and of course will pass it along to truckers who will haul it. The cycle of poor business practices expands even greater and nothing good will come of it. Soon enough we’ll read on this site of brokers shutting their doors.

Noble1

.

If the trucking industry has any intelligence they would unite rather than compete against one another through primitive cut throat tactics .Then you would “control” the market and set the rate equal for everyone . You are so powerful united , yet so weak divided . When are you people going to wake up ? How can you possibly allow a shipper to dictate your rate ? It should be the other way around !

In my humble opinion

.

Elvis G

ABSOLUTELY agreed! As a CONTRACTOR, I set my RATE. I set a rate not to please any lame broker/shipper, I set a rate NOT to be doing favors. And thats the issue here. Working below the margin of profit line. Bad habit these brokers/shippers been implementing! And idiotic independent carriers taking cheap loads! Now wanna see what happens with this new insurance law coming up jacking insursnce rates up. Time to get out of this trucking GARBAGE

Noble1

If the trucking industry has any intelligence they would unite rather than compete against one another through primitive cut throat tactics .Then you would “control” the market and set the rate equal for everyone . You are so powerful united , yet so weak divided . When are you people going to wake up ? How can you possibly allow a shipper to dictate your rate ? It should be the other way around !

In my humble opinion

Jon

My InstaRate screen in our AscendTMS system shows rates have been pretty even for the first 2 weeks of July.

Steven

Flattish for JB and broke for small carriers.

That actually the intention of mega mega all.