Calls for the U.S. government to regulate the shipping industry in response to costly disruptions are misguided because conditions are the result of overwhelming consumer demand and unusual supply volatility caused by COVID, a leading freight economist said Wednesday.

Port delays, insufficient vessel and container capacity, skyrocketing transport rates and terminal late fees have roiled import and export supply chains since last year.

“You’ve got an industry in freight movement that grows at a 3% to 5% pace a year. All of a sudden you have this surge of 20% in volumes. There’s no way this global industry, much less here in the U.S., could we have ever increased the capacity that much,” Walter Kemmsies, managing partner of The Kemmsies Group and a strategic adviser to public- and private-sector entities involved in international trade, said in a virtual chat during the FreightWaves OceanWaves Summit.

“So yelling at folks who behave rationally and don’t overinvest in capacity so they don’t get fired, or go bankrupt, is really not a smart thing to do,” Kemmsies said.

The U.S. Department of Justice and the Federal Maritime Commission, at the behest of the White House, are closely examining the behavior of foreign ocean carriers for potential anti-competitive behavior, in response to allegations of overcharging, unreasonable fees and refusal to service exporters in favor of more profitable imports.

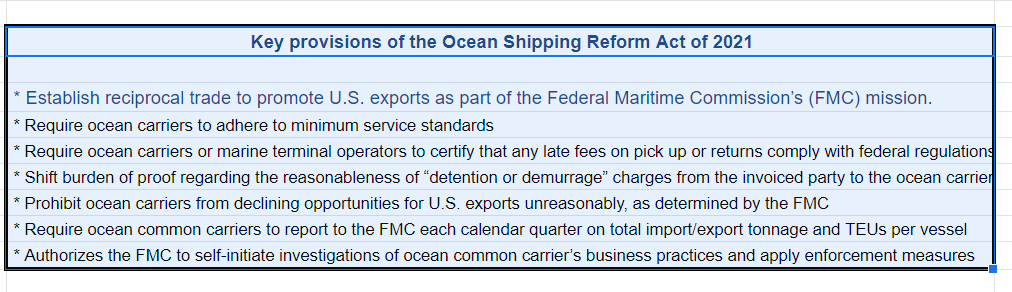

Meanwhile, a coalition of 152 companies and trade associations representing U.S. importers, exporters, transportation providers and other supply chain stakeholders last month announced support for the Ocean Shipping Reform Act of 2021, introduced by Reps. John Garamendi, D-Calif., and Dusty Johnson, R-S.D. They argue that the current law needs updating after 20 years to reflect carrier consolidation, the growth of alliances, new chassis ownership and other industry changes.

The impetus for the current supply chain gridlock was $4.5 trillion in stimulus spending that gave U.S. residents the wherewithal to go on a huge merchandise buying binge while stuck at home during the past 18 months. COVID knocked out manufacturers in Asia at the start of the pandemic and they haven’t been able to catch up with the onslaught of orders. As a result, U.S. inventories are at 2016 levels while sales are at levels that two years ago were not predicted until 2027 or later, said Kemmsies, who also serves on a Department of Commerce advisory committee focused on supply chain competitiveness.

Major ports, such as Los Angeles/Long Beach and Savannah, are experiencing 20% volume growth each month compared to the prior year. Marine terminals and warehouses are full and understaffed, and truck drivers, container equipment and railcars are in short supply or not available when needed.

After waiting 10 days or more at anchor, ultra-large vessels are dumping all their volume at the first port of call instead of making other stops and rushing back to Asia for the next load. That is resulting in more dislocation of trucks, containers and chassis to reposition freight to faraway destinations.

Transportation costs are soaring, most notably in ocean freight, where short-term rates for a container can easily top $20,000 — 10 times the precrisis level. Companies are experiencing 20% inflation, according to the Purchasers Price Index, because of freight transportation, wage increases that have put average hourly logistics pay near $21 and spikes in the prices of commodities.

Inflation will begin to roll back by the middle of next year, Kemmsies said, and remain low because companies continue to outsource production, contrary to some assessments of large-scale manufacturing relocation to the U.S.

“As long as the stuff people are spending a lot of money on continues to outsource to cheap labor places there’s a downdraft on inflation,” he said.

Liner companies have made large vessel orders, with new capacity expected to start entering service in 2023. Kemmsies predicted container lines will eventually cancel or postpone many orders to spread out the capacity increase once consumer spending and supply chains normalize.

“Currently we have a lot more supply side volatility and we have a tsunami of consumer spending on retail goods. And the combination of those two things is why it looks like we’re not rightsized to serve world trade,” he said.

Carriers, he explained, are making rational investment decisions because peak conditions won’t last forever.

“You don’t build a church for Easter Sunday. You build a church for the expected attendance,” he said in an Aug. 30 presentation to the Cargo Network Services conference in Miami.

Click here to read more FreightWaves/American Shipper stories by Eric Kulisch.

RECOMMENDED READING:

Night moves: Long Beach begins trial of extended hour cargo pickup

LA/LB ports to test expanded night, weekend hours

Record shattered: 73 container ships stuck waiting off California coast

Darren

Would love to see Government run/funded freight/shipping and logistics companies similar to USPS (USA) and CanadaPost (Canada). Would it necessarily solve the problems of today? No. Would it help alleviate the problems of tomorrow, quite possibly. Not quite sure why this doesn’t exist to date.

Fred

Excellent Title.

Jack Harrison

Boy this guy must be on the take from freight lines and railyards. They’re a bunch of crooks. Imagine Amazon being unable to ship your product on time, and because of that, they start charging your 250 per day storage fees. That’s what freight lines are doing once the container gets here