Shipments and expenditures plummeted year over year (y/y) in May at the fastest pace in nearly three years, according to data provided by Cass Information Systems on Tuesday.

The Cass Freight Index recorded a 5.6% y/y decline in shipments during the month with expenditures falling 15.7%.

Shipments captured on the index were up 1.9% from April. “While it was a softer-than-normal seasonal increase from April, it was nonetheless an increase,” the report said.

“Declining real retail sales trends and ongoing destocking remain the primary headwinds to freight volumes, but dynamics are shifting as real incomes improve and the worst of the destock is in the rearview,” ACT Research’s Tim Denoyer commented.

He said the previous three downturns lasted 21 to 28 months. While the index has recorded a stretch of mixed results compared to the prior year, it first turned negative 17 months ago, suggesting the market is “closer to a bottom.”

| May 2023 | y/y | 2-year | m/m | m/m (SA) |

| Shipments | -5.6% | -8.1% | 1.9% | -0.8% |

| Expenditures | -15.7% | 7.5% | -6.8% | -7.8% |

| TL Linehaul Index | -15.3% | -4.2% | -2.6% | NM |

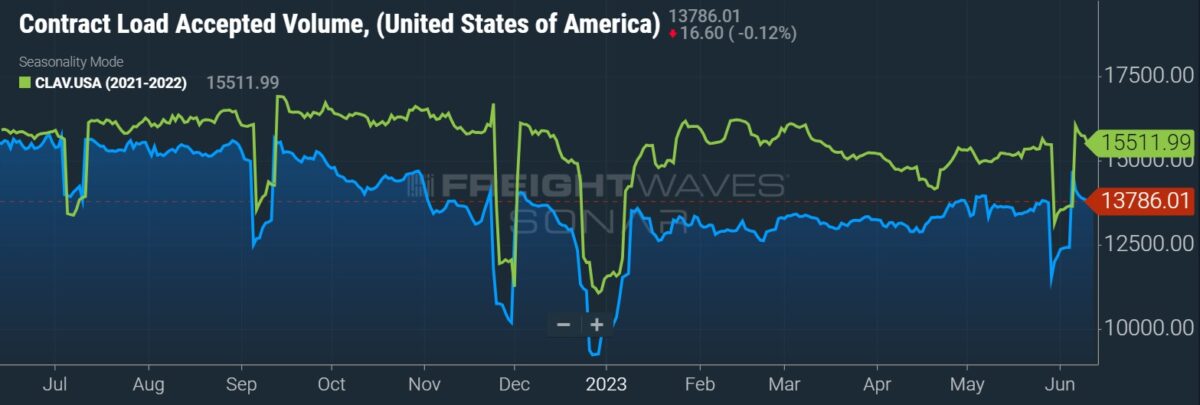

The y/y weakness has also been captured in FreightWaves data. The Contract Load Accepted Volume Index (SONAR: CLAV.USA) has shown a pretty healthy gap to year-ago levels. The index is off 11% y/y currently.

Cass expects its shipments index to be down 3% y/y in June, assuming normal seasonal trends occur.

Cass’ expenditures data set was down 6.8% sequentially in May in addition to the large y/y decline. The subindex measures the total amount spent on freight, including fuel, which was off approximately 30% y/y in the month.

Accounting for the increase in shipments, actual rates were inferred to be down 10.7% y/y in the month.

The expected drop in the expenditures index for 2023 was recast lower to down 16% y/y compared to last month’s forecast of down 12%. However, even with normal seasonal patterns moving forward, the new forecast may be too high.

“With both freight volume and rates under pressure at this point in the cycle, that assumption could be optimistic, so we may be looking at a ~20% decline in freight spending this year,” the report said.

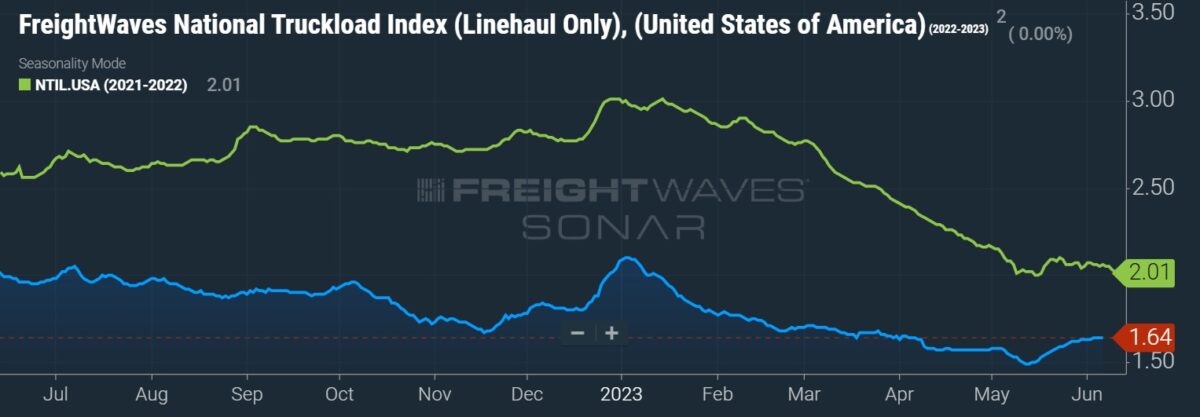

Cass’ index for truckload linehaul rates, which excludes fuel surcharges and accessorials, fell 15.3% y/y and was 2.6% lower than the April level. This was the biggest y/y decline ever recorded in the 18-year-old index. Compared to two years ago, TL linehaul rates were down 4.2%.

A loose spot market and contract rates continuing to reset lower weighed on the index.

“Volumes softness does not appear to be over, but after a long soft patch, we see the U.S. freight transportation industry on the cusp of a new cycle as we begin to transition from the bottoming phase into the early phase of the freight cycle in the months to come,” Denoyer said.

Data used in the Cass indexes is derived from freight bills paid by Cass (NASDAQ: CASS), a provider of payment management solutions. Cass processes $44 billion in freight payables annually on behalf of customers.

More FreightWaves articles by Todd Maiden

- Teamsters not ‘bailing out’ Yellow again, unmoved by carrier’s finances

- Yellow’s tonnage remains in free fall

- ArcBest’s chief yield officer steps down

Mckenan Pierce

Corporate profits about to hit a all time high.

Price for consumer is higher than ever, and the rate for the trucker is lower than ever.

Meanwhile a piece of bread cost and arm and a leg.