Yesterday, the Bureau of Labor Statistics released data on wholesale prices from January, showing a modest rise in the prices that producers receive for their output. On its face, there was little surprise about these results, suggesting that there is some building pressure for consumer prices in coming months.

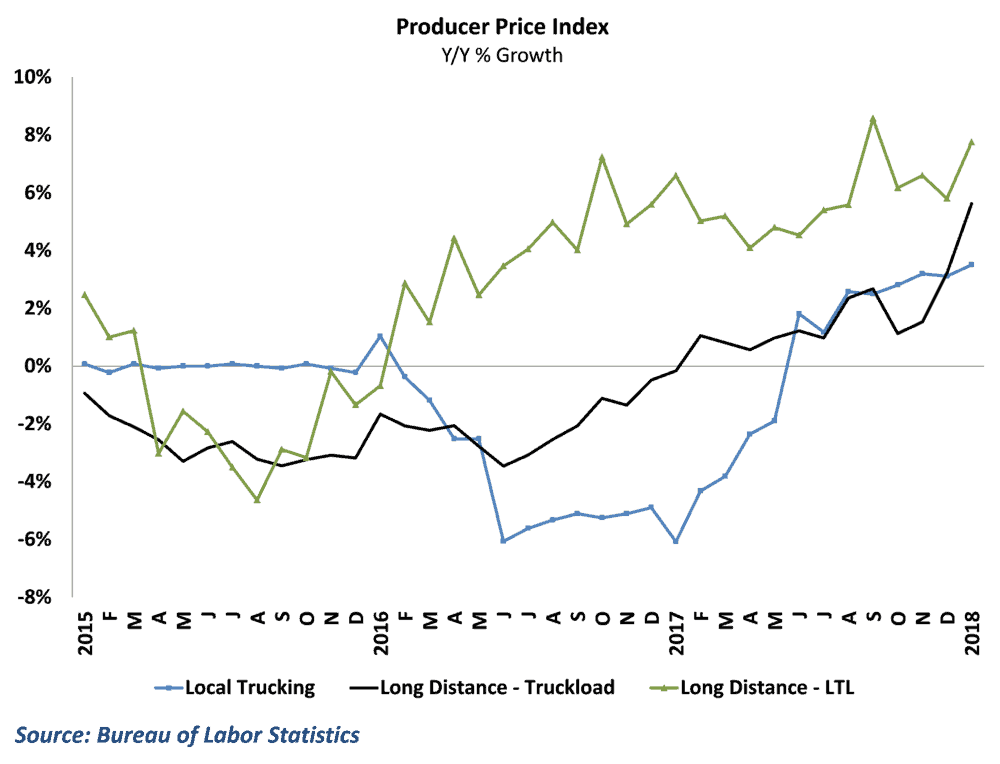

The details of this report illustrate some interesting trends within the freight industry, though. While producer price inflation for the overall service sector has remained fairly benign, hovering between 2-2.5%, freight trucking inflation has been accelerating rapidly. After a dismal 2-year period of declining rates within the trucking industry, prices have picked up, with inflation reaching a 6-year high in January.

There are many different reasons for the recent surge in freight rates in recent quarters. On the demand side, the steady growth in consumer spending and renewed appetite for business investment has helped revive domestic manufacturing activity. On the supply side, trucking companies continue to struggle with driver shortages, deteriorating infrastructure, and the implementation of the ELD mandate.

Drilling down even further into the details provides additional insight into trucking freights. Most of the acceleration in freight rates has been driven by long distance truck transportation, while local trucking rate growth has been more muted. The effects have been even more pronounced with less-than-truckload shipments, with inflation nearing 8% in January.

Behind the Numbers:

The data today highlights some of the implications of recent trends within freight, as the combination of a tight labor market and higher regulatory costs are having a noticeable effect on rates within the industry. Demands on the trucking industry will likely get even higher in upcoming quarters, as recent tax cuts are expected to boost consumer and business demand further throughout the year. As this happens, expect additional upward pressure on freight rates going forward.

The rate performance within LTL shipping is also an interesting trend, as LTL prices have increased faster than TL rates by a considerable margin. LTL has arguably been a bigger beneficiary of recent trends within e-commerce than full truckloads, and the rapid growth of electronic shopping and fulfillment is likely playing a role in boosting LTL rates in addition to general improvement in the overall economy.

Ibrahiim Bayaan is FreightWaves’ Chief Economist. He writes regularly on all aspects of the economy and provides context with original research and analytics on freight market trends. Never miss his commentary by subscribing.