July data from Cass Information Systems showed the freight market is staying “lower for longer” as both shipments and expenditures fell sharply.

Shipments during the month were down 8.9% year over year (y/y) while expenditures were off 24.4%, according to the Monday report. The drop in freight costs also incorporates lower fuel surcharges. Fuel prices were down 27% y/y in the month.

The reading on the July shipments subindex was slightly lower than the January level. Normal seasonal trends have historically produced a 10% increase over that time period. Shipments were 1.2% lower than in June on a seasonally adjusted comparison.

“Declining real retail sales and destocking remain the primary issues, but dynamics are shifting as real incomes improve and the worst of the destock is in the rearview,” ACT Research’s Tim Denoyer commented in the report.

| July 2023 | y/y | 2-year | m/m | m/m (SA) |

| Shipments | -8.9% | -4.7% | -2.2% | -1.2% |

| Expenditures | -24.4% | -2.5% | -2.8% | -2.0% |

| TL Linehaul Index | -12.7% | -3.5% | -0.2% | NM |

The report noted the freight market has been contracting for 19 months and that the duration of the past three downturns was 21 to 28 months.

The weakness seen in July was voiced by most trucking management teams during the second-quarter earnings season. The lack of a sequential inflection during the quarter, as previously guided to earlier in the year, resulted in carriers reeling in 2023 outlooks. Most management teams expect another tough quarter during the third as the full impact of bid season and lower contractual rates are implemented across a larger number of accounts.

The group is hopeful for more typical seasonal trends in the fourth quarter.

Expenditures were down 2% seasonally adjusted from June. With the modest sequential reduction in shipments, actual rates were likely off 1% from June.

The data set is expected to fall 18% y/y in 2023, following two years of robust increases totaling more than 60%. The decline is due to falling volumes and rates as well as fuel prices. However, a recent jump in diesel prices could limit the decline in total expenditures.

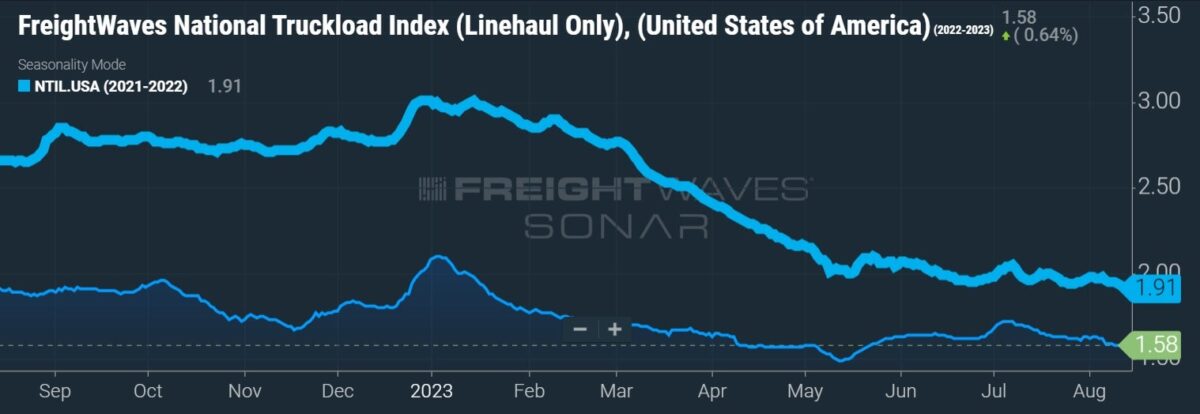

Cass’ truckload linehaul index, which excludes fuel surcharges and accessorial charges, fell 12.7% y/y. A 0.2% sequential dip during July marked 14 straight months of decline.

The report pointed to private fleet growth at the expense of the publicly traded for-hire fleets. Tractor counts at the public fleets were down 3% in the first half of 2023 while for-hire operating authorities throughout the industry have also been in decline.

“Private fleets represent over half of Class 8 tractor capacity, and we believe their growth is pulling freight out of the for-hire market, prolonging the industry downturn,” Denoyer said. “Though significant progress has been made in rebalancing, we think it’s unlikely that industry capacity will broadly tighten until pressure from private fleet growth eases, which looks unlikely this year.”

Data used in the Cass indexes is derived from freight bills paid by Cass (NASDAQ: CASS), a provider of payment management solutions. Cass processes $44 billion in freight payables annually on behalf of customers.

More FreightWaves articles by Todd Maiden

- Forward Air merges with Omni Logistics, will target expedited LTL

- XPO to ramp up capacity to fill Yellow void

- Forward Air starting to see impact from Yellow’s exit

Name Of Game

running carriers and truckers into bankrupcty.