C.H. Robinson (NASDAQ: CHRW), a leading third-party logistics provider and the largest freight brokerage in North America, reported third-quarter financial results after markets closed on Oct. 29.

Robinson’s business was finally hit hard by the industrial recession in the United States, slowing global trade and a contracting eurozone.

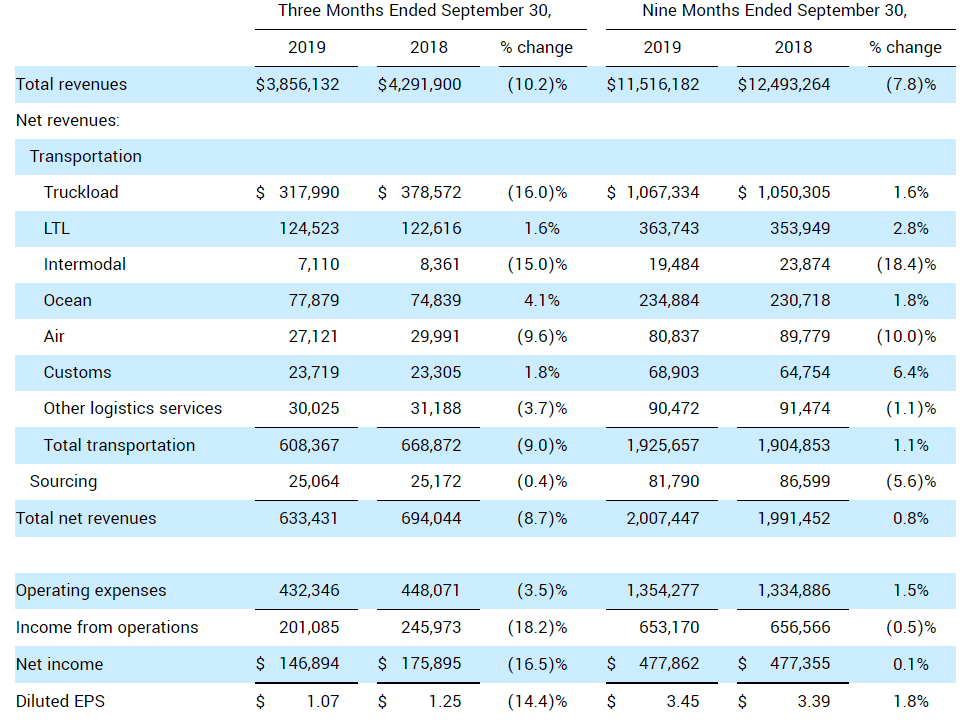

Total revenues were down 10.2% year-over-year to $3.9 billion; net revenues fell 8.7% from the prior year, to $633.4 million. Diluted earnings per share decreased 14.4% to $1.07, missing Wall Street’s expectations of $1.14.

Last quarter, Robinson managed to grow earnings by 8% and beat the Street by a penny, but the truckload cycle has started to shift against the 3PL. Spot rates — a freight brokerage’s cost to buy trucking capacity — have bottomed, while contract rates, which represent about 70% of C.H. Robinson’s revenue, are still being revised downward.

“The third quarter provided challenges in both our North American Surface Transportation and Global Forwarding segments,” Chief Executive Officer Bob Biesterfeld said in a statement. “Our net revenues, operating income and EPS results finished below our long-term expectations. We anticipated an aggressive industry pricing environment coming into the second half of this year driven by excess capacity and softening demand and knew we faced difficult comparisons versus our strong double-digit net revenue growth in the second half of last year. Our results were negatively impacted by truckload margin compression in North America.”

Still, Robinson’s North American Surface Transportation (NAST) division, the truckload brokerage, widened its gross margins slightly to 15.4% from 15.34% a year ago. The issue is that the brokerage’s top line revenue was down 12.4% to $2.82 billion and net revenue dropped 13.2%. NAST suffered from decremental margins, as its income from operations — a rough measure of the business unit’s internal profitability — fell even faster, by 21.3% on a year-over-year basis.

Global Forwarding was less sensitive to the downturn in ocean and air pricing and air volumes. Total revenues fell 6.5% year-over-year to $597 million, but net revenues were up 1.3% and income from operations climbed 3.5%. Ocean revenues in particular climbed on margin expansion, Robinson said in its earnings release (overall Global Forwarding gross margins were 22.7% for the quarter compared to 20.9% a year ago).

In Robinson’s “All Other and Corporate” segment, Robinson Fresh’s net revenues contracted slightly by 0.1% year-over-year to $23.6 million; Managed Services grew net revenues by 7.4% to $21.5 million; and other Surface Transportation grew net revenues by 13.6% to $15.9 million.

Biesterfeld gave pessimistic guidance for freight markets going forward.

“Looking ahead, we expect that North American routing guides will continue to reset at lower prices in response to the falling cost environment and decline in spot market freight opportunities,” Biesterfeld said. “While industry data suggests capacity continues to exit the North America truckload market, we believe capacity will exceed available shipments for the next few quarters. Despite the current freight environment, our long-term goals remain unchanged. We remain focused on taking market share, automating core processes while delivering industry-leading quality service to our customers and carriers, and improving operating leverage in our businesses.”