Respondents to its latest survey tell Morgan Stanley that the freight markets are unpredictable right now, and the outlook over the next three months remains cloudy at best. (Photo: Jim Allen/FreightWaves)

Data is continuing to roll in, and unless it wasn’t already obvious, the COVID-19 coronavirus outbreak is disrupting the freight markets in unpredictable ways.

Morgan Stanley’s latest Freight Transportation Truck Stop/TLSS survey shows its index outperformed seasonality for the second update in a row, and increased sequentially. The latest survey outperformed by about 1,600 basis points, moving up from last week’s 1,200 basis point outperformance. Supply was up about 600 basis points.

The report, though, cautions about a rough second quarter ahead for freight.

“We expect several shippers to ‘go dark’ after this week heading into a period of prolonged shutdown in 2Q, and as such expect this to be the last strong TLFI read for some time. The shape and severity of the ‘V’ remains the key debate,” the firm wrote.

The demand component of the index increased sequentially and outperformed seasonality, Morgan Stanley said, increasing about 2,200 basis points.

Morgan Stanley asked respondents about their outlook on demand, supply and rates. Currently, 63% of respondents hold a negative outlook on rates with just 14% expressing positive sentiments. There isn’t much more optimism in three months, with only 13% holding a positive outlook. But when it comes to rates over the next three months, 55% have a neutral view on rates, up from just 23% currently.

The three-month outlooks for demand and supply are more optimistic, with 14% of respondents having a positive outlook on supply and 19% the same with demand, versus 5% and 8% currently.

On the carrier side, many are saying there is plenty of demand, but some are having difficulty gaining insight into the future.

“Tons of demand right now,” one wrote. “Just got to keep our people healthy and take care of the customers who are fair to us year round,” while another said it is “hard to say what all the dynamics will be on [the] impact from the coronavirus at this time.”

The comments for Morgan Stanley’s survey were solicited between March 18 and March 24.

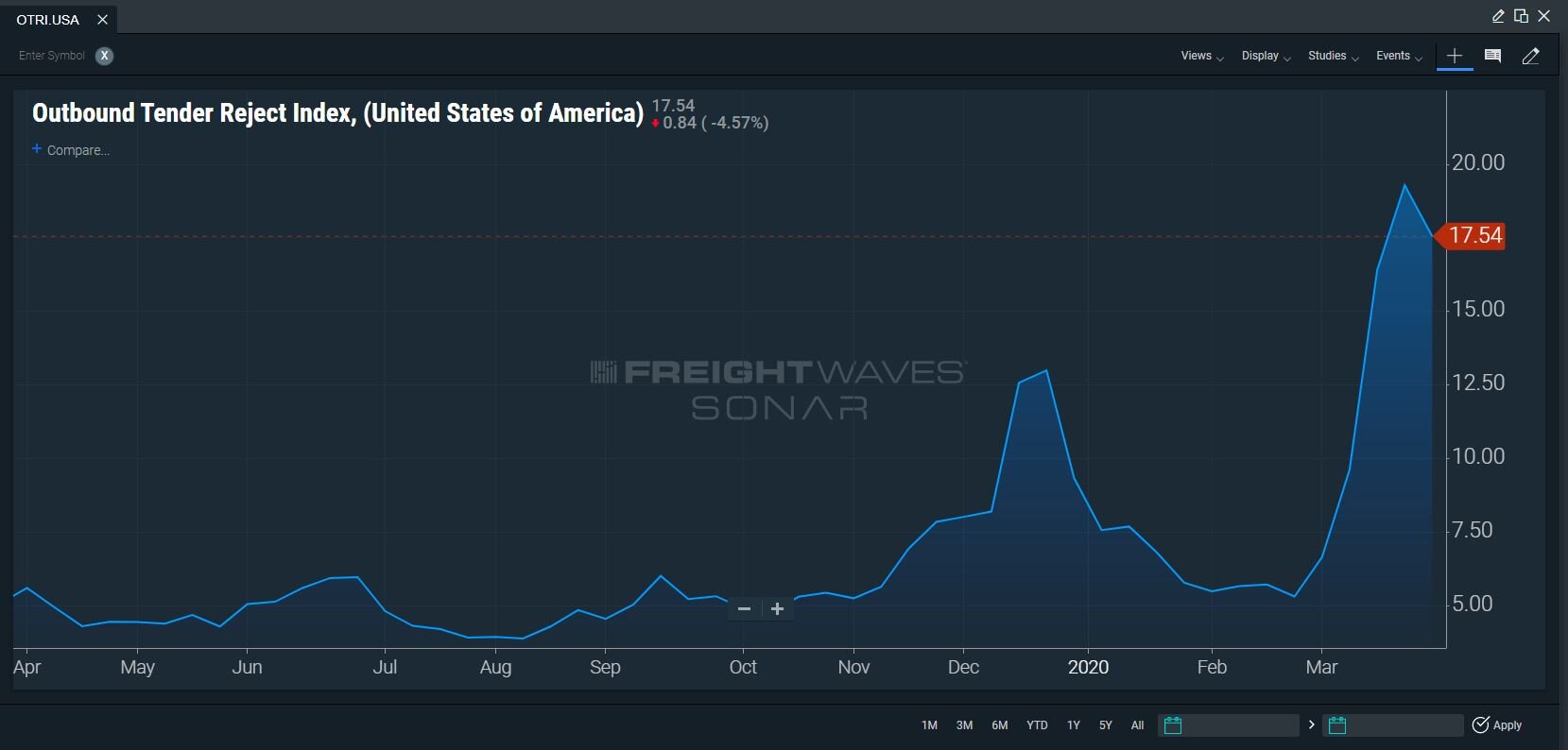

The SONAR Outbound Tender Reject Index shows that tender rejections remain high as carriers fight for loads. (SONAR: OTRI.USA)

In Wednesday’s Freight Market Update, Zach Strickland, FreightWaves’ director of freight market intelligence, said the company’s proprietary Outbound Tender Reject Index (SONAR: OTRI.USA) is showing a high level of loads being rejected by carriers. The index was down 4.57% from Tuesday’s level to 17.54.

OTRI measures the percentage of outbound tenders being rejected by carriers and is updated daily.

“[It’s] not a dramatic drop in terms of overall tender rejection rates,” Strickland said, noting the index has fallen from 19%. “We’re still at a very high level and capacity is still relatively tight out there, especially considering the commodities some of these trucks are moving right now – food and beverages, etc. – but we are on the downward slide from where we were a few days ago.”

Strickland went on to say that capacity is becoming available.

“Capacity is definitely going to loosen and we’re noticing its loosening more quickly than it tightened,” he said. “We’re not seeing the volumes drop as quickly as we saw them increase, but we’re seeing tender rejections drop quicker than we saw them increase … as capacity is a little more responsive to the market than the volumes are.”

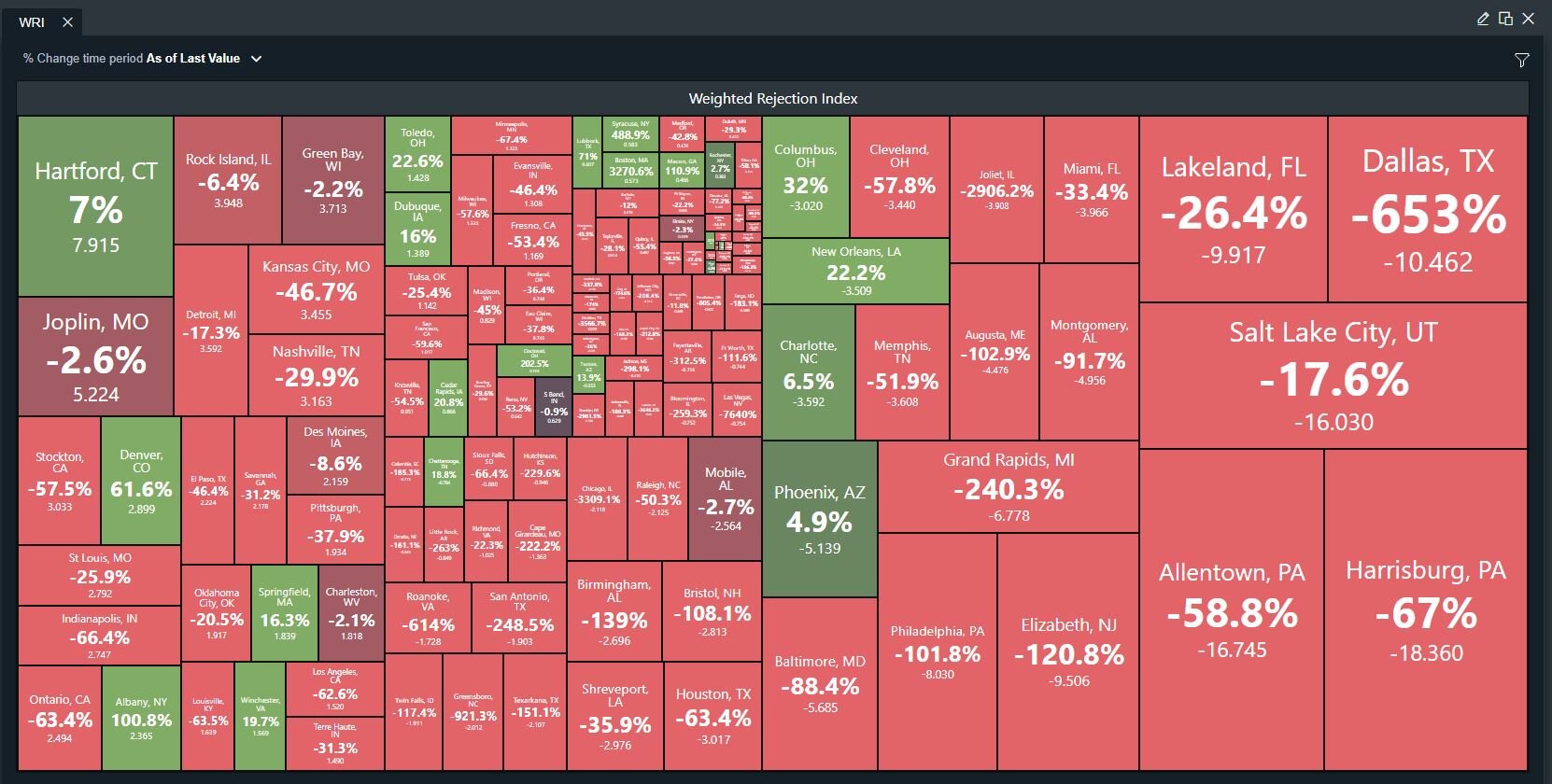

A SONAR market map of the Weighted Rejection Index, which measures tender rejection rate changes by market. The top number is the percent week-over-week change, as of April 1, 2020, while the bottom number is the index value. (SONAR: WRI.USA)

SONAR data is bearing that out. The Weighted Rejection Index (SONAR: WRI.USA), which measures the tender rejection rate change by market, has seen significant changes in recent days.

“A week or two ago we were talking about Weighted Rejection Index values from about 30 to negative 2, now we’ve shifted that from a 7.92 at the highest end to a negative 18.36, another sign that the market has dramatically turned,” Strickland said. “We are starting to loosen a lot more. Again, this is a week over week change, not a month over month.”

As capacity loosens, shippers seem to be recognizing the importance of the carriers, according to the Morgan Stanley survey.

“Transportation will be critical to returning to normal by keeping products on store shelves,” one shipper wrote. “Shippers and receivers need to do everything they can to keep drivers moving while protecting the safety of the drivers and their own employees.”

Grocery staples are a large part of freight right now. According to project44, grocery shipments increased 69% for the week of March 22 over the pre-crisis trend of 2020. The number was 16% higher week-over-week and 81% higher year-over-year. Weekend shipments are up 94% compared to the pre-crisis trend line for 2020.

Shippers in the Morgan Stanley survey are concerned about the uncertainties ahead as well.

“Current demand is tanking with automotive suppliers and fabricators closing their doors. Expect [more] production cutbacks to come,” wrote one.

“This market is truly fluid and unpredictable at this point,” said another. “We are anticipating this lack of predictability to continue for sometime and then a short term tightening during the ‘bullwhip’ period before a lull. We are likely going to hold off on executing a bid until we have confidence the market has found a calm point and reliability returns.”

Brokers are concerned about contract pricing, noting providers are not honoring current prices.

“Some of my providers are starting to increase their pricing and not honoring their contracted pricing,” wrote one broker. “I’m getting feedback from them that both demand for capacity and rates are spiking.”

Another said the “concept of contract pricing is going to become increasingly less prevalent in 2020.”

One shipper noted that there is plenty of truckload capacity, just not where it is needed, as drivers want to stay as close to home as possible.

Digging into the survey a bit further, 32% of respondents expect truckload supply to be abundant in three months while just 13% believe it will be tight. Demand is equally split between those that believe it will be weak and strong, at 19% each.

In the comments, some shippers noted that rates will rise due to the market chaos that is causing “significant network inefficiencies.” Right now, 63% of total respondents said rates are lower and 32% said they will be lower in three months. Only 13% think rates will increase in the next three months.