Woe to the analyst of freight markets who departs the kingdom of volume, capacity and rates for the fairyland of hopes and dreams.

A blog post this week by DAT calls for an imminent rebound in trucking spot rates. Meanwhile, the average trucking carrier stock is down 15% in the past four days.

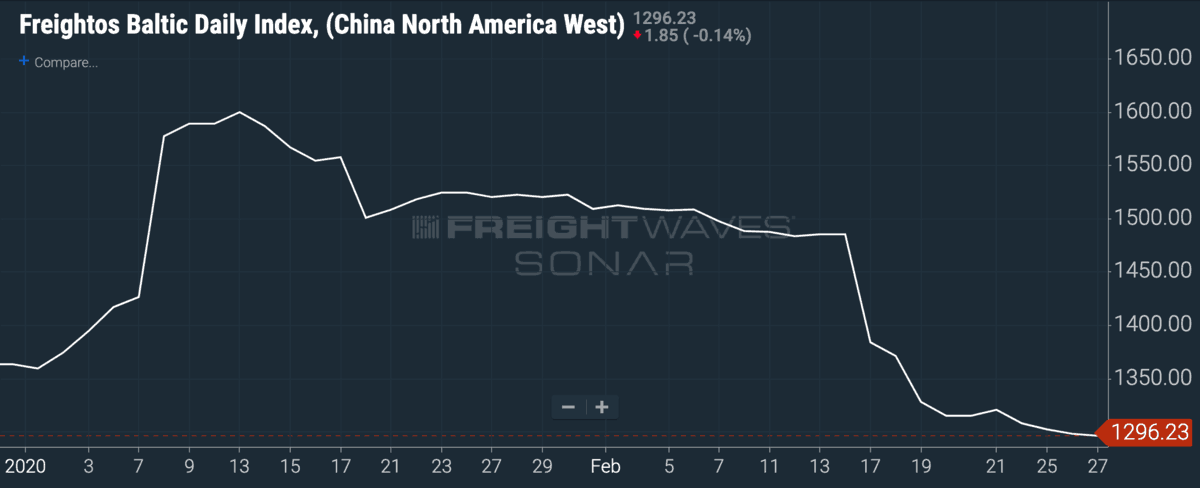

Despite an unprecedented number of blank sailings on the trade lanes connecting the world’s largest economies — which still have not kept pace with crashing volumes — DAT believes that freight brokers will pay carriers more. Container rates from China to the West Coast are down 19% since their mid-January high and will fall further.

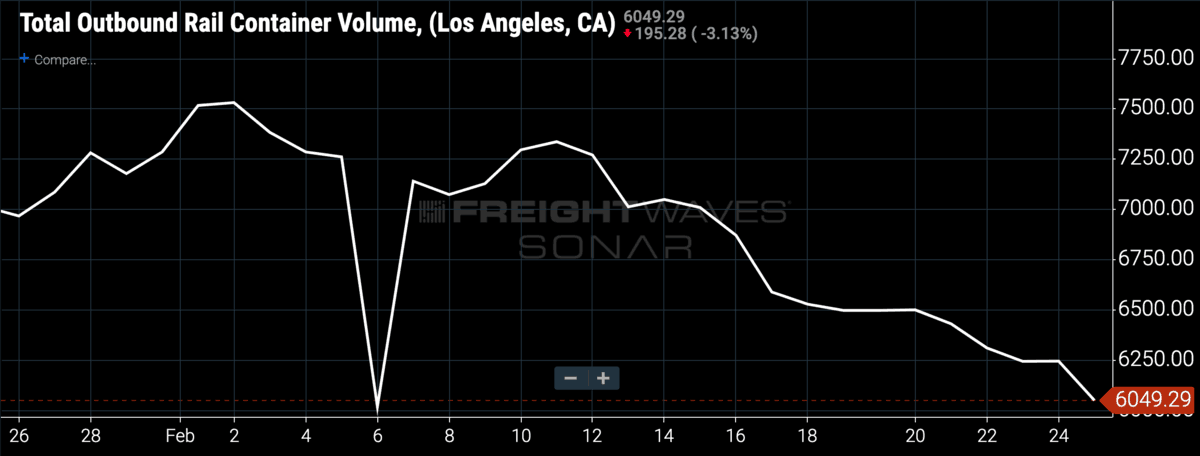

As intermodal volumes out of Los Angeles crumbled by 22% over the course of February, DAT analysts grew more bullish on spot markets. The national average dry van linehaul spot rate fell from $1.60 a mile to $1.37 a mile since the beginning of the year to bottom right around carriers’ operating costs, but DAT is counting blooming daffodils in the freight markets.

Relative capacity, while stagnant for a month, loosened further Wednesday. Now transportation providers are rejecting just 5.4% of the contracted loads tendered to them by shippers, indicating that brokers and carriers have few options. The move downward in tender rejections is particularly significant because shippers have just de-rated contract prices lower — carriers are accepting more loads even with lower rates.

Calling for a melt-up in trucking spot rates on the eve of a global pandemic left us scratching our heads. DAT’s amateur epidemiology was similarly incoherent.

“Another nice feature of spring: people spend more time outdoors instead of huddling in their homes, catching and spreading viruses,” the DAT analyst wrote. According to the World Health Organization, the containment strategy being implemented globally calls for the closing of schools and bars and the cancellation of sports events and other ‘mass gatherings,’ not for more people to leave their houses and spend time outside.

The disconnect between DAT’s bullish spot market call and current fundamentals underscores, for us, the limitations of freight forecasting based on historical data. According to typical seasonality, a month after the Jan. 25 Chinese New Year, West Coast port volumes should recover.

Alas, the quarantining of hundreds of millions of human beings in the United States’ most important trading partner is not reflected in DAT’s historical rate data. Neither were the Trump administration’s erratic trade policies in 2018 nor the destructive hurricanes of the year prior.

The modern transportation and logistics industry, which involves a complex orchestration of information, payment, and freight movements across many partners and many miles, is more sensitive than ever to external, unforeseen factors.

“The coronavirus is a black swan event not reflected in historical data,” said Craig Fuller, FreightWaves CEO. “These unforeseen events make it clear why near-time data is crucial for freight operations.”

Even publicly traded transportation companies, always hesitant to give negative guidance after a down year, were in expectation-management mode on their fourth-quarter earnings calls. The rails complained that their industrial customers were risk-averse toward capital expenditure and growing their businesses.

The truckload carriers who ventured positive guidance said that maybe trucking markets would improve in the second half of 2020, though they cited few concrete reasons. Most frequently mentioned among the reasons given for a potential 2H recovery was that tough business conditions and an increased regulatory burden would force capacity out of the industry, eventually tightening markets and raising rates.

“Our expectations for improving performance throughout 2020 are based on assumptions of 1) declining truckload industry capacity due to, among other factors, a continuation of falling new truck production, competitors exiting the industry, and tighter federal drug-testing regulations, 2) continued U.S. economic expansion, 3) the successful disposal of excess real estate and revenue equipment, and 4) the reallocation of assets to more profitable operations,” said Richard Cribbs, chief financial officer at Covenant Transport.

Apart from the self-help operational changes, management commentary sounds a lot like “If it keeps getting worse, it’ll eventually get better.”

In our view, the only thing propping up trucking spot rates has been robust consumer activity (and if the public equities market sell-off continues, consumer sentiment will react negatively). Industrial production is soft. Capacity is loose and carrier sentiment continues to be negative, based on truckers’ appetite for new equipment.

China’s economy will dramatically underperform in the first quarter. China accounted for 21.2% of all U.S. imports in 2018; that flow has been cut at least in half.

The risk going forward is that other East Asian countries with strong U.S. trade relationships will also be forced into strict control measures that impact production and shipping. South Korea, the United States’ sixth-largest trading partner, represents 2.9% of all U.S. import volumes and currently has 1,766 confirmed coronavirus infections.

Japan, the U.S.’s fourth-largest trading partner, provides 5.6% of all U.S. imports; there are 189 confirmed infections in Japan, and authorities there have closed schools until April 1. If the outbreak gets worse among Japan’s aging population, expect movement restrictions, quarantines, dampened consumer activity and industrial production, and, of course, fewer exports.

Like DAT, we hope trucking spot rates return to sustainable levels so that transportation providers can operate profitably. We just don’t confuse wishful thinking with analysis.

DT

DAT staff live in a bubble. They have NO idea about rates or what is going on in this industry. Few people there have even worked in this business before. That’s why their products are 3 years behind Truckstops, their rate guides suck, and clearly from their most recent advice above their “analyst” expertise is about as good as the first 4 letters in that word. S**t.

DAT STOP TEACHING US ABOUT SOMETHING YOU KNOW NOTHING ABOUT NOR UNDERSTAND. Get with the program and HELP US DON’T LECTURE US.